Summary:

Any nation-state that meets these four requirements is fully exposed to a global loss of faith in its economy, debt, balance of payments and currency.

There’s an entire sub-industry in journalism devoted to the idea that China is poised to replace the U.S. as the “global empire” / hegemon. This notion of global empire being something like a baton that gets passed from nation-state to nation-state is seriously misleading, in my view, for this reason:

There is only one global empire: finance. China and the U.S. both exist within the Empire of Finance. Virtually every mercantile nation with access to global markets lives, works and thrives/dies within the Empire of Finance. Every nation that allows capital to flow into

Topics:

Charles Hugh Smith considers the following as important:

China Gross Domestic Product,

Featured,

newslettersent,

The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Any nation-state that meets these four requirements is fully exposed to a global loss of faith in its economy, debt, balance of payments and currency.

There’s an entire sub-industry in journalism devoted to the idea that China is poised to replace the U.S. as the “global empire” / hegemon. This notion of global empire being something like a baton that gets passed from nation-state to nation-state is seriously misleading, in my view, for this reason:

There is only one global empire: finance. China and the U.S. both exist within the Empire of Finance. Virtually every mercantile nation with access to global markets lives, works and thrives/dies within the Empire of Finance. Every nation that allows capital to flow into its economy is subservient to the Empire of Finance. Every nation with capital and debt markets exposed to (or dependent on) global financial flows is just another fiefdom in the Empire of Finance.

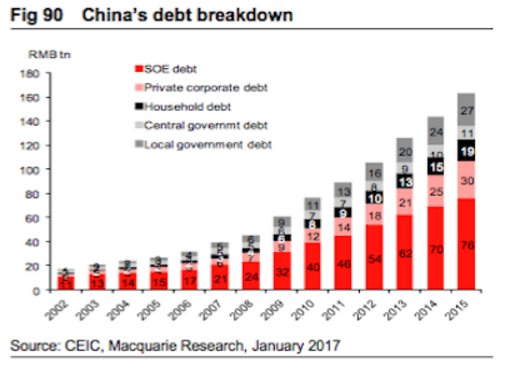

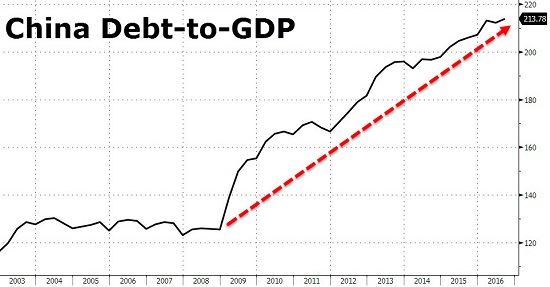

China has thrived within the Empire of Finance by creating more debt and at a faster rate of expansion than any other fiefdom. China has brought 20 years of future growth and income forward, and eventually that vein of “wealth” runs out as time advances into the stripmined future.

The same can be said of all nations that have borrowed heavily from future growth and income to fund consumption/GDP “growth” today.

The Empire of Finance has few requirements for hegemony in its realm, but they are big ones.

1. If you want your national currency to act as a global reserve currency (or the global reserve currency), you must run permanent large trade deficits to export your currency in size to the rest of the world. This is the essence of Triffin’s Paradox, which I have covered many times.

2. Your national currency must float freely in the global marketplace and be liquid enough to trade $1 to 2 trillion per day in global foreign exchange (FX) markets.

3. Your sovereign debt/bonds must float freely in the global credit/debt marketplace and be liquid enough to trade in size (tens of billions of dollars) daily.

4. Global capital must be free to flow in and out of your currency, debt, assets and economy without restriction. (Ease of capital flow is the core of liquidity, risk management, and profitability.)

Any nation-state that meets these four requirements is fully exposed to a global loss of faith in its economy, debt, balance of payments and currency.The Empire of Finance is a harsh master; any nation-state that wants to secure the privileges of hegemony must first be willing to accept the risk of full exposure to skittish global markets and capital flows.

Nothing wipes out “wealth” quite as quickly or effectively as a currency meltdown resulting from a sudden loss of faith / risk-averse capital exodus.Such a loss of faith or fear of loss quickly kills a nation’s ability to float more debt on the global marketplace.

There’s an irony in all this talk of empire: only nation-states that operate within the unforgiving global Empire of Finance can establish hegemony in that Empire, but only nations that become autonomous autarkies (i.e. self-sufficient and independent of global markets, resources, credit, capital, etc.) can thrive outside the global Empire of Finance.

There’s only one global empire, that of Finance. If you want global hegemony, you must accept the dominance of global finance and pay tribute. If you don’t want to submit to the empire, then you cannot be a global hegemon.

| When the Empire of Finance collapses under the weight of its debt, perverse incentives, exploitation and inequality, the financial system of every nation-state within the Empire of Finance will collapse, too. Being the hegemon within the collapsing system won’t protect the hegemon from collapse. Every nation-state that has submitted to the Empire of Finance will collapse.

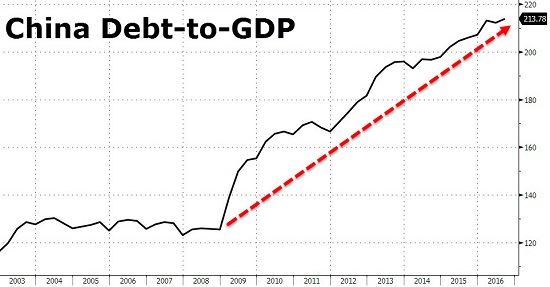

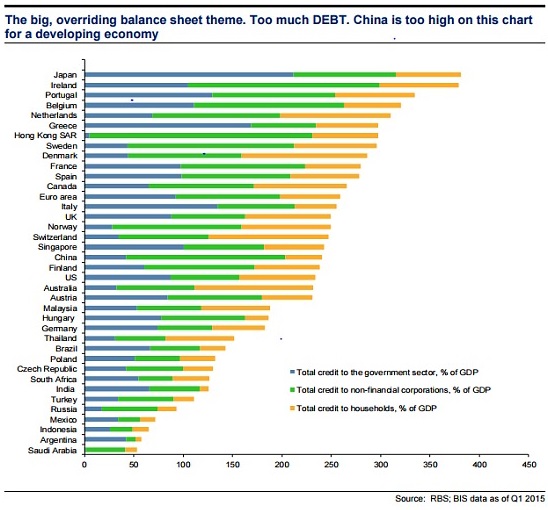

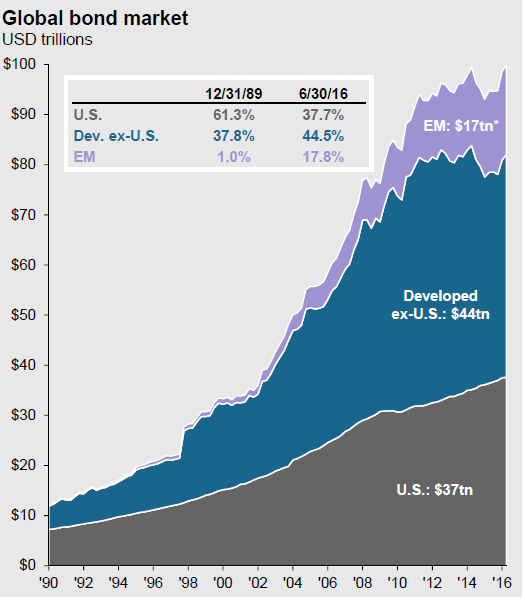

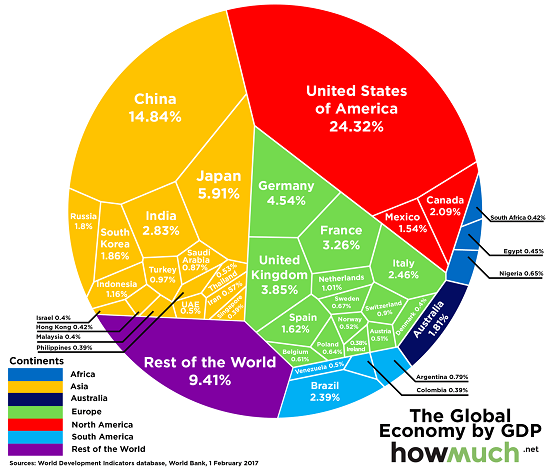

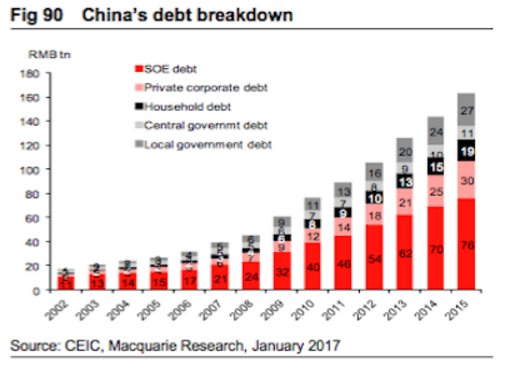

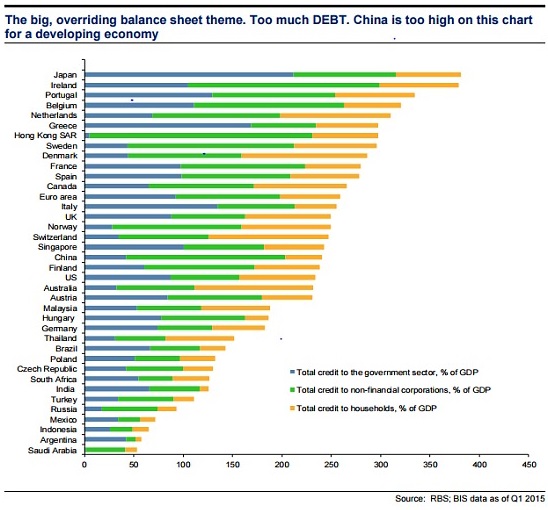

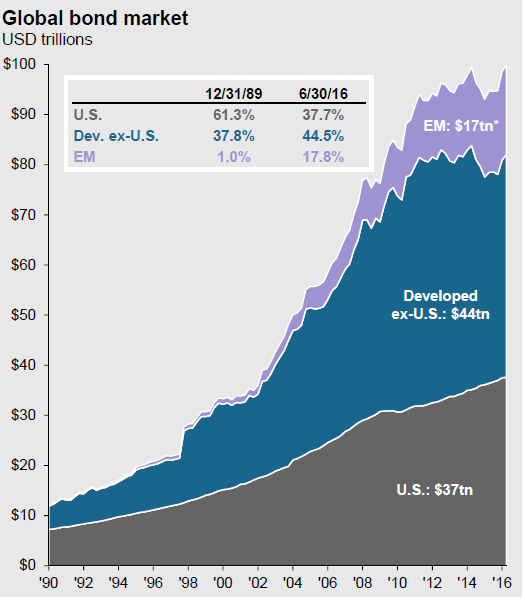

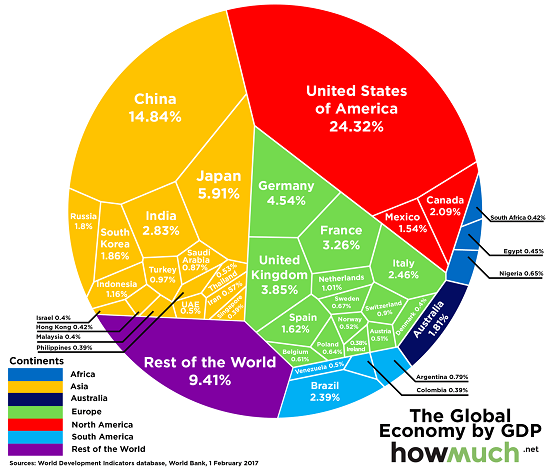

These charts are snapshots of an unsustainable global financial system.

|

China Debt - Breakdown, 2002 - 2016 - Click to enlarge |

| Debt is outracing “growth” everywhere, including China:eeeeeeeee |

China Debt to GDP, 2003 - 2017(see more posts on China Gross Domestic Product, ) - Click to enlarge |

| To the moon, baby! There’s no upper limit on debt–until there is. |

Global Debt 2016 - Click to enlarge |

| There’s no limit on the sale of claims on future energy, income and “wealth”–i.e. bonds: |

Global Bond Market, 1990 - 2017 - Click to enlarge |

| The global economy, by one (flawed) measure (GDP): |

Global Economy by GDP - Click to enlarge |

As for hegemony and empire–be careful what you wish for. Life outside the financial bubble is much more contingent and risky than life inside the bubble–until it pops.If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

My new book is #9 on Kindle short reads -> politics and social science For more, please visit the

book's website.

Tags:

China Gross Domestic Product,

Featured,

newslettersent