Modest wage pressures and low inflation expectations mean we see no reason to change our forecast of a single Fed rate increase this year, probably in December The US Employment Cost Index increased by 0.6% quarter-on-quarter and by 2.3% year-on-year in the second quarter, in line with expectations.Potential domestic wage pressures in the US remain hard to analyse. The unemployment rate has fallen sharply, and most other labour market indicators have improved. Although there is much discussion about the slack remaining in the US labour market, there is no denying it has diminished markedly. At some stage, the fall in unemployment should feed through into wage inflation, and we are probably seeing just the beginning of that. However, although we continue to expect wage increases to pick up gradually over the coming months, for the time being most measures of wages are continuing to rise at a gentle pace, at least by past standards. As a consequence, we think the impact of wage increases on overall core inflation should remain pretty muted, at least for the coming six to 12 months.As widely expected, the Federal Open Market Committee’s (FOMC) July statement, published earlier this week, sounded less dovish than June’s.

Topics:

Bernard Lambert considers the following as important: FOMC July statement, Macroview, US interest rates, US labour market, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Modest wage pressures and low inflation expectations mean we see no reason to change our forecast of a single Fed rate increase this year, probably in December

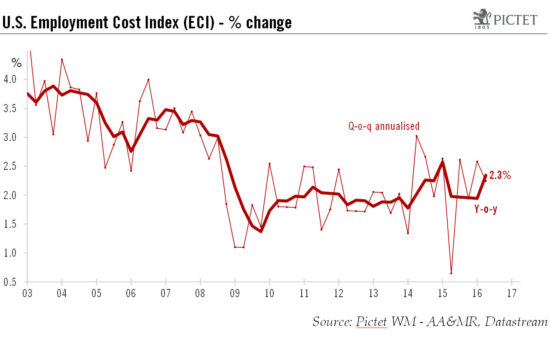

The US Employment Cost Index increased by 0.6% quarter-on-quarter and by 2.3% year-on-year in the second quarter, in line with expectations.

Potential domestic wage pressures in the US remain hard to analyse. The unemployment rate has fallen sharply, and most other labour market indicators have improved. Although there is much discussion about the slack remaining in the US labour market, there is no denying it has diminished markedly. At some stage, the fall in unemployment should feed through into wage inflation, and we are probably seeing just the beginning of that. However, although we continue to expect wage increases to pick up gradually over the coming months, for the time being most measures of wages are continuing to rise at a gentle pace, at least by past standards. As a consequence, we think the impact of wage increases on overall core inflation should remain pretty muted, at least for the coming six to 12 months.

As widely expected, the Federal Open Market Committee’s (FOMC) July statement, published earlier this week, sounded less dovish than June’s. The Fed upgraded its assessment of the situation in the economy and in the labour market and indicated that “near-term risks to the economic outlook have diminished”. However, the Fed didn’t provide any meaningful hawkish signal either. Overall, the statement was consistent with a Fed that remains in a wait-and-see mode, but would like to hike base rates at least once this year. If monetary conditions remain reasonably relaxed and the labour market continues to improve noticeably, a September rate hike will become a distinct possibility.

However, with inflation – and inflation expectations –remaining low and with only a modest pick-up in wage increases, we continue to believe that the most likely scenario is that the Fed will wait until December before acting. In short, we continue to expect the FOMC to hike rates once this year, most probably in December, and twice in 2017.