Strong money-supply growth in February enables us to maintain our forecast for euro area real GDP growth unchanged at 1.8% in 2016. Euro area bank credit flows increased again in February, in line with other indicators such as the ECB’s Bank Lending Survey (see the chart below) and quite remarkably given the challenging financial context in February. We continue to believe that the credit cycle has legs. Moreover, we expect the ECB’s new Targeted Long Term Refinancing Operations (TLTRO II) to lower bank funding costs and support bank lending. As a result, we maintain our forecast for euro area real GDP growth unchanged at 1.8% for 2016. The detail of the February M3 report revealed that the annual rate of expansion in the euro area money supply (M3) was stable at 5.0% y-o-y in February, in line with consensus expectations, and averaged 4.9% in the three months from December to February. Meanwhile, growth of the narrow aggregate M1, which includes currency in circulation and overnight deposits, decelerated slightly from 10.5% y-o-y to 10.3% y-o-y, its slowest rate since March 2015. Looking at the breakdown of loans within M3, the pace of credit expansion to private sector remains subdued by historical standards but is gradually recovering. The annual growth rate of loans to the private sector (adjusted for sales and securitisations) edged up to 0.

Topics:

Nadia Gharbi considers the following as important: Eurozone, GDP growth, Macroview, money-supply growth, TLTRO

This could be interesting, too:

Marc Chandler writes Eurozone Growth Surprises, Lifts Euro, while UK Budget is Awaited

Marc Chandler writes The Dollar Goes Nowhere Quickly

Jeffrey P. Snider writes As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

Cesar Perez Ruiz writes Weekly View – Big Splits

Strong money-supply growth in February enables us to maintain our forecast for euro area real GDP growth unchanged at 1.8% in 2016.

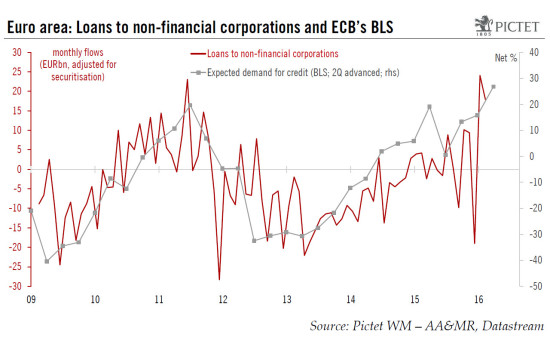

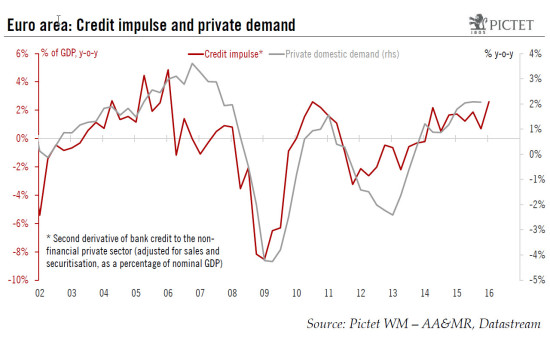

Euro area bank credit flows increased again in February, in line with other indicators such as the ECB’s Bank Lending Survey (see the chart below) and quite remarkably given the challenging financial context in February. We continue to believe that the credit cycle has legs. Moreover, we expect the ECB’s new Targeted Long Term Refinancing Operations (TLTRO II) to lower bank funding costs and support bank lending. As a result, we maintain our forecast for euro area real GDP growth unchanged at 1.8% for 2016.

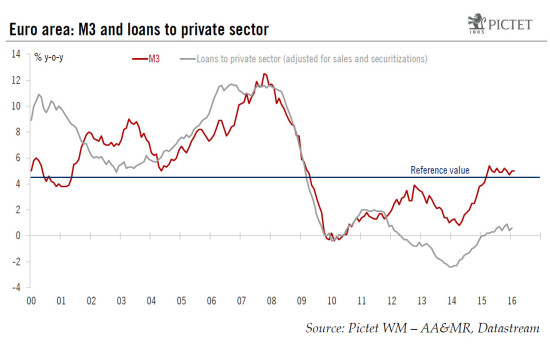

The detail of the February M3 report revealed that the annual rate of expansion in the euro area money supply (M3) was stable at 5.0% y-o-y in February, in line with consensus expectations, and averaged 4.9% in the three months from December to February. Meanwhile, growth of the narrow aggregate M1, which includes currency in circulation and overnight deposits, decelerated slightly from 10.5% y-o-y to 10.3% y-o-y, its slowest rate since March 2015.

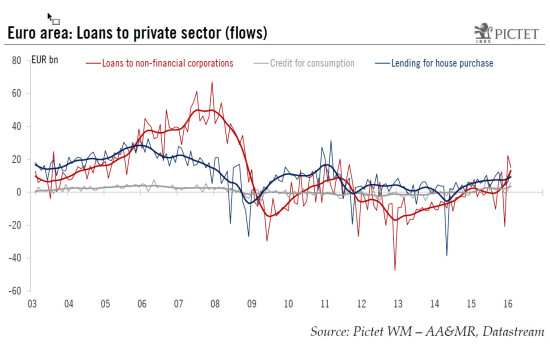

Looking at the breakdown of loans within M3, the pace of credit expansion to private sector remains subdued by historical standards but is gradually recovering. The annual growth rate of loans to the private sector (adjusted for sales and securitisations) edged up to 0.9% y-o-y in February from 0.6% in January (see the chart below). Broken down by sectors, the annual growth rate of loans to households rose from 1.4% y-o-y in January to 1.6% y-o-y in February, while expansion of loans to non-financial corporations (NFCs) rose from 0.6% y-o-y in January to 0.9% y-o-y in February, the fastest pace since December 2011.

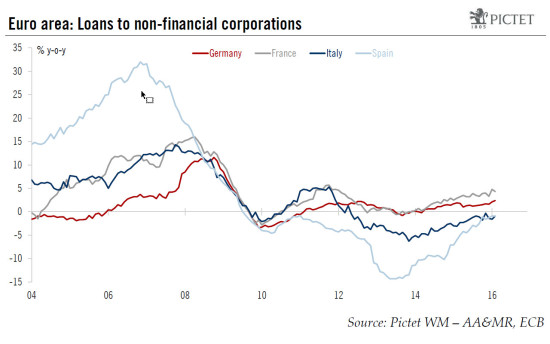

At a country level, the gap between core and periphery remained wide. In Germany (+2.4% y-o-y), lending to non-financial corporations continued to pick up pace, while France (+4.3% y-o-y) still displayed the highest loan growth. In contrast, bank loans to NFCs remained subdued in the periphery. Recovery is ongoing, but the annual growth rate remained in negative territory in Italy (-0.9% y-o-y) and Spain (-0.9% y-o-y) (see the chart below).

Looking at flows, the surge in bank credit to non-financial private sector was broad-based across sectors. Loans to households (adjusted for sales and securitisations) rose by EUR 9bn in February, stronger than in recent months. Meanwhile, loans to NFCs (adjusted for sales and securitisations) were up by EUR 18bn. This was the second straight month of increase and was in line with forward-looking indicators such as the ECB’s Bank Lending Survey (see first chart).

Overall, putting euro area flows numbers into our credit impulse calculation, the result is consistent with strong domestic demand growth in Q1. This is in line with our forecast for euro area real GDP growth of 1.8% in 2016.