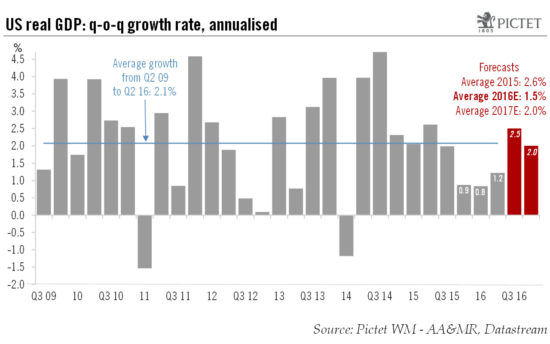

Disappointing GDP growth in the second quarter and downward revisions for the previous two quarters mean we are revising our GDP forecast for the US. US GDP grew by a surprisingly soft 1.2% (quarter on quarter, q-o-q, annualised) in Q2, well below consensus expectations of 2.5%. Moreover, growth in Q4 2015 and Q1 2016 was revised noticeably lower. Year-on-year growth in Q1 was revised down from 2.1% to 1.6%. In Q2, consumer spending grew by a strong 4.2% and final demand by a healthy 2.0%. However, changes in inventories contributed a negative 1.2 percentage points (which is actually a good omen for Q3 growth).Financial conditions in the US have eased back noticeably since the first quarter, the collapse in investment in the oil sector is ending, and the contribution from inventory build-up should turn positive again in the second half of this year. The main change we expect in the second half is less buoyant growth in consumer spending. Fuel prices have rebounded over the past few months and employment growth seems to be slowing down. At the same time, job creation should remain relatively healthy, while we believe wage increases are likely to pick up gradually.

Topics:

Bernard Lambert considers the following as important: Macroview, US GDP, US growth, US growth forecast, US growth revisions

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Disappointing GDP growth in the second quarter and downward revisions for the previous two quarters mean we are revising our GDP forecast for the US.

US GDP grew by a surprisingly soft 1.2% (quarter on quarter, q-o-q, annualised) in Q2, well below consensus expectations of 2.5%. Moreover, growth in Q4 2015 and Q1 2016 was revised noticeably lower. Year-on-year growth in Q1 was revised down from 2.1% to 1.6%. In Q2, consumer spending grew by a strong 4.2% and final demand by a healthy 2.0%. However, changes in inventories contributed a negative 1.2 percentage points (which is actually a good omen for Q3 growth).

Financial conditions in the US have eased back noticeably since the first quarter, the collapse in investment in the oil sector is ending, and the contribution from inventory build-up should turn positive again in the second half of this year. The main change we expect in the second half is less buoyant growth in consumer spending. Fuel prices have rebounded over the past few months and employment growth seems to be slowing down. At the same time, job creation should remain relatively healthy, while we believe wage increases are likely to pick up gradually.

Any fall in the growth in consumer spending should be more than compensated for by the disappearance of two important headwinds that weighed on growth in H1, namely the contraction in investment in the oil sector and the sharp negative contribution from changes in inventories. As the importance of oil sector investment as a component of GDP has become quite small, any positive impact should be very limited, but the markedly negative contribution to growth from this source during H1 will certainly disappear. Inventory build-up significantly damped GDP growth in H1. But the inventory adjustment has most probably run its course and in H2 the contribution of stockbuilding to GDP growth is likely to turn positive, at least slightly.

All in all, we expect GDP growth to recover to 2.5% in Q3 and to settle at 2.0% in Q4. Nevertheless, with the US growth figures for Q4 2015 and Q1 2016 revised down, and with Q2 softer than expected, we are cutting our yearly average growth forecast for 2016 from 1.8% to 1.5%. Our forecast for 2017 remains unchanged at 2.0%.