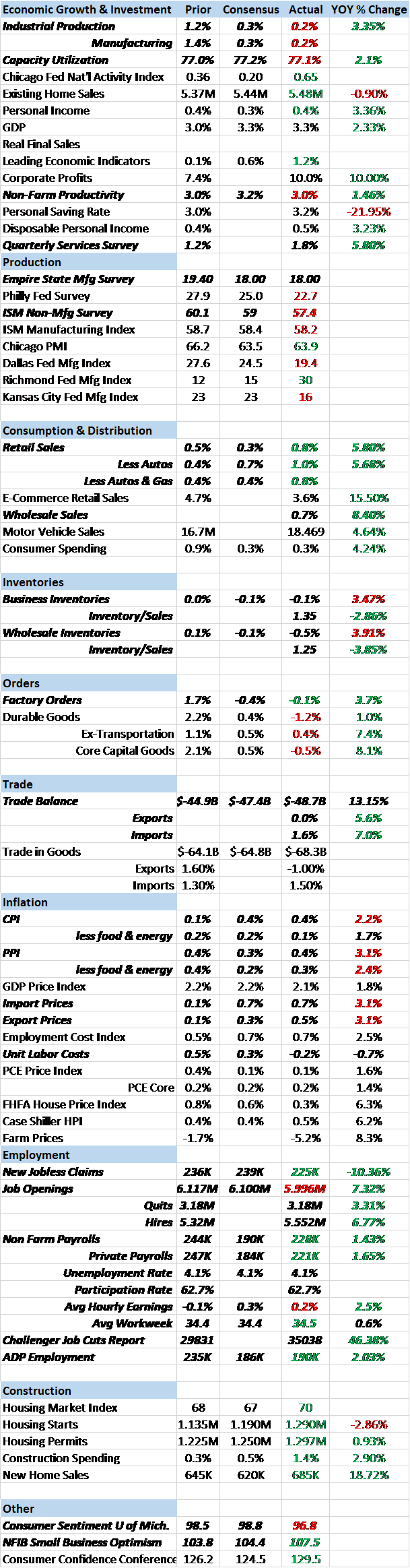

The economic data over the last two weeks continued the better than expected trend. Some of the data was quite good and makes one wonder if maybe, just maybe, we are finally ready to break out of the economic doldrums. Is it possible that all that new normal, secular stagnation stuff was just a lack of animal spirits? Is it possible that the mere anticipation of tax cuts was sufficient to break us out of the 2% growth paradigm? Or are there other factors that have us on the precipice of a third consecutive quarter of 3%+ growth? It is easy to find the positives in the economic data these days. Retail sales surged last month and are now up nearly 6% year over year. Wholesale sales are up over 8% and inventories are

Topics:

Joseph Y. Calhoun considers the following as important: Alhambra Research, Bi-Weekly Economic Review, bonds, commodities, credit spreads, currencies, economic growth, economy, Featured, Gold, Interest rates, Markets, newslettersent, real interest rates, stocks, tax reform, Taxes/Fiscal Policy, The United States, US dollar, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The economic data over the last two weeks continued the better than expected trend. Some of the data was quite good and makes one wonder if maybe, just maybe, we are finally ready to break out of the economic doldrums. Is it possible that all that new normal, secular stagnation stuff was just a lack of animal spirits? Is it possible that the mere anticipation of tax cuts was sufficient to break us out of the 2% growth paradigm? Or are there other factors that have us on the precipice of a third consecutive quarter of 3%+ growth?

It is easy to find the positives in the economic data these days. Retail sales surged last month and are now up nearly 6% year over year. Wholesale sales are up over 8% and inventories are improving relative to sales. Imports and exports are up 7% and 5.6% respectively. Factory orders are rising at about a 4% clip. Productivity was up 3% last quarter. The Fed’s worries about inflation also seem reasonable considering CPI and PPI well above the Fed’s target rate of inflation. Import and export prices are both up over 3% year over year. With the unemployment rate down to 4.1% you can understand why the Philips Curve disciples are getting antsy.

But that’s just a snapshot, a particular moment in time. Some of this recent surge is certainly due to recovery spending after two big hurricanes in September. It is impossible to gauge the size of the impact yet but there is no doubt that insurance money is flowing into the affected areas and being spent. That shows up in higher sales today but it isn’t likely to be repeated soon and it will start to taper off soon. Take into account both numerator and denominator when you look at those improving inventory/sales ratios. Productivity? Yes, it was up 3% last quarter but the longer term trend hasn’t changed with the year over year rate only 1.5%. Inflation? With unit labor costs down 0.7% year over year? With capacity utilization at only 77.1%? There is no supply side constraint globally and demand is shackled by debt. Headline inflation is mostly driven by fluctuating oil prices while the core remains tepid. Inflation might be a problem someday but not right now.

The questions in the opening paragraph are not easy ones to answer. Indeed, they may be impossible to answer, at least until we have the space of time to look back on the period and make some definitive observations. But don’t even count on that much; economists are still arguing about the Great Depression nearly 90 years after the fact. Observing the economic landscape and speculating about the causes and effects is not a process with a great track record. You can slice and dice the data any way you wish, psychoanalyze the entire planet and you still can’t predict the future. Just ask the Fed, which has basically unlimited resources for economic analysis – and a track record that makes astrologers look good by comparison.

Since we can’t even begin to match the Fed’s budget for economic forecasting, we generally don’t try to predict the future. Yes, we do occasionally indulge our urge to speculate about the effects of economic policy but usually only in a very general way. For instance, we don’t believe the tax bill – with the biggest changes in corporate taxes – will have a large impact on economic growth. That isn’t based on a deep dive into the details of the bill which is enormous and way too boring to actually read unless you are a CPA or tax lawyer. It is merely an observation that corporate profits and margins are already near all time highs and companies are still choosing to pay dividends, buy back stock and make acquisitions at all time high prices rather than make capital investments. The tax bill does not relieve some constraint on the economy and so seems unlikely to create a surge of growth.

But economies are complex and impossible to predict precisely because they are human, imbued with all the frailties associated with the species. What I don’t know – and what is important – is how individuals will respond to this bill. If companies use the extra cash flow to pay more dividends and buy back more stock that doesn’t mean it is a failure – contrary to one of the most common arguments against the bill. You have to look beyond the first order effect to see if the bill is effective. If companies pay more dividends, what do the individuals and entities who receive that cash do with it? If companies choose to buy back stock, what do the people who sold them the stock do with the proceeds? The limiting factor in the economy is not that companies are lacking cash to make investments. The limiting factor is that individuals, whether they be corporate CEOs or shareholders, are not willing – or able in the case of many Americans – to make capital investments. If that changes for the better, so will economic growth. My biggest problem with the tax bill is that it doesn’t directly address this underlying problem.

Now it may be that the “animal spirits” that are stirring will change that dynamic. There is no doubt that sentiment toward the economy has improved markedly; the NFIB small business optimism index just made a new high and consumer sentiment has improved as well. How much of that is due to anticipation of lower taxes I can’t say. It may be that the more important changes under the Trump administration have been in the regulatory arena. There hasn’t been a lot of press about regulatory changes other than in health care but small business’ biggest complaint the last few years has been about regulations, not taxes. So maybe the change in sentiment is more about that and the tax reform bill is just a bonus.

But, as I said above, we don’t do economic analysis by anecdote, guessing at the impact of monetary or fiscal policy. We know we can’t predict the future and neither can economists. Economists, in fact, can’t even agree on how to analyze the past much less the present or the future. So rather than rely on economists and their models, we rely on markets. They aren’t perfect but they do embody the wisdom of crowds and probably offer the best view of the future we can hope for. Those who see the tax bill as a big positive point to the stock market as confirmation of their views. And they almost universally predict a surge of capital will come flowing back to invest in the US in the wake of lower corporate tax rates. I suppose that could be true but there are problems with this view.

First of all, it isn’t just US stocks that have gone up this year. In fact, over the last year US stocks, while up nicely, have lagged international markets. EAFE (EFA, 24.9%), Emerging markets (EEM, 35.3%), Asia ex-Japan (AAXJ, 36.4%), China (FXI, 33%), Europe (EZU, 31.3%) and Latin America (ILF, 27.8%) have all outperformed the S&P 500 (SPY, 21.02%). And even Japan, who everyone thinks is still doing terribly, only lagged the US by a little (EWJ, 20.9%). I suppose you can argue that US tax reform is going to be a positive for the entire global economy and that might even be true to some degree but if so, it seems that it may be better for the rest of the world than the US.

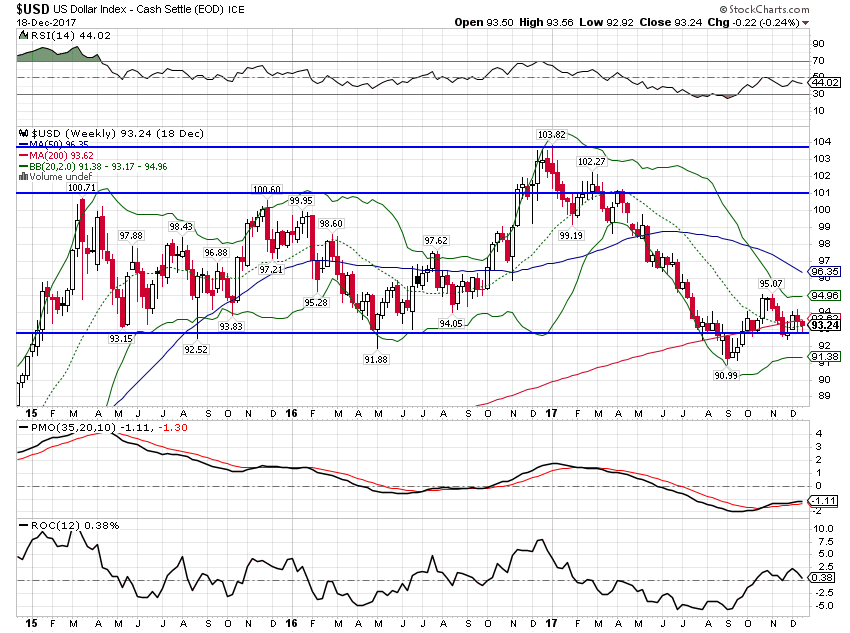

| Second, if markets were anticipating a rush of capital back to US shores, one would expect the dollar to be at least a little perkier. Instead the dollar index is down nearly 10% over the last year. It has at least stopped falling recently but it hasn’t rallied much off the lows as tax reform has steadily advanced through Congress. This would also seem to refute the idea that low rates in Europe are holding down US rates. If Europeans are buying US Treasuries because rates there are negative – as so many have suggested – then why doesn’t the dollar reflect those flows? Are they hedging? Is the market so broken that a Euro based investor can buy Treasuries, hedge all the currency risk and still do better than just buying European bonds? Seems unlikely. | |

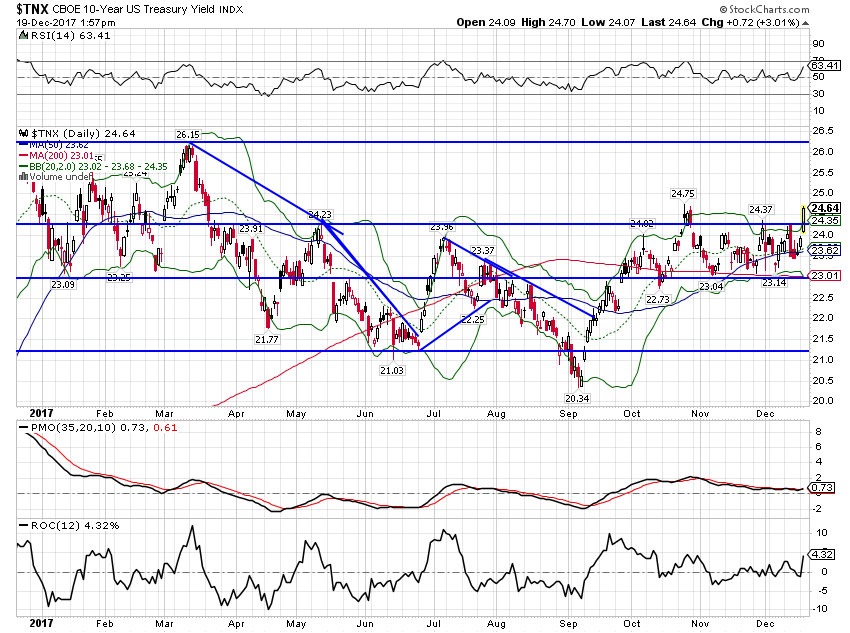

| And it is those bond markets that offer the greatest evidence that the current growth surge will not be sustained even with the passage of the tax bill. The yield on the 10 year Treasury is basically unchanged this year – and it was only a surge today, as I write this, that got it back to even. It may be that the bond market was waiting until the absolute last minute to respond to the passage of the tax bill but I have my doubts. |

US Treasury Yield, Feb - Dec 2017(see more posts on U.S. Treasuries, ) |

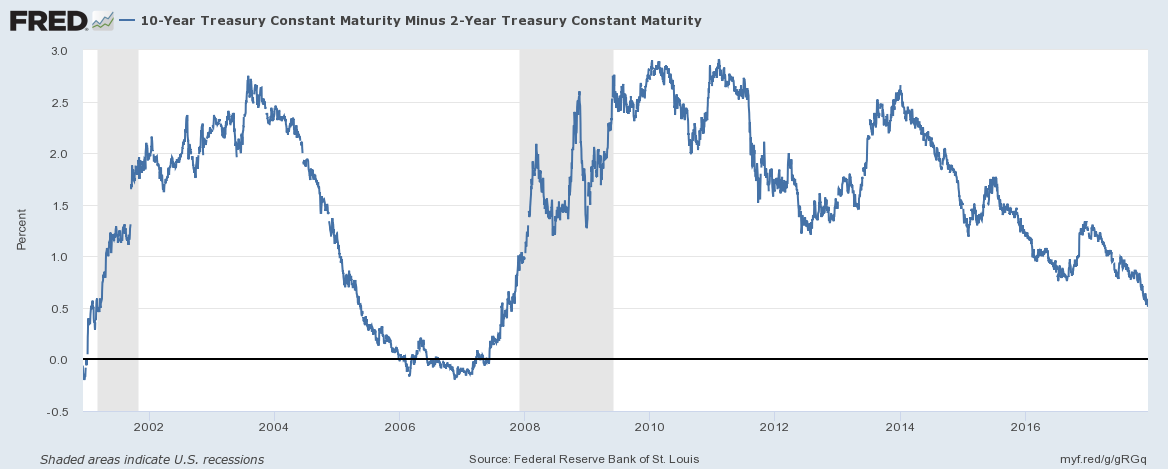

| The best indicator we have for future growth is the yield curve and it has also moved counter to the improving growth narrative. That may be a reaction to the Fed’s tightening but no matter the reason, flat yield curves are associated with slower growth. What the flattening curve really shows in this case is a mismatch between the growth expectations of the Fed and the market. Short term yields reflect the Fed’s views of growth and market expectations regarding future changes in Fed policy. Long term yields reflect the market’s views on growth and inflation. In this case the Fed is more optimistic than the market, a condition Alan Greenspan dubbed a “conundrum”. Of course, it wasn’t really a conundrum; Greenspan was wrong and the market was right. And I wouldn’t bet against a similar outcome this time around. |

US Treasury Constant Maturity, 2002 - 2017 |

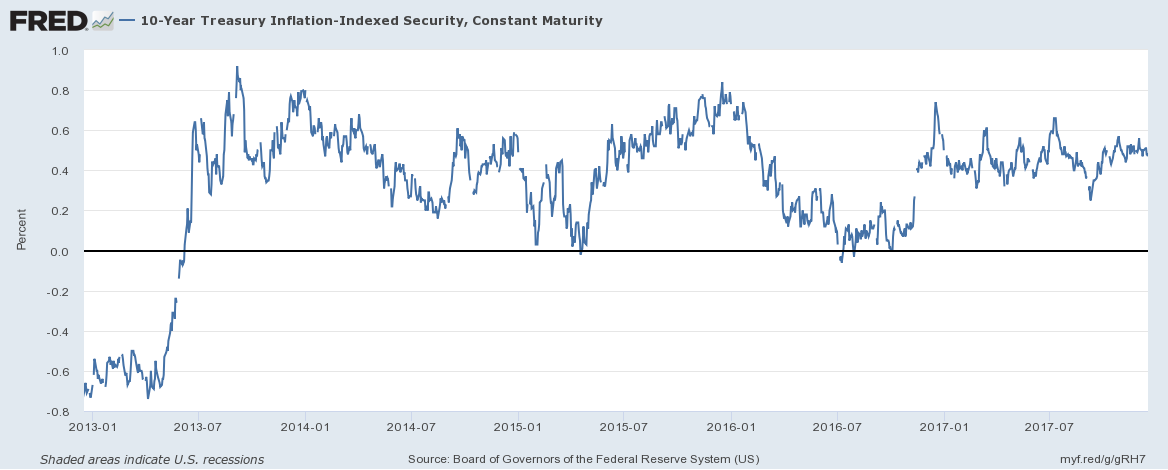

| TIPS yields tell a similar story about real growth expectations. The 10 year is still trading in the same range it has been in since mid-2013. |

Treasury Inflation - Indexed Security, Jan 2013 - Dec 2017 |

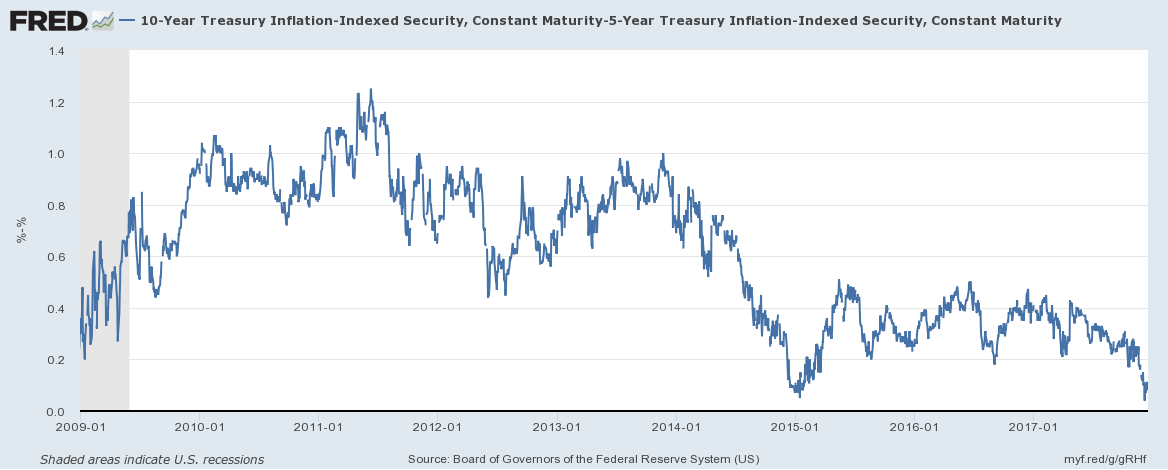

| And the real yield curve is even flatter than the nominal curve (10/5 TIPS spread): |

US Treasury Inflation - Indexed Security, Jan 2009 - Dec 2017 |

| Bond markets just aren’t in agreement with stocks on future growth. And bonds are generally more accurate in these predictions which is where the old Wall Street saying that stocks have predicted nine of the last five recessions comes from. You can make that one a little more modern if you like; stocks have predicted three booms since the turn of the century and so far they are 0 for 2 with one pending.

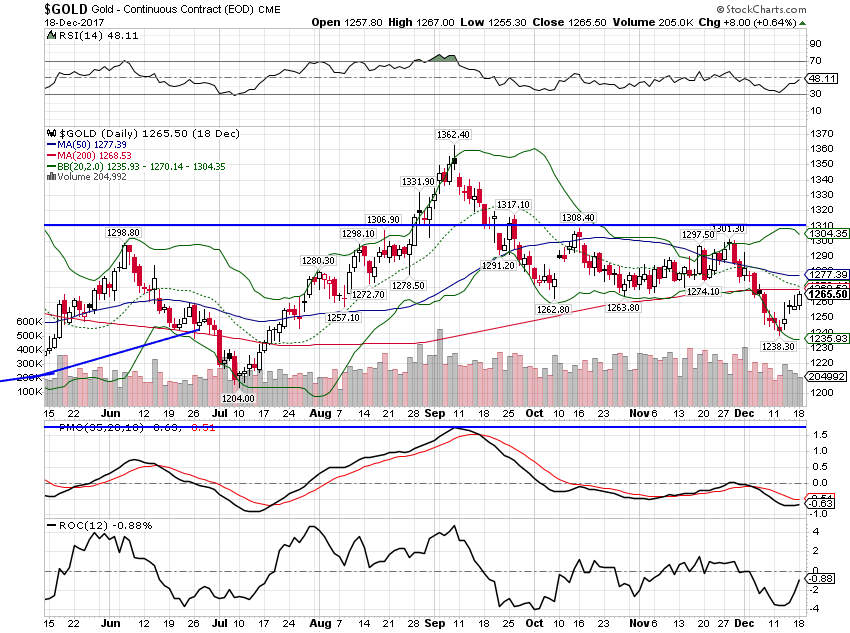

There are some other signs of growth in the market so I don’t want to dismiss the idea entirely and just assume that we are interpreting the bond and currency markets correctly. Markets are affected by a lot of things, not just economic growth expectations. Gold, for instance, has been soft recently, an indication of improving growth expectations. People don’t buy gold when they have a better place to put their capital. On the other hand, gold’s weakness may be explained by bitcoin strength. And it should also be noted that gold is still up over 11% in the last year, so a turn toward growth in the gold market is a very recent phenomenon. |

Gold Daily, Jun - Dec 2017 |

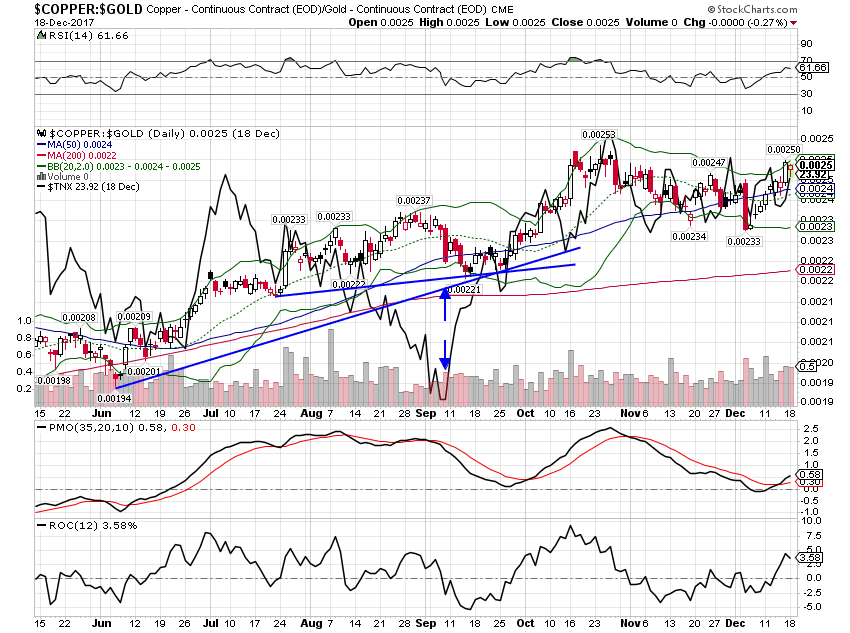

| We can also see an improvement in growth expectations by looking at the ratio of copper prices to gold. When the ratio is rising, so are growth expectations. And it has been rising since the spring. And it is up about 10% over the last year which would seem to point to dollar weakness as the primary cause in rising commodity prices, not growth expectations. |

Copper : Gold Continuous Contract, Jun - Dec 2017 |

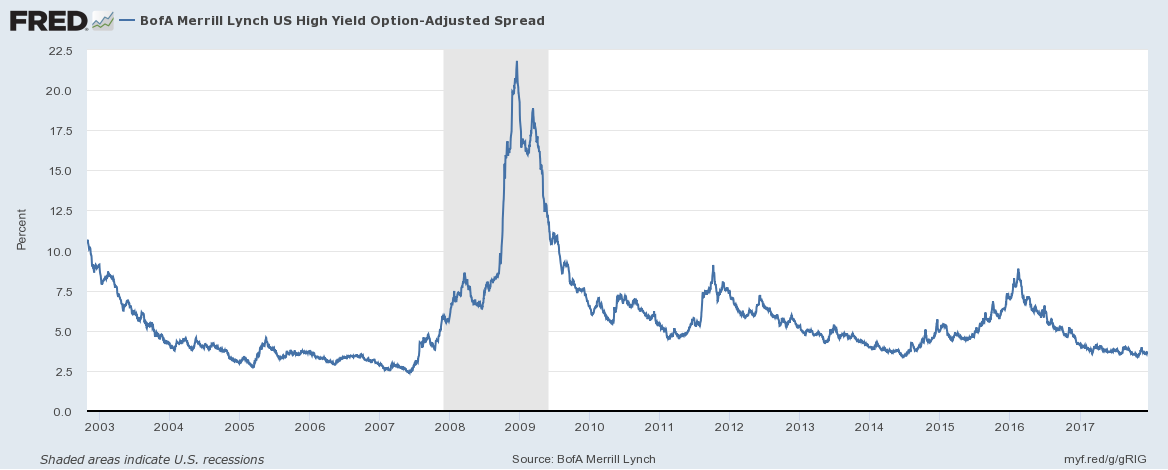

| Another area we watch for clues about future growth is credit spreads, a market measure of those animal spirits. Narrow spreads mean risk appetite is high, investors demanding little protection to buy lower rated bonds. In other words, it is a sentiment measure more than anything. Like consumer sentiment or surveys of market sentiment (which all show a plethora of bulls right now), credit spreads can change rapidly and tend to be at their highest right before recession so be careful taking comfort in these measures. But for now, there is no stress in junk bond land. |

US BofA Merrill Lynch High Yield Option, 2003 - 2017 |

There is no way to predict the future course of the economy. Economic theory offers little insight and economists are most often tainted by their political views (although I’m sure they would all deny that). Only the market offers an unbiased view of the future. Unfortunately, it is a murky view at best. Right now, no one can deny that the data flow is improving and stocks are responding positively to that and tax reform. But bond and currency markets offer a much more sober view of the future. Not recession, slap in the face sober, just a continuation of the sluggish growth to which we’ve become accustomed. Sentiment, meanwhile, is the very opposite of sober, with bitcoiners swinging from the chandelier and volatility salesmen passed out under the lamp shade. This is not your father’s bull market. How long will the party last? I have no idea but it might be a good idea to at least find the door. It’s right over there behind that ICO.

Tags: Alhambra Research,Bi-Weekly Economic Review,Bonds,commodities,credit spreads,currencies,economic growth,economy,Featured,Gold,Interest rates,Markets,newslettersent,real interest rates,stocks,tax reform,Taxes/Fiscal Policy,US dollar,Yield Curve