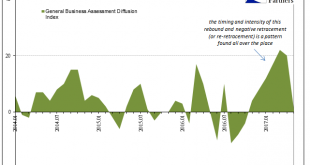

Both US manufacturing PMI’s underwhelmed just as those from China did. The IHS Markit Index was lower than the flash reading and the lowest level since last September. For May 2017, it registered 52.7, down from 52.8 in April and a high of 55.0 in January. Just by description alone you can appreciate exactly what pattern that fits. The ISM Manufacturing PMI was slightly higher in May than April, 54.9 versus 54.8, but...

Read More »Bi-Weekly Economic Review: The Return of Economic Ennui

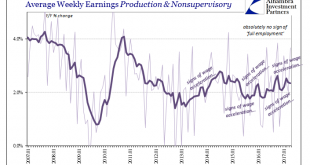

The economic reports released since the last of these updates was generally not all that bad but the reports considered more important were disappointing. And it should be noted that economic reports lately have generally been worse than expected which, if you believe the market to be fairly efficient, is what really matters. The disappointing employment report and the generally less than expected tone of the reports...

Read More »How Debt-Asset Bubbles Implode: The Supernova Model of Financial Collapse

When debt-asset bubbles expand at rates far above the expansion of earnings and real-world productive wealth, their collapse is inevitable. The Supernova model of financial collapse is one way to understand this. As I noted yesterday in Will the Crazy Global Debt Bubble Ever End?, I’ve used the Supernova analogy for years, but didn’t properly explain why it illuminates the dynamics of financial bubbles imploding....

Read More »Will the Crazy Global Debt Bubble Ever End?

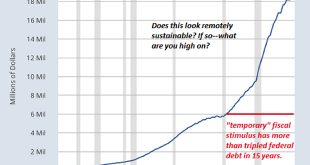

We’ve been playing two games to mask insolvency: one is to pay the costs of rampant debt today by borrowing even more from future earnings, and the second is to create wealth out of thin air via asset bubbles. The two games are connected: asset bubbles require leverage and credit. Prices for homes, stocks, bonds, bat guano futures, etc. can only be pushed to the stratosphere if buyers have access to credit and can...

Read More »Simple (economic) Math

.The essence of capitalism is not strictly capital. In the modern sense, the word capital has taken on other meanings, often where money is given as a substitute for it. When speaking about things like “hot money”, for instance, you wouldn’t normally correct someone referencing it in terms of “capital flows.” Someone that “commits capital” to a project is missing some words, for in the proper sense they are “committing...

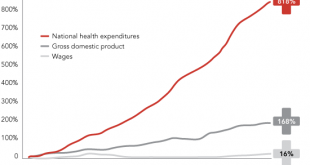

Read More »Inflation Isn’t Evenly Distributed: The Protected Are Fine, the Unprotected Are Impoverished Debt-Serfs

The Consumer Price Index (CPI) measure of inflation is bogus on a number of fronts, a reality I’ve covered a number of times: though the heavily gamed official CPI is under 2% for the past four years, the real rate is 7% to 12%, depending on whether you happen to live in locales with soaring rents/housing and healthcare costs. The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016) Revealing the...

Read More »The Keynesian Cult Has Failed: “Emergency” Stimulus Is Now Permanent

What do we call a status quo in which “emergency measures” have become permanent props? A failure. The “emergency” responses to the Global Financial Meltdown of 2008-09 are, eight years on, permanent fixtures. Everyone knows what would happen if the deficit spending, money-printing, zero interest rates, shadow banking, asset purchases by central banks and all the rest of the Keynesian Cult’s program stopped: the status...

Read More »Not Do We Need One, But Do We Need A Different One

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean. As President, Obama’s main task was not to deliver specifics about auto lending or the inner workings at...

Read More »Suddenly Impatient Sentiment

Two more manufacturing surveys suggest sharp deceleration in momentum, or, more specifically, the momentum of sentiment (if there is such a thing). The Federal Reserve’s 5th District Survey of Manufacturing (Richmond branch) dropped to barely positive, calculated to be just 1.0 in May following 20.0 in April and 22.0 in March. It follows an all-too-familiar pattern, where sentiment spiked to start this year after being...

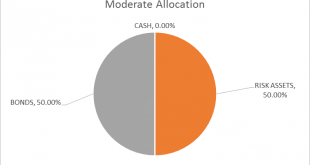

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs. Based on the bond markets there has been little change in the growth and inflation outlook since the last asset allocation update. Based on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org