Privately owned e-bikes are used to replace cars more often than for sharing schemes. Keystone / Laurent Gillieron Shared e-scooters and e-bikes can have a negative effect on the climate, a Swiss study has found. This is because such services generally replace trips with normal bicycles, rather than cars. Many big cities, including Zurich, have schemes to rent and share e-bikes and e-scooters to relieve urban traffic and help reduce CO2 emissions. But until now it...

Read More »Taking Back Our Liberty in 2022

For those of us who value liberty, these past two years have been a bad dream. It seems like we fell asleep in early 2020 and woke up in 1984! They said that if we just put on a mask and stayed home for two weeks, we’d be able to return to normal. The two weeks came and went and instead of going back to normal they added more restrictions. These past two years have been a story of moving goalposts and “experts” like Anthony Fauci constantly contradicting themselves....

Read More »How Many More Americans Might Have Quit Their Jobs Than The Huge Number Already Estimated, And What Might This Mean For FOMC Taper

There were a few surprises included in the BLS JOLTS data just released today for the month of November (note: the government has changed its release schedule so that JOLTS, already one month further in arrears than the payroll report, CES & CPS, will now come out earlier so that its numbers are publicly available for the same monthly payrolls before the next CES & CPS get released). Not really about the JOLTS figures themselves, though there are...

Read More »The Economy / Market Look “Healthy” Until They Have a Seizure and Collapse

So one index or asset or another hits a new high, wow, more proof everything is so robust and healthy, we never had it so good–right up to the seizure and collapse. Some readers occasionally make the point that I’ve been predicting a market crash for ten years and been dead-wrong for ten years. I’m all for mocking presumptuous pundits of either the tin-foil hat or mainstream variety, but that’s not quite what I’ve been saying for 13 long, tedious years. What I’ve...

Read More »Samsung will NFTs mit seinen Smart-TVs anbieten

Samsung könnte mit seinem Vorstoß einen weiteren Boom des NFT Marktes auslösen. Die Non Fungible Token sollen mit der neuen Generation der Samsung Smart-TVs nutzbar sein. Crypto News: Samsung will NFTs mit seinen Smart-TVs anbieten Die Nutzung des linearen Fernsehens ist seit Jahren rückläufig. Doch immer mehr Menschen nutzen Internetfernsehangebote mit Smart-TVs. Damit hat sich das Fernsehen bereits neu erfunden – Mediatheken und Streaming-Anbieter wie Netflix...

Read More »Why Did the World Choose a Gold Standard Instead of a Silver Standard?

Among those who support the end of government fiat money, it’s not uncommon to hear and see claims that gold is “the best money” or “natural money” or the only substance that’s really suited to be commodity money. In many of these cases, when they say “gold” they mean gold, and not silver, platinum, or any other precious metal. Naturally, one can expect to encounter these claims among those who have made a living out of promoting gold and gold-related investments for...

Read More »Pandemic pushes Swiss house prices higher

Consumer prices have risen sharply in Switzerland, increasing the attractiveness of tangible assets such as residential property © Keystone / Christian Beutler The value of residential property in Switzerland continued to rise strongly in 2021 in the wake of Covid-19. Property prices are likely to rise further this year, according to an analysis. Owners of freeholder apartments saw an increase in value of 7.3% over the course of the year. The increase for...

Read More »New York State Has Imposed New Covid Rituals. This Time There’s Some Resistance.

With new mask and vaccine mandates, New York’s Governor Kathy Hochul has reaffirmed the state’s status as the nation’s most zealous practitioner of covid cultism. Original Article: “New York State Has Imposed New Covid Rituals. This Time There’s Some Resistance.” Friday, December 10, New York State governor Kathy Hochul reaffirmed the state’s status as the nation’s most zealous practitioner of covid cultism with the announcement of a new statewide “vax-or-mask”...

Read More »Annual consumer price inflation hits 0.6 percent

The cost of energy is a less important factor for the Swiss consumer price index than in other countries. Keystone/Alessandro Della Bella Consumer prices in Switzerland increased by 0.6% on average last year, according to the Federal Statistics Office. The rise is due in particular to higher prices for petroleum products and for housing rentals. In contrast, prices for international package holidays and medicines decreased, the officeExternal link said on Tuesday....

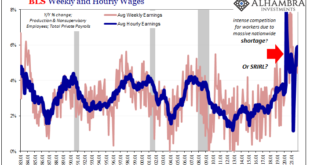

Read More »As The Fed Tapers: What If More Rapid (published) Wage Increases Are Actually Evidence of *Deflationary* Conditions?

Since the Federal Reserve is not in the money business, their recent hawkish shift toward an increasingly anti-inflationary stance is a twisted and convoluted case of subjective interpretation. Inflation is money and if the Fed was a central bank the issue of consumer prices wouldn’t necessarily be simple, it would, however, be much simpler: is there or isn’t there too much money flowing through the economy. News to the vast majority of the public, no one at any...

Read More » SNB & CHF

SNB & CHF