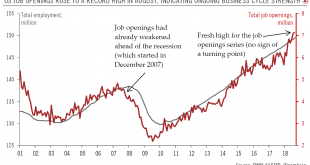

No sign of a let-up in the US business cycle as job openings continue to rise.We particularly like job openings data as an indicator for a turning point in the US macroeconomic cycle, even though this series has not much history (data start in December 2000), and in spite of its long lag to release (we just had data for August, i.e. it is more than two months old now).Still, job openings did a rather good job of indicating an inflexion point right before the global financial crisis: the US...

Read More »US employment – chugging along

The July employment report confirmed that the US economy is in great shape, and still unaffected by international trade tensions.The US labour market remains in fine fettle, as the three-month average in job growth up to July was 224,000. The unemployment rate dropped to 3.9%, while the ‘broader’ unemployment rate (U6) fell to 7.5%, its lowest level since May 2001.Wage growth remained relatively tame (especially in light of the low unemployment rate), with average hourly earnings growth at...

Read More »US jobs momentum remains robust

The May nonfarm report shows the labour market remains in fine fettle, even though wage gains are still not broad based.The May employment report showed that the US labour market – and the US economy more broadly – remains in great shape, with non-farm payrolls growing by 223,000 last month. The 2018 year-to-date average, at 207,000, is above last year’s 182,000. This strength is reassuring news, especially given the erratic course of US trade policy. The US labour market’s strength was...

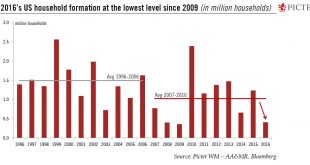

Read More »Soft household formation to curb US housing

Household formation trends mean the housing sector is unlikely to make a meaningful contribution to US GDP.The recently released Census Bureau’s Annual Social and Economic Supplement (ASEC) brought sobering news for the US housing market: new household formation slowed significantly, to 405,000 in 2016, the lowest level since 2009 (+357,000), compared with 1,232,000 in 2015. In other terms, the number of households grew only 0.3% last year, compared with +1.0% in 2015.In general, household...

Read More »US wages continue to rise at a gentle pace

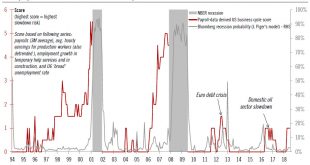

Modest wage pressures and low inflation expectations mean we see no reason to change our forecast of a single Fed rate increase this year, probably in December The US Employment Cost Index increased by 0.6% quarter-on-quarter and by 2.3% year-on-year in the second quarter, in line with expectations.Potential domestic wage pressures in the US remain hard to analyse. The unemployment rate has fallen sharply, and most other labour market indicators have improved. Although there is much...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org