The payroll report for August 2017 thoroughly disappointed. The monthly change for the headline Establishment Survey was just +156k. The BLS also revised lower the headline estimate in each of the previous two months, estimating for July a gain of only +189k. The 6-month average, which matters more given the noisiness of the statistic, is just +160k or about the same as when the Federal Reserve contemplated starting a...

Read More »Why We’re Doomed: Stagnant Wages

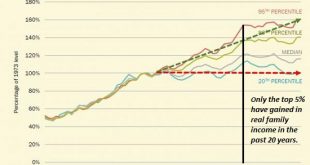

The point is the present system cannot endure. Despite all the happy talk about “recovery” and higher growth, wages have gone nowhere since 2000–and for the bottom 20% of workers, they’ve gone nowhere since the 1970s. Diverging Income Trajectories 1947 - 2014 - Click to enlarge Gross domestic product (GDP) has risen smartly since 2000, but the share of GDP going to wages and salaries has plummeted: this is simply...

Read More »Proving Q2 GDP The Anomaly, Incomes Yet Again Fail To Accelerate

One day after reporting a slightly better number for Q2 GDP, the BEA reports today that there is little reason to suspect it was anything more or lasting. The data for Personal Income and Spending shows that the dominant condition since 2012 remains in effect – “good” quarters, or whatever passes for one these days, are the anomaly. There still is no meaningful rebound in income. Real Personal Income excluding...

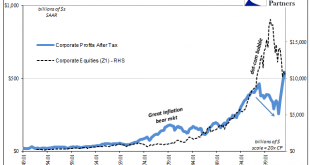

Read More »The Two Parts of Bubbles

What makes a stock bubble is really two parts. Most people might think those two parts are money and mania, but actually money supply plays no direct role. Perceptions about money do, even if mistaken as to what really takes place monetarily from time to time. In fact, for a bubble that would make sense; people are betting in stocks on one monetary view that isn’t real, and therefore prices don’t match what’s really...

Read More »Why Wages Have Lost Ground in the 21st Century

The problem with stagnant wages is our socio-economic system requires ever-higher incomes to function. One of the enduring mysteries for conventional economists is why wages aren’t rising for the bottom 95% even as unemployment is low and hiring remains robust. According to classical economics, the limited supply of available workers combined with strong demand for workers should push wages higher. Why have wages for...

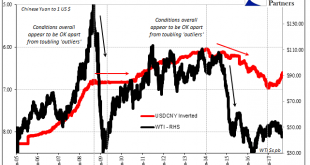

Read More »Moscow Rules (for ‘dollars’)

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is...

Read More »Deja Vu

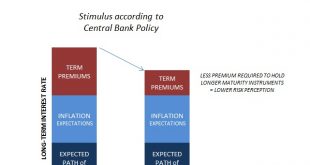

According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that...

Read More »Currency Risk That Isn’t About Exchange Values (Eurodollar University)

This week the Bureau of Economic Analysis will release updated estimates for Q2 GDP as well as Personal Consumption Expenditures (PCE) and Personal Incomes for July. Accompanying those latter two accounts is the currently preferred inflation standard for the US economy. The PCE Deflator finally hit 2% and in two consecutive months, after revisions, earlier this year. - Click to enlarge The inability of consumer...

Read More »Bi-Weekly Economic Review: Don’t Underestimate Gridlock

The economic reports released since the last update were slightly more upbeat than the previous period. The economic surprises have largely been on the positive side but there were some major disappointments as well. The economy has been doing this for several years now, one part of the economy waxing while another wanes and the overall trajectory not much changed. Indeed, the broad Chicago Fed National Activity index...

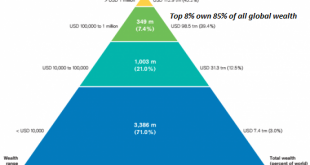

Read More »The 5 Steps to World Domination

You don’t need an army to achieve World Domination; all you need is enough cheap credit to buy up everything that generates the highest value and/or income. World Domination–it has a nice ring, doesn’t it? Here’s how to achieve it in 5 steps: 1. Turn everything into a commodity that can be traded on the global market:land, leases on land, options to purchase land, houses, buildings, rooms in slums, labor, tools, robots,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org