In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth. First, they promote debt-funded consumption because spending – money supply/credit and velocity – is equivalent to nominal GDP growth, and as long as you have nominal GDP growth you can always add more debt to the existing stock ad infinitum. That obviously came crashing down in 2008. At that important juncture, which proved to even the most ingrained and indoctrinated Krugmanite that something was seriously wrong with the economic model a proper re-set would be the only route toward sustainable prosperity. Instead of taking the honest path, countercyclical policy measures, both fiscal and monetary, aimed at maintaining and even expanding debt on top of the bloated and highly unsustainable level that existed at the 2008 inflection point. As parasitical, id est consumptive, debt got thrown a lifeline by the global central bankers with the explicit condonation by the like of the IMF, it is no wonder growth has been weak or even absent in the aftermath of reaching debt saturation. Old structures have been cemented and new capital formation mal-invested.

Topics:

Eugen von Böhm Bawerk considers the following as important: Austrian economics, Bawerk, Economics, Featured, Japan, newsletter, Politics, US

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth.

First, they promote debt-funded consumption because spending – money supply/credit and velocity – is equivalent to nominal GDP growth, and as long as you have nominal GDP growth you can always add more debt to the existing stock ad infinitum. That obviously came crashing down in 2008. At that important juncture, which proved to even the most ingrained and indoctrinated Krugmanite that something was seriously wrong with the economic model a proper re-set would be the only route toward sustainable prosperity. Instead of taking the honest path, countercyclical policy measures, both fiscal and monetary, aimed at maintaining and even expanding debt on top of the bloated and highly unsustainable level that existed at the 2008 inflection point.

As parasitical, id est consumptive, debt got thrown a lifeline by the global central bankers with the explicit condonation by the like of the IMF, it is no wonder growth has been weak or even absent in the aftermath of reaching debt saturation. Old structures have been cemented and new capital formation mal-invested.

Specifically from the latest IMF report on the global economy, we learn that “…persistent slow growth has scarring effects that themselves reduce potential output and with it, consumption and investment…”circulus in probando!

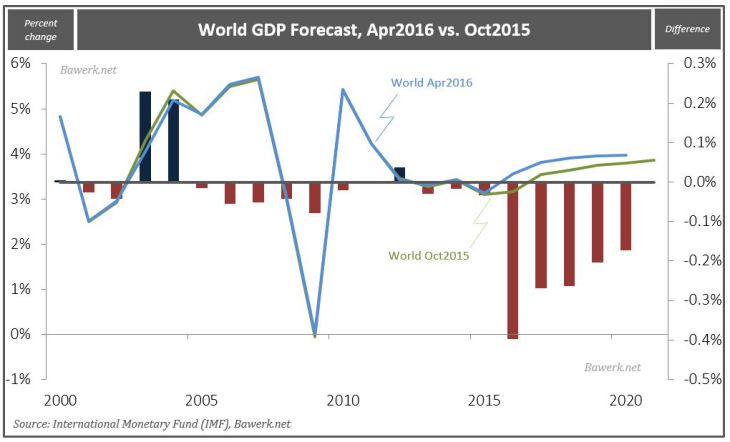

IMF now expect world growth to be 3.2 per cent in 2016, down from 3.6 per cent by their October outlook. |

|

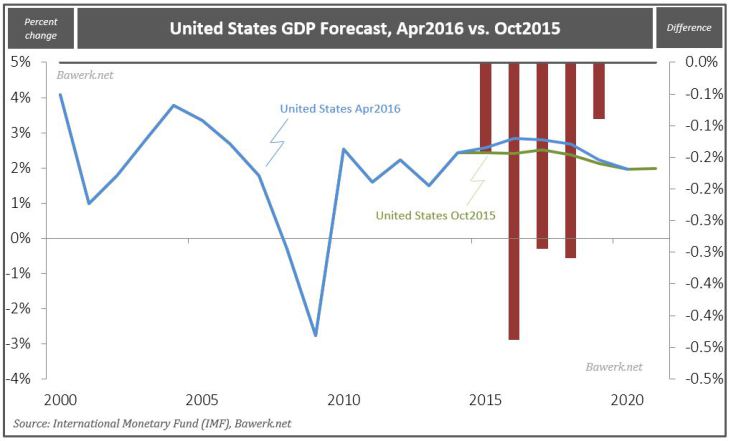

The most recent US projection tells you everything you need to know about the credibility of IMF, or dare we say mainstream, forecasting. While the IMF slashed the expected growth for 2016 by more than 40 basis points compared to their October release, to 2.4 per cent they will still be way off even upon release of the report.

The US economy probably did not grow at all in the first quarter and as we will show in an upcoming report, the US economy is already in, or at the very least heading straight into a recession. |

|

Why so optimistic? There are two reasons. First, being taught from the scriptures of Keynes they believe the business cycle is solely driven by animal spirits and if they can somehow change people’s perception of the world by providing a rosy outlook the world will automatically become better. Magic. We call it Goebbelnomics.

The second reason is less insincere and more technical. In the New Testament of the scripture, originally written by Ragnar Frisch it is postulated that all economic processes can be mathematically deduced in a complex web of equations, commonly known as an econometric model. An economic model is nothing more than an extrapolation of historical data and does not tell us anything worth knowing, such as upcoming structural shifts and unsustainable economic processes.

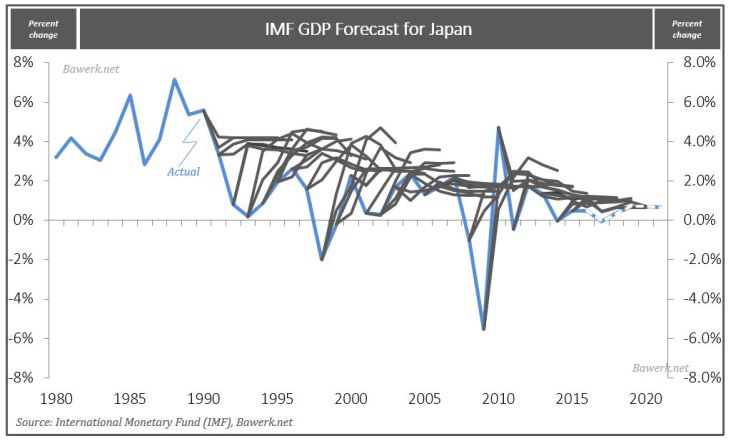

We looked at the rate of growth in Japan since 1980 and all IMFs forecast for Japan since 1990 and plotted them. The result is unsurprising, but striking nonetheless. |

|

Japan, opting for monetary stimulus to restructure their economy away from exports toward domestic consumption on back of a forced dollar deprecation emanating from the Louvre Accord (sounds familiar?) crashed in 1990. It was a structural shift, but IMFs models looked to recent history and consistently projected rapid growth. It was not until the mid-2000s, nearly 15 years after the fact that models got enough low-growth data into their sample to adjust forecasts accordingly. Ironically, that was just in time for another structural shift hitting the Japanese economy, which was obviously also completely missed by models guided by rear-view mirror. Just as a wave hitting the shoreline, economic forecast rises rapidly while only gradually abating toward the new reality.

Any honest person working with such models know their gross limitations and how awful their track-records are. Still, these are the tools guiding the world’s central planners when they micromanage economies, be it fiscal or monetary expansion.

They are obviously completely clueless, but still act with an extravagant level of hubris simply because they believe the scripture and their models.