In the early morning of July 6th, an explosion damaged a monument in Georgia known as the Georgia Guidestones. Because of the damage, the rest of the monument was demolished for safety reasons. The stones were erected by anonymous donors in 1980 and list ten principles for humanity. At the time of writing, it seems that the explosion was the result of purposeful sabotage. Writing at Marginal Revolution, Alex Tabarrok compares the willful destruction of the monument...

Read More »What the Heck Is Happening to Silver?!

The dollar rose this week, from 17.87mg gold to 18.24mg (that’s “gold fell from $1,740 to $1,705” in DollarSpeak), a gain of 2.1%. In silver terms, it rose from 1.61g to 1.67g (in DollarSpeak, “silver dropped from $19.24 to $18.64), or 3.7%. As always, we want to look past the market price action. Two explanations are hot today. Let’s look at them first, before moving on to our unique analysis of the basis. JP Morgan and Motte and Bailey JP Morgan’s manipulation of...

Read More »The Euro Dollar University Breakdown Jeff Snider || Inflation & Recession Bear Market

The Euro Dollar Breakdown Jeff Snider, Inflation & Recession Bear Market . Jeff Snider is one of the foremost experts on the global monetary system, specifically the eurodollar money system, and all aspects of its misunderstood inner workings and how they impact global markets, commerce, and economy. Jeff snider breakdown the cause of the euro dollar and inflation. #jeffsnider#recession DISCLAIMER : I am not a financial advisor. The ideas presented in this video are for entertainment...

Read More »The Dollar is on its Back Foot

Overview: The dollar’s downside correction continues today, helped by hawkish signals from the Reserve Bank of Australia and unnamed sources who have played up the chances of a 50 bp hike by the European Central Bank on Thursday. Asia Pacific equities were mixed, and mostly lower after the losses in the US yesterday. The prospect of a more aggressive ECB is weighing on European equities. The Stoxx 600 is slightly lower after rallying 2.7% in the past two sessions....

Read More »Jeff Snider on the Best Form of Money

Clip from 'Everything You Know About the Economy is Wrong with Jeff Snider' - What Bitcoin Did Episode 528. Listen to the full episode here: https://youtu.be/KNa-fewraJA

Read More »Covid-19 and the Continuing Erosion of Private Property Rights

This article is the second in a two-part series. Check out part 1 here. Even though the downhill trajectory we’ve seen over the last decades in terms of property rights is bad enough, nothing could have ever prepared us for what the covid-19 crisis would bring. Even those of us who have read enough history to know that there’s really no line that the state will not cross in its fervent pursuit of absolute power were sincerely surprised. How could the ruling elite...

Read More »The Swiss army: your questions answered Part 5

In Switzerland, all able-bodied men complete compulsory military service, while others opt for a civilian service. But how useful is a conscript army in light of what Russia did to Ukraine? This is one of many questions SWI readers sent to us. Daniel Reist, head of media relations for the Swiss armed forces, takes a shot at answering them. Our fifth question is: what would the army do if there was a nuclear war? More questions and answers are to follow in the coming weeks. ---...

Read More »Markt erholt sich, doch haben wir die Talsohle wirklich durchschritten?

Die Signale sind in den letzten Tagen wieder auf Grün gesprungen. Im gesamten Markt gibt es ein klares Kursplus. Bitcoin legte im Wochenvergleich 10 Prozent zu. Doch ist dies der Anfang eines Bullenruns oder könnte es in naher Zukunft wieder runtergehen? Bitcoin News: Markt erholt sich, doch haben wir die Talsohle wirklich durchschritten?Seit Donnerstag letzter Woche ging es für den BTC stetig nach oben. Gestern erreichte der Kurs dann sogar ein Monatshoch von mehr...

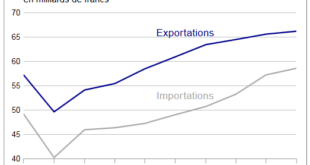

Read More »Swiss Trade Balance 2nd quarter 2022: 8th consecutive quarterly increase

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

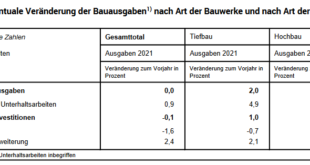

Read More »Construction expenditure remains at the same level in 2021 for the second time in a row

17.07.2022 – Construction expenditure again remained stable in 2021 compared with the previous year. Investments in civil engineering rose by 1.0% and those in building construction fell by 0.4%. As a result, total investment in construction showed a decline of 0.1%. These are the provisional findings from the Construction Statistics from the Federal Statistical Office (FSO). Percentage change in construction expenditure by type of building and by type of work...

Read More » SNB & CHF

SNB & CHF