Foreign outflows from Japanese equity markets are being more than offset by the BoJ’s purchases of ETFs.Japanese equities received net inflows in March. Nevertheless, foreigners were net sellers – with the highest monthly net foreign redemptions in the past 18 months. Thanks to the Bank of Japan’s (BoJ) purchases of Exchange Traded Funds (ETFs), there have still been net inflows into Japanese equities despite the strong foreign outflows.The BoJ is buying ETFs according to plan, currently running at a pace of JPY 6000 trillion per year. The central bank did not significantly increase its purchases in March.The share of equity ETFs in the BoJ’s purchase programme has increased from 4.3% in September 2016 to nearly 11% today.Japanese equity valuations have fallen back, as they have in

Topics:

Jacques Henry considers the following as important: Bank of Japan asset purchases, Japanese equities, Japanese equity market, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Foreign outflows from Japanese equity markets are being more than offset by the BoJ’s purchases of ETFs.

Japanese equities received net inflows in March. Nevertheless, foreigners were net sellers – with the highest monthly net foreign redemptions in the past 18 months. Thanks to the Bank of Japan’s (BoJ) purchases of Exchange Traded Funds (ETFs), there have still been net inflows into Japanese equities despite the strong foreign outflows.

The BoJ is buying ETFs according to plan, currently running at a pace of JPY 6000 trillion per year. The central bank did not significantly increase its purchases in March.

The share of equity ETFs in the BoJ’s purchase programme has increased from 4.3% in September 2016 to nearly 11% today.

Japanese equity valuations have fallen back, as they have in Europe, and the two regions’ equities are now trading at comparable levels. The TOPIX is currently trading at 13.8x 12-month forward earnings, compared with 15.8x for the S&P 500.

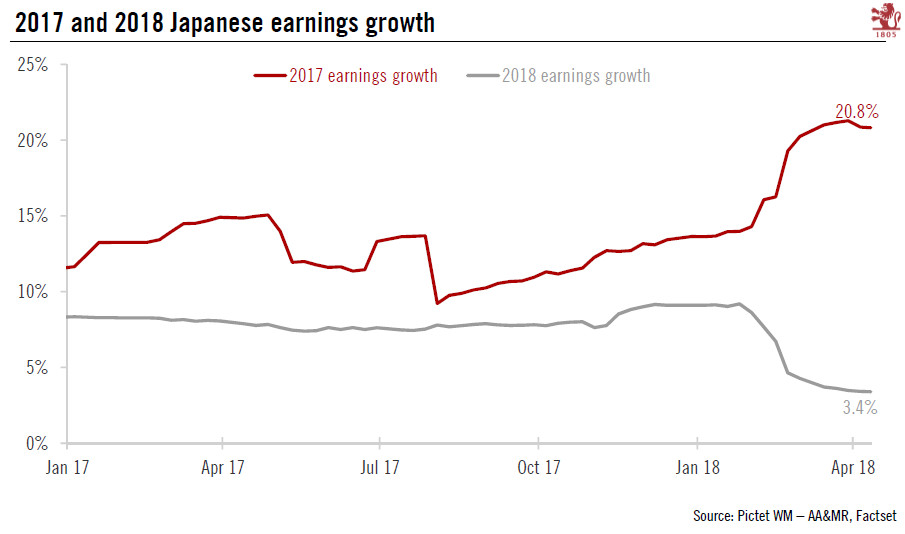

2018 earnings growth in Japan is expected at 3.4% and saw downwards revisions during the Q4 17 reporting season that provided the highest net income surprises in six years. In fact, 2017 earnings growth was revised up from around 14% to just under 21% (see Chart below). This is partly linked to the tax cuts in the US, which boosted the earnings of Japanese companies with operations in the US.

The trade war between the US and China is a potential risk for Japanese equities as Japan is a major exporter, and has a trade surplus with the US.