On today’s episode I sit down with Jeff Snider. Jeff is the Head of Global Research at Alhambra Investments. He’s developed a working model for the global monetary system that is unlike anything else I’ve seen to date. The general thesis is that the Eurodollar system is working behind the scenes to soak up dollar liquidity, which results in a global dollar shortage. A lot of what you’ll hear today flies in the face of other narratives we discuss on this show, which is...

Read More »457 TIP. Why The Dollar Keeps Rising w/ Jeffrey Snider

On today’s episode I sit down with Jeff Snider. Jeff is the Head of Global Research at Alhambra Investments. He’s developed a working model for the global monetary system that is unlike anything else I’ve seen to date. The general thesis is that the Eurodollar system is working behind the scenes to soak up dollar liquidity, which results in a global dollar shortage. A lot of what you’ll hear today flies in the face of other narratives we discuss on this show, which is...

Read More »Bitcoin stabilisiert sich oberhalb von 20K

Die Abwärtsbewegung des BTC-Preises wurde erst einmal gestoppt. Oberhalb von 20.000 US-Dollar kam es zur Stabilisierung des Kurses. Damit hat der Bitcoin dennoch im 10-Tages-Vergleich etwa 50 Prozent seines Wertes verloren. Allerdings kommt die Stabilisierung zu diesem Zeitpunkt überraschend. Bitcoin News: Bitcoin stabilisiert sich oberhalb von 20KIn den USA kündigten die Zentralbanken einen Anstieg der Zinsen an, den es in dieser Höhe zuletzt vor mehr als 30 Jahren...

Read More »Fritz Zurbrügg: Introductory remarks, news conference

In my remarks today, I will present the key findings from the new Financial Stability Report, published this morning by the Swiss National Bank. Economic environment In the period between the publication of the last Financial Stability Report and the end of 2021, economic and financial conditions for the Swiss banking system remained favourable. GDP has returned to, or even exceeded, pre-crisis levels in most countries and unemployment rates have receded globally....

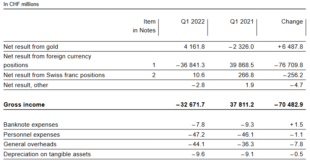

Read More »Тhomas Jordan: Introductory remarks, news conference

Ladies and gentlemen It is my pleasure to welcome you to the Swiss National Bank’s news conference. In my remarks, I will begin by explaining our monetary policy decision and our assessment of the economic situation. After that, Fritz Zurbrügg will present the key messages from this year’s Financial Stability Report. Andréa Maechler will then comment on the situation on the financial markets and the implementation of monetary policy. We will – as ever – be pleased to...

Read More »Andréa M. Maechler: Introductory remarks, news conference

I will begin my remarks with a review of developments on the financial markets over the past half-year. I would then like to discuss the lowering of the threshold factor mentioned by Thomas Jordan. Situation on the financial markets Volatility on the financial markets has increased again significantly since the beginning of the year (cf. chart 1). This was driven by the sharp rise in inflation abroad and by attendant expectations regarding a speedier tightening of...

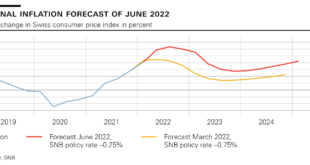

Read More »SNB Monetary policy assessment of June 2022

Swiss National Bank tightens monetary policy and raises SNB policy rate to −0.25% The SNB is tightening its monetary policy and is raising the SNB policy rate and the interest rate on sight deposits at the SNB by half a percentage point to −0.25% to counter increased inflationary pressure. The tighter monetary policy is aimed at preventing inflation from spreading more broadly to goods and services in Switzerland. It cannot be ruled out that further increases in the...

Read More »Swiss lower economic growth forecasts due to war and inflation

SECO lowered this year’s GDP growth forecast from 2.8% (in March) to 2.6%. © Keystone / Gaetan Bally The Swiss Secretariat for Economic Affairs (SECO) has downgraded its economic growth forecast for 2022 to 2.6% due to the war in Ukraine and uncertainties in China. “The Swiss economy made a solid start to the year, but prospects for the international environment have waned,” SECO saidExternal link on Wednesday. “In particular, the global economy is at risk from the...

Read More »Bribe Money for Ukrainian Officials?

In my blog post of May 18, 2022, I raised the possibility that the $40 billion aid package that Congress quickly approved for Ukraine was going to be used, at least in part, to pay multimillion dollar bribes to Ukrainian officials. After all, why else would the members of Congress, as well as the Pentagon’s assets within the mainstream press, react so vociferously against the idea of having the Inspector General monitor how the money is being used? And what better...

Read More »Ukraine war forces Swiss business to make choices on neutrality

Zurich’s Kunsthaus, where the Bührle collection is a reminder of the moral hazards of neutrality. © Keystone / Walter Bieri Sanctions imposed on Russia have focused debate over the country’s long-cherished economic haven status. In the gleaming new Chipperfield extension of the Zurich Kunsthaus, all polished limestone and gold, is a room dedicated to expiating the moral debits of economic neutrality. The Bührle collection is one of the greatest privately-amassed...

Read More » SNB & CHF

SNB & CHF