Irina Zubchenko walks with her dog Max amid the destruction caused after shelling of a shopping center in March 2022, in Kyiv, Ukraine. Keystone How to set Ukraine on the path to recovery will be the focus of a major international conference hosted by Switzerland in Lugano in early July. But that may be easier said than done with war still raging in parts of the country and lingering concerns about corruption. “Priority number one remains ending the war, because...

Read More »Macro and Prices

(Combining the weekend macro commentary and price action review in one note. Check out the July monthly.) Three economic reports highlight the week ahead: Japan's labor cash earnings at the start of the week and the US employment report and China's CPI at the end of the week. In addition, the Reserve Bank of Australia meets early on July 5. The Bank of Japan's insistence that inflation, which is running slightly above target is not sustainable is that it is a...

Read More »Argentinien beschlagnahmt Crypto-Wallets

Die Wallets wurden im Zusammenhang mit Steuerhinterziehung beschlagnahmt. Es handelt sich dabei, Berichten zu Folge, um mehr als 1.200 Wallets, die angeblich „säumigen Steuerzahlern“ zugeordnet werden konnten. Crypto News: Argentinien beschlagnahmt Crypto-WalletsDie Steuerbehörde selbst hat die Beschlagnahmung veranlasst, die darauf von einem Gericht abgesegnet wurde. Allerdings geht man aktuell davon aus, dass die Versäumnisse nicht zwingend im Zusammenhang mit...

Read More »64: Hidden Monetary System Running The World – Jeff Snider, Eurodollar University

Jason Hartman interviews Jeff Snider, Chief Investment Strategist and Head of Global Research at Alhambra Investment Partners. Consumer prices and asset markets have created the illusion of a red hot economy, but according to Jeff, the bond market has been telling us what's been wrong since 2008. Jeff shares with us some incredible data that shakes up traditional thinking and gives us his insights on the Federal Reserve, interest rate hikes, monetary policy and money printing and the...

Read More »Swiss gold imports come under scrutiny as G7 targets Russia

Some Western countries plan to officially ban gold imports from Russia. In 2021, Russia dug up 314 tonnes of gold, nearly 10% of the metal mined globally. Ria Novosti An unexpected spike in Switzerland’s gold imports from Russia is under scrutiny as the leaders of the world’s wealthiest nations gear up to introduce a ban on the precious metal. The G7’s focus on gold, Russia’s second-largest export after energy, marks the latest effort by Western nations to ramp up...

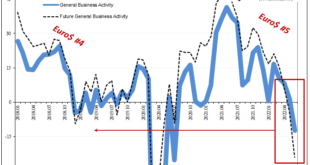

Read More »Getting Whipped Will Really Hurt

The Federal Reserve’s various branches don’t just do manufacturing surveys anymore. This is a modern economy, after all, meaning industry isn’t the same top dog as what it used to be. While still important, and still able to tear down even the global-iest synchronized of growth-y, services are the big macro enchilada. Reflecting this fact, there are now regional Fed services surveys producing services indices to go along with the manufacturing sentiment stuff. I’ll...

Read More »Peter Lewin and Steven Phelan: How Do Entrepreneurs Calculate Economic Value Added? Subjectively.

At the core of the entrepreneurial orientation that is the engine of vibrant, growing, value-creating, customer-first businesses, we find the principles of subjectivism and subjective value. Subjective value embraces not only the value the customer seeks, but also the value that entrepreneurs establish in their companies: capital value. Once businesses master these two principles in combination, they can open new horizons of innovation and growth. Key Takeaways...

Read More »Who Really Makes US Foreign Policy? Who Benefits and Who Loses?

In a piece of news that shocked the mainstream media, but which shocked no one familiar with the academic industry writ large, retired US Army general John Allen was forced to resign as president of the Brookings Institution after it was revealed the FBI was investigating him for lobbying on behalf of the Qatari monarchy. Of course, the real news, scarcely noted by the Washington Post, New York Times, or any other purported paper of record, is that Allen was only...

Read More »War and peace: dual-use technologies divide

New technologies, developed to improve our society, are increasingly being used to wage war. Switzerland, which leads the development of autonomous drones, is very much affected by this phenomenon. But regulating it is very difficult and requires a joint effort by the international community – a tall order when interests collide. The war in Ukraine has emphasised that all innovations can have both civilian and military applications. It’s a two-way street that has...

Read More »Swiss franc worth more than the euro

© Cameracraft8 | Dreamstime.com This week, the Swiss franc rose to beyond parity with the euro as traders sought safe haven assets as concerns about risks to global growth grew. The Euro-Swiss Franc pair fell below 1.00 franc per euro during the morning of 29 June 2022 and remained below 1.00 until the morning of 1 July 2022 when the value of a euro exceed that of a franc. The pair has not been this low since 2015. The rise has been driven by the franc’s haven status...

Read More » SNB & CHF

SNB & CHF