Die Zahl der bei Banken in der Schweiz beschäftigten Mitarbeitenden stieg im vergangenen Jahr gemäss der Bankenstatistik der SNB um 0,7 Prozent auf 90’577. Trotz anspruchsvollem Umfeld und der Pandemie-Situation ist das zum zweiten Mal in Folge ein leichter Anstieg. Der Anteil der weiblichen Beschäftigten in der Schweizer Bankbranche bleibt mit knapp 38% im Vergleich zum Vojahr unverändert. (Bild: Shutterstock.com/Fizkes) Wie die am Donnerstag veröffentlichte...

Read More »Reaction Show: Jay Powell Opening Statement 75bps Hike [Eurodollar University, Ep. 249]

Jeff Snider reacts live to Jay Powell's June 15, 2022 opening statement to assembled members of the press regarding the Federal Reserve's 75-basis point rate hike to the Federal Funds target range: the overarching message, overall economic activity, inflation, labor, and the 3/4-point move. ----EP. 249 REFERENCES---- Transcript of Chair Powell’s Press Conference June 15, 2022: https://bit.ly/3bbk40N Alhambra Investments Blog: https://bit.ly/3wh01G2 RealClear Markets Essays:...

Read More »Unheeded warnings: Václav Klaus at the Marmara Forum

This not the first time that Václav Klaus’ astute observations and experience-based predictions turn out to be shockingly accurate years later, and I’m pretty confident it will not be the last. Even before the examples that follow and that he clearly laid out in his address at the Marmara Forum, the former President of the Czech Republic has repeatedly proven to be quite prophetic in his assessment of the future. From his critique and his warnings about...

Read More »The Inverted Yield Curve and Recession

The “yield curve” refers to a graph showing the relationship between the maturity length of bonds—such as one month, three months, one year, five years, twenty years, etc.—plotted on the x axis, and the yield (or interest rate) plotted on the y axis.1 In the postwar era, a “normal” yield curve has been upward sloping, meaning that investors typically receive a higher rate of return if they are willing to put their funds into longer-dated bonds. A so-called inverted...

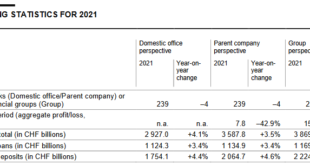

Read More »Annual banking statistics for 2021

The Swiss National Bank has today published data on the annual financial statements of banks in Switzerland for the 2021 financial year. For the first time, the published data also comprises bank office data (Domestic office perspective) in addition to the data from individual financial statements (Parent company perspective) and consolidated financial statements (Group perspective). The Domestic office perspective shows data on the business of banks including their...

Read More »Ep – 34 The BearLord: A Recession Cometh

We welcome Travis Kimmel, AKA the Dollar Fatalist, the Wizard of Web1, the Crusher of Cryptocurrency dreams, and our favorite moniker, the illustrious BearLord, onto the Gold Exchange Podcast! Travis joins Keith to talk about Bitcoin acolytes’ underlying Marxist philosophy, interest rate hikes, balance sheets, and so much more. Listen in to hear what the famous BearLord thinks about whether a recession cometh, and why it’s insanity to hike rates in this market. This...

Read More »The Great Reset: Turning Back the Clock on Civilization

The covid-19 pandemic featured an unprecedented fusion of the interests of large and powerful corporations with the power of the state. Democratically elected politicians in many countries failed to represent the interests of their own citizens and uphold their own constitutions and charters of rights. Specifically, they supported lockdown measures, vaccine mandates, the suppression of a variety of early treatment options, the censorship of dissenting views,...

Read More »Could Retail “Bagholders” Spark a Rally “Smart Money” Will Be Forced to Chase?

There would be some deliciously karmic justice in the “dumb money” driving a rally that forced the “smart money” to cover their shorts and chase the rally that shouldn’t even be happening. Being cursed with contrarianism, as soon as a trade gets crowded and the consensus is one way, I start looking for whatever is considered so unlikely that it’s essentially “impossible.” Sorry, I can’t help myself. The crowded trades are 1) long the Commodity Super-Cycle and 2) long...

Read More »Why The Dollar Keeps Rising w/ Jeffrey Snider (TIP457)

On today’s episode I sit down with Jeff Snider. Jeff is the Head of Global Research at Alhambra Investments. He’s developed a working model for the global monetary system that is unlike anything else I’ve seen to date. The general thesis is that the Eurodollar system is working behind the scenes to soak up dollar liquidity, which results in a global dollar shortage. A lot of what you’ll hear today flies in the face of other narratives we discuss on this show, which is...

Read More »457 TIP. Why The Dollar Keeps Rising w/ Jeffrey Snider

On today’s episode I sit down with Jeff Snider. Jeff is the Head of Global Research at Alhambra Investments. He’s developed a working model for the global monetary system that is unlike anything else I’ve seen to date. The general thesis is that the Eurodollar system is working behind the scenes to soak up dollar liquidity, which results in a global dollar shortage. A lot of what you’ll hear today flies in the face of other narratives we discuss on this show, which is...

Read More » SNB & CHF

SNB & CHF