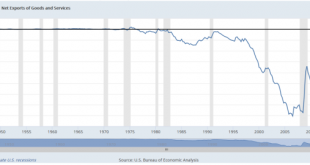

Dans la série sur la balance des paiements et les zooms sur les balances commerciales, voici l’évolution de la balance commerciale américaine. Nous voyons clairement qu’elle était neutralisée à 0 durant l’ère où les devises du monde devaient être arrimées, selon les Accords de Bretton Woods, au dollar qui lui-même était partiellement couvert par l’or. La valeur du dollar devait se référer à un prix fixe de l’or de 35...

Read More »Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession. Dudley was at that moment, however, undaunted. His eye was cast toward the unemployment rate and that was nothing but encouraging no matter the...

Read More »U.S. Export/Import: Losing Economic Trade

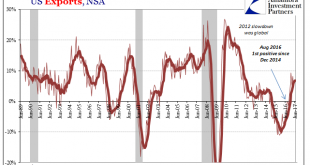

The oil effect continued to recede in late spring for more than just WTI prices or inflation rates. US trade on both sides, inbound and outbound, while still positive has stalled since the winter. US Exports, Jun 1989-2017 - Click to enlarge Exports grew by just 6.2% year-over-year (NSA) in June 2017, about the same pace as estimated in December 2016. After contracting for nearly two years, twenty-two months...

Read More »Are We Already in Recession?

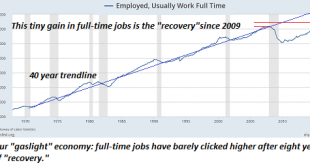

If we stop counting zombies, we’re already in recession. How shocked would you be if it was announced that the U.S. had just entered a recession, that is, a period in which gross domestic product (GDP) declines (when adjusted for inflation) for two or more quarters? Would you really be surprised to discover that the eight-year long “recovery,” the weakest on record, had finally rolled over into recession? Anyone with...

Read More »Bi-Weekly Economic Review: Ignore The Idiot

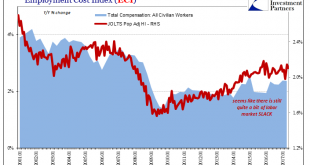

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it. I don’t waste much time on it myself because it is subject to large revisions and has little predictive capability. In...

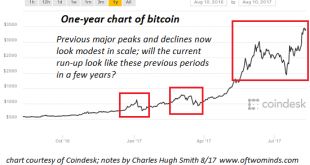

Read More »What the Mainstream Doesn’t Get about Bitcoin

The real demand for bitcoin will not be known until a global financial crisis guts confidence in central banks and politicized capital controls. I’ve been writing about cryptocurrencies and bitcoin for many years. For example: Could Bitcoin Become a Global Reserve Currency? (November 7, 2013) I am an interested observer, not an expert. As an observer, it seems to me that the mainstream–media, financial punditry,...

Read More »Oil Prices, CPI: Why Not Zero?

In the early throes of economic devastation in 1931, Sweden found itself particularly vulnerable to any number of destabilizing factors. The global economy had been hit by depression, and the Great Contraction was bearing down on the Swedish monetary system. The krona had always been linked to the British pound, so that when the Bank of England removed gold convertibility (left the gold standard) from its...

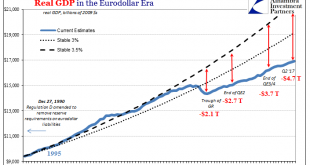

Read More »Real GDP: The Staggering Costs

How do we measure what has been lost over the last ten years? There is no single way to calculate it, let alone a correct solution. There are so many sides to an economy that choosing one risks overstating that facet at the expense of another. It’s somewhat of an impossible task already given the staggering dimensions. If someone had told you in 2006 that the Federal Reserve as well as all its central bank cohorts...

Read More »Industrial Production: Irreführende Statistiken

Germany’s Federal Statistical Office (DeStatis) reported today disappointing figures for Industrial Production. The seasonally-adjusted series fell in June 2017 month-over-month for the first time this year, last declining in December 2016. The index had been on a tear, rising nearly 5% in the first five months of this year. The move was considered by many if not most in the mainstream a prime example of Mario Draghi’s...

Read More »Oil Prices: The Center Of The Inflation Debate

The mainstream media is about to be presented with another (small) gift. In its quest to discredit populism, the condition of inflation has become paramount for largely the right reasons (accidents do happen). In the context of the macro economy of 2017, inflation isn’t really about consumer prices except as a broad gauge of hidden monetary conditions. Therefore, if inflation behaves as it is supposed to after so many...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org