© Cameracraft8 | Dreamstime.com This week, the Swiss franc rose to beyond parity with the euro as traders sought safe haven assets as concerns about risks to global growth grew. The Euro-Swiss Franc pair fell below 1.00 franc per euro during the morning of 29 June 2022 and remained below 1.00 until the morning of ...

Topics:

Investec considers the following as important: 1) SNB and CHF, 3.) Investec, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

This week, the Swiss franc rose to beyond parity with the euro as traders sought safe haven assets as concerns about risks to global growth grew.

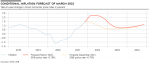

The Euro-Swiss Franc pair fell below 1.00 franc per euro during the morning of 29 June 2022 and remained below 1.00 until the morning of 1 July 2022 when the value of a euro exceed that of a franc. The pair has not been this low since 2015.

The rise has been driven by the franc’s haven status and the Swiss National Bank’s (SNB) no nonsense approach to heading off inflation. With Swiss inflation at 2.9% (May 2022) the SNB decided to hike rates by 50 basis points and has signalled that it may go further if necessary.

By comparison, the European Central Bank (ECB) responded to eurozone inflation of 8.1% (May 2022) with no hikes, although it has said it will raise its deposit rate by 25 basis points from its current level of -0.5% at its next meeting in July 2022. On 1 July 2022, the ECB also paused its programme of bond buying, or quantitative easing. However, eurozone inflation continues to rise. In June 2022, it rose to 8.6%, adding further to the challenge.

The SNB rate rise was the first in 15 years, while the planned July ECB hike will be the first in 11 Years.

The Swiss franc also strengthened against the US dollar during June 2022.

Tags: Featured,newsletter