In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not. 10 year yields fell nearly 40 basis points in a matter of days as did TIPS yields. The...

Read More »Bi-Weekly Economic Review: Growth Expectations Break Out?

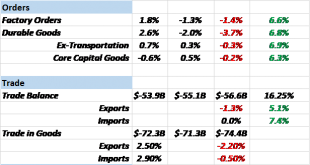

There are a lot of reasons why interest rates may have risen recently. The federal government is expected to post a larger deficit this year – and in future years – due to the tax cuts. Further exacerbating those concerns is the ongoing shrinkage of the Fed’s balance sheet. Increased supply and potentially decreased demand is not a recipe for higher prices. In addition, there is some fear that the ongoing trade...

Read More »Bi-Weekly Economic Review: The New Normal Continues

There has been a lot of talk about the economic impact of the recent tax reform. All of it, including the analyses that include lots of fancy math, amounts to nothing more than speculation, usually informed by little more than the political bias of the analyst. I am guilty of that too to some degree but I don’t let my personal political views dictate how I view the economy for purposes of investing. I am, to put it...

Read More »Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

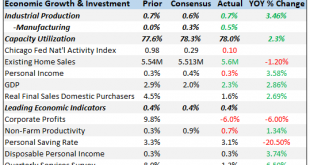

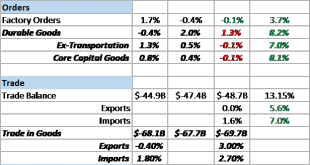

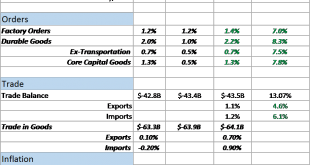

Economic Reports Employment We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits. The Fed has been talking about a tight labor market but this report peaked last July so that may not be as much a concern as they...

Read More »Bi-Weekly Economic Review: Housing Market Accelerates

The economy ended 2017 with current growth just slightly above trend. In general the reports of the last two weeks of the year were pretty good with housing a standout performer going into the new year. We are still trying to get past the impact – positive and negative – from the hurricanes a few months ago though so it is probably prudent to wait for more evidence before making any definitive pronouncements about the...

Read More »Bi-Weekly Economic Review: Animal Spirits Haunt The Market

The economic data over the last two weeks continued the better than expected trend. Some of the data was quite good and makes one wonder if maybe, just maybe, we are finally ready to break out of the economic doldrums. Is it possible that all that new normal, secular stagnation stuff was just a lack of animal spirits? Is it possible that the mere anticipation of tax cuts was sufficient to break us out of the 2% growth...

Read More »Bi-Weekly Economic Review: Who You Gonna Believe?

We’ve had a pretty good run of data recently and with the tax bill passing the Senate one would expect to see markets react positively, to reflect renewed optimism about economic growth. We have improving economic data on pretty much a global basis. It isn’t a boom by any stretch of the imagination but there is no doubt that the rate of change has recently been more positive. We also have a change in tax policy that...

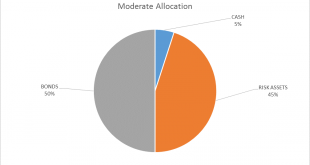

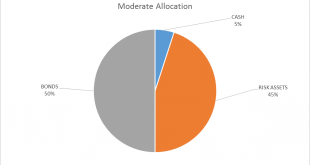

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash. Prediction is very difficult, especially about the future… Niels Bohr Every time I see that quote I think to myself, “but that...

Read More »Bi-Weekly Economic Review: Gridlock & The Status Quo

The good news is that the economy just printed its second consecutive quarter of 3% growth, a feat not accomplished since Q2 and Q3 2014. The bad news is that the growth spurt in 2014 was better, quantitatively and qualitatively. Those two quarters produced gains of 4.6% and 5.2% (annualized) in GDP, much better than the most recent 3.1% and 3% prints of Q2 and Q3 2017. And it took a hurricane to get the most recent...

Read More »Global Asset Allocation Update

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise. Moderate Allocation - Click to enlarge No...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org