What would “unconscionably excessive” even look, legally speaking? More to the issue, who gets to decide what constitutes “excessive?” The way the phrase has been inserted, it’s as if Congress today seeks to plant its members on some incorporeal higher plane than mere physical substance, too, diving deep into the moral consciousness of the nation and economy in order justify taking general action. Just last week, the House of Representatives passed a bill which...

Read More »Austrian Economists Are Not Surprised by the Shortages

While supporters of the Biden administration fault Putin for shortages, Austrian economists know the answer lies in Washington’s monetary and economic mismanagement. Original Article: “Austrian Economists Are Not Surprised by the Shortages” In the last few years, it seems as if there has been a hot new story about a different commodity facing some form of shortage every single day. Most recently we have seen a baby formula shortage. However, that is most certainly...

Read More »Ukraine war hits supplies of food packaging material

Switzerland is considering emergency stockpiling of plastic packaging as the Ukraine war brings a world shortage of packaging material, reports the NZZ am Sonntag. Up to now the government has only stockpiled plastic to be able to produce disinfectant bottles. “With the experiences from the pandemic as well as the changed availabilities and strong price developments, the needs are being reviewed,” the Federal Office for National Economic SupplyExternal link confirmed...

Read More »Deirdre McCloskey Becomes a Fellow of the Erasmus Forum

The Austrian Economics Center and the Hayek Institut congratulate Deirdre McCloskey on becoming a Fellow of the Erasmus Historical and Cultural Research Forum. Next week, on June 1, the London School of Economics is celebrating its Deirdre McCloskey inaugural lecture as a Fellow of the Erasmus Forum. This inaugural edition of the lecture will be held by McCloskey herself on The Near Impossibility of Policy. We at the Austrian Economics Center want to...

Read More »Is It Being Demanded?

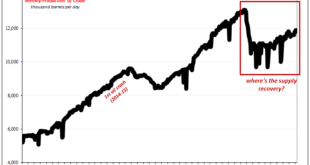

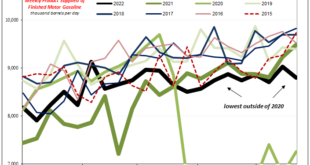

Shipping container rates have been dropping since early March – right around the time when we had just experienced our “collateral days” and then stood by to witness chaotic financial fireworks, inversions, the whole thing. The bane of the logistical supply-side snafu-ing, it has been container redistribution mucking the goods economy up.The recent and sharp decline in container rates, according to Freightos, is because China’s been closed down by Xi’s pursuit of...

Read More »Christianity and the Development of Human Capital: Challenging the Narratives

While the standard secular narrative is that Christianity held back science and human development, history tells a different story, one of literacy and the development of human capital. Original Article: “Christianity and the Development of Human Capital: Challenging the Narratives” Undeniably, the advent of Christianity has fundamentally transformed the world. But this startling fact has been obscured by thinkers eager to depict Christianity as a backward religion...

Read More »China sorgt für Crash des Altcoins STEPN

Innerhalb weniger Stunden verloren zwei Cryptocoins genannt GMT und Green Satoshi etwa die Hälfte ihres Werts. Die Ursache für den Crash zeigt, wie staatliche Eingriffe den Markt zum Glückspiel machen können. Crypto News: China sorgt für Crash des Altcoins STEPNGreen Satoshi fiel von knapp über 2 US-Dollar auf etwas mehr als einen Dollar. GMT fiel von 1,38 US-Dollar auf ungefähr 0,80 US-Dollar. Was war passiert?Beide Altcoins sind über das Projekt STEPN verbunden....

Read More »Fed is Hiking when it should be Cutting [Eurodollar University, Ep. 238]

The Federal Reserve is hiking rates as part of political theater in response to pressure from the legislative and executive branches of the US government. 'Do something!' A panoply of economic, monetary and financial accounts are screaming for looser monetary policy, not tighter. ----EP. 238 REFERENCES---- History Shows the Fed Would Be Cutting Rates by Now: https://bit.ly/3G2vCyF Alhambra Investments Blog: https://bit.ly/3wh01G2 RealClear Markets Essays: https://bit.ly/38tL5a7 Epoch Times...

Read More »Public Healthcare Threatens Liberty in the U.S.

Despite higher healthcare costs, Americans receive better healthcare, provided by the individually tailored healthcare plans, courtesy of the private sector. There is no such thing as a free lunch. Whether you pay with your time or someone else’s money, Milton Freedman hit the nail on the head. Nothing in life is ever free; healthcare included. Many Americans argue that a universal healthcare system such as the ones implemented in Europe is the most...

Read More »Hong Kong Stocks Pivot Euro$ #5

The stock market hasn’t been moneyed; well, US equities, anyway. What do I mean by “moneyed?” Common perceptions (myth) link the Federal Reserve’s so-called money printing (bank reserves) with share prices. Everyone still thinks there’s a direct monetary injection in this case by the central monetary agency which causes stocks to rise for no good reason. While we don’t have to argue the Fed’s bank reserves here, the truth of the matter is stocks have been severed...

Read More » SNB & CHF

SNB & CHF