The Federal Reserve really wants to raise rates, but they do not dare as the consequence of interrupting an unprecedented level of capital misallocation is too grave to face head on. So our money masters continue their low interest rate policy; pulling society further and further into a capital structure that cannot be sustained long term. In other words, scare capital is consumed in order to feed the present structure of production. Low rates thus cement what cannot be upheld and the...

Read More »The Fed is likely to wait until September before hiking rates

As widely expected, core personal consumer expenditure (PCE) inflation dropped back slightly in March in the US, while wage increases remained subdued in Q1. We now expect that the Federal Open Market Committee (FOMC) will hike rates only once in 2016, probably in September. Read the full report here In Friday's report on income and consumption, data were also published on the PCE deflator, the price measure targeted by the Fed in gauging inflation. The core PCE price index (excluding...

Read More »Hillary Will be the Least of Your Worries – America has Economic Diarrhea

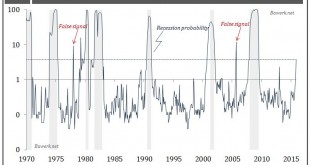

Economic Expansions and Recessions in the US since 1900 According to the National Bureau of Economic Research (NBER), the official recession arbiter, the US economy is currently at its fourth longest expansion in history. By the sheer nature of a capitalistic society with its inherent cyclicality it is a safe bet that a new economic recession will hit in the not too distant future. We have argued since June last year that the next recession is imminent and we now feel increasingly...

Read More »Circulus in probando

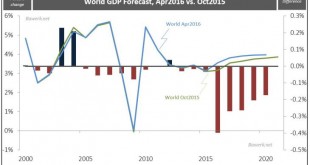

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth. First, they promote debt-funded consumption because spending – money supply/credit and velocity – is equivalent to nominal GDP growth, and as long as you have nominal GDP growth you can always add more debt to the existing stock ad infinitum. That obviously came crashing down in 2008. At that...

Read More »OPEC’s Doha Dilemma: 3mb/d US lock in?

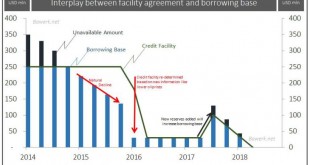

Bawerk shows that more than 3 mb/d of American oil production was helped by US$55.5bn in credit facilities, by excessive debt. This production is now at risk and the debt may not be repaid. The big OPEC players are playing against US shale oil and some smaller OPEC members that have higher costs. Another month, another flight to Hamad international airport for 17th April after initial agreement to hold ‘upstream horses’ in February 2016. While it’s no doubt great fun getting back...

Read More »L’empire américain impose ses lois au monde. Jean-Michel Quatrepoint

L’extraterritorialité du droit et du fisc américains est une réalité potentiellement amère pour la concurrence étrangère Accueil de Jean-Michel Quatrepoint, journaliste économique, membre du Conseil scientifique de la Fondation Res Publica, auteur de « Alstom, un scandale d’État – Dernière liquidation de l’industrie française » (Fayard : août 2015), au colloque « L’extraterritorialité du droit américain » du 1er février 2016. . L’exportation du droit américain, l’extraterritorialité des...

Read More »Les grands gagnants de l’endettement. Liliane Held-Khawam+ l’analyse du chef du départment monétaire de la BRI

Avant-propos: « Celui qui emprunte est l’esclave de celui qui prête ». Cette affirmation trouve sa source dans un des plus vieux livres de la terre: le livre des Proverbes dans la Bible! La polarisation du monde actuel est bien moins une question de droite ou de gauche, de religions, de races que de celle de créancier à débiteur. Toute la crise financière vécue à ce jour et dont les racines remontent à plusieurs décennies est une problématique d’endettement. L’éclatement de la crise de...

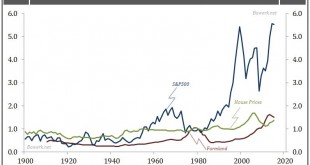

Read More »Greenspan, the Sheepherder

It is common knowledge by now that Federal Reserve Chairman Alan Greenspan oversaw, enabled and approved of, a major transition in the US economy. His infamous “Greenspan-put” in which his actions at the central bank would be driven, if not dictated, by the whims of financial markets, clearly led to higher asset prices. Investors obviously picked up on the strong bias in the Greenspan-Fed’s conduct of monetary policy as they slashed rates at the tiniest hiccup in financial markets, and...

Read More »Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beginning of a recession is not deflationary but the exact opposite. As can be seen from the chart, consumer prices do indeed move higher into recessions as represented by the shaded areas. Why? The most obvious explanation is simply that the...

Read More »Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beginning of a recession is not deflationary but the exact opposite. As can be seen from the chart, consumer prices do indeed move higher into recessions as represented by the shaded areas. Why? The most obvious explanation is simply that the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org