Summary:

The Consumer Price Index (CPI) measure of inflation is bogus on a number of fronts, a reality I’ve covered a number of times: though the heavily gamed official CPI is under 2% for the past four years, the real rate is 7% to 12%, depending on whether you happen to live in locales with soaring rents/housing and healthcare costs. The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016) Revealing the Real Rate of Inflation Would Crash the System (August 3, 2016) The Disaster of Inflation–For the Bottom 95% (October 28, 2016) But the other reality is that inflation is not evenly distributed throughout the economy or populace: many people have little exposure to the crushing inflation of healthcare

Topics:

Charles Hugh Smith considers the following as important: Featured, newslettersent, The United States

This could be interesting, too:

The Consumer Price Index (CPI) measure of inflation is bogus on a number of fronts, a reality I’ve covered a number of times: though the heavily gamed official CPI is under 2% for the past four years, the real rate is 7% to 12%, depending on whether you happen to live in locales with soaring rents/housing and healthcare costs. The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016) Revealing the Real Rate of Inflation Would Crash the System (August 3, 2016) The Disaster of Inflation–For the Bottom 95% (October 28, 2016) But the other reality is that inflation is not evenly distributed throughout the economy or populace: many people have little exposure to the crushing inflation of healthcare

Topics:

Charles Hugh Smith considers the following as important: Featured, newslettersent, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

|

The Consumer Price Index (CPI) measure of inflation is bogus on a number of fronts, a reality I’ve covered a number of times: though the heavily gamed official CPI is under 2% for the past four years, the real rate is 7% to 12%, depending on whether you happen to live in locales with soaring rents/housing and healthcare costs.

The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016)

Revealing the Real Rate of Inflation Would Crash the System (August 3, 2016)

The Disaster of Inflation–For the Bottom 95% (October 28, 2016)

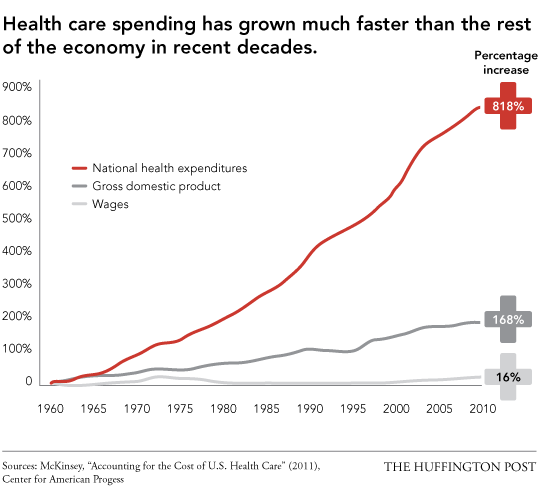

But the other reality is that inflation is not evenly distributed throughout the economy or populace: many people have little exposure to the crushing inflation of healthcare and higher education. For these people, inflation is a non-issue or a minor impact on their wealth, income and lifestyle.

Those fully exposed to the skyrocketing costs of healthcare insurance and higher education are being reduced to impoverished debt-serfs.

The key factor here that is missed in the official CPI is the relative size and impact of each cost input. Televisions, for example, have plummeted in price as LCD screens have become commoditized.

But how often does a household buy a new TV? Every four years? Every five years? And how big a difference does a $50 or $100 drop in the cost of a new TV make in their lifestyle?

Items that decline in price are modest slices of household budgets, while items that are soaring higher every year are big-ticket expenses that dominate household budgets. So a new TV drops in price by $100. If you buy a new TV every four years, that’s $25 savings per year. Big Freakin’ Deal: that deflationary price “bonus” means you can buy one extra pizza.

Meanwhile, households exposed to the actual cost of healthcare insurance are absorbing increases of $5,000 or more annually. $5,000 increases every year add up: $5,000 + $10,000 + $15,000 + $20,000 = $50,000 was extracted from the household budget over the four-year period.

|

|

|

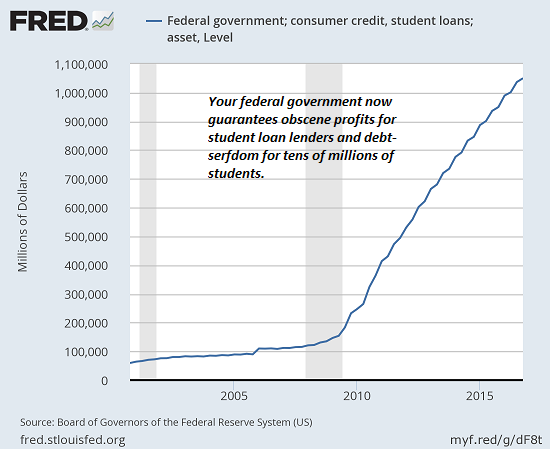

The household paying the unsubsidized cost of higher education is paying tens of thousands of dollars more for the same marginal-value education. Where a four-year college degree once cost the equivalent of a new car (i.e. $30,000), now it costs the equivalent of a house in many parts of the U.S. ($120,000 and up).

So a retiree with a small fixed-rate mortgage in a state with Prop 13 limits on property tax increases who qualifies for Medicare may complain about modest increases in co-pays for office visits and medications totaling a few hundred dollars annually, a young self-employed couple might be facing thousands of dollars in rent increaess, healthcare insurance costs, childcare expenses and so on–each a big-ticket item with a crushing impact on household spending and debt.

Households protected from actual big-ticket inflation by subsidies or luck (i.e. buying a house 30 years ago when prices were a fraction of today’s prices) have no experience of real inflation. Only the unprotected, unsubsidized households struggling to pay rising rents, soaring college tuition and fees and skyrocketing healthcare insurance premiums have an unmediated experience of the real inflation ravaging the the U.S. economy.

|

|

|

If you’re on Medicaid, Medicare or your premiums are mostly paid by your employer, you have no idea of the system’s actual costs. The self-employed aren’t subsidized, so we are exposed to the full inflation rate of healthcare, in which the costs of medications are jacked up by 4,000% because, well, Big Pharma has a free hand, thanks to our pay-to-play “democracy”.

We’re supposed to accept that because TVs are cheaper,the rate of inflation is near-zero. Meanwhile the unsubsidized costs of big-ticket items are rising by thousands of dollars annually.

|

|

|

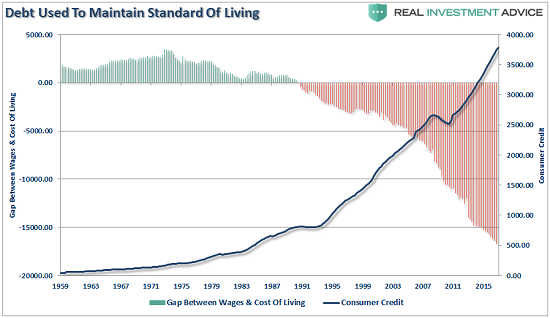

My insightful colleague Lance Roberts prepared this devastating chart that shows how debt-serfs deal with soaring prices–they borrow more to fill the widening gap between what they earn (stagnating) amd the cost of living (skyrocketing).

The inside-the-Beltway crowd that dominates Washington and the overpaid technocrats that dominate our financial skimming machine are both protected from the true ravages of inflation, so our corporate media never mentions the impact on the unprotected. Our job is to shoulder the higher prices by taking on more debt.

Welcome to debt-serfdom, the only possible output of the soaring cost of living for the unprotected many who are ruled by a hubris-soaked, subsidized Protected Elite.

|

Tags: Featured,newslettersent