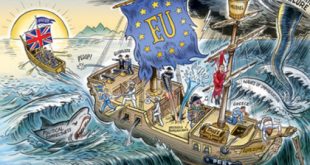

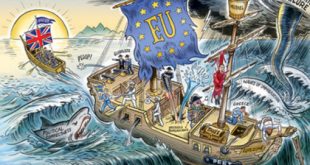

Authored by Alastair Macdonald, originally posted at Reuters.com, Stalemate between Britain and the European Union over what happens next following Britons’ referendum vote to leave has opened up a host of possible scenarios. Here are some that are (in some cases, barely) conceivable: 1. BY THE BOOK Prime Minister David Cameron, who said he will resign after losing his gamble to end British ambivalence about...

Read More »Quitting the Cucumber Affair

Winners and Quitters Vince Lombardi, the famous American football coach, once said, “Winners never quit and quitters never win.” Maybe he meant that winners overcome obstacles to reach their goals while quitters give up and fall short… or something to that effect. Certainly, this makes for a good bumper sticker. Perhaps it’s a helpful quote for the first time marathon runner to repeat come mile 20. Saying it aloud...

Read More »Another Sexual Assault Gets Refugees Banned From Pools In Austria

Authorities in the Austrian town of Mistelbach issued a temporary pool ban for refugees following a sexual assault by a “dark-skinned’ man on a 13-year-old girl. German and Swiss are issuing leaflets how to behave in pools. Earlier this year we reported that a town in Germany had banned adult male asylum seekers from the public pool after receiving complaints that some women were sexually harassed. As a result,...

Read More »Britain’s Dreams of a ‘Swiss Miracle’ Look More Like Fantasy

Electoral workers prepared a polling station for the referendum on the European Union in north London. Credit Neil Hall/Reuters To help explain why the British voted to leave the European Union, look to Switzerland. The famously neutral Swiss rejected membership in the European Economic Area, a potential steppingstone to the European Union, in a 1992 referendum, but Switzerland didn’t formally withdraw its dormant...

Read More »In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal. Jeff Gundlach confirmed as...

Read More »British Discontent About The EU: Only A Precursor To Unrest On The Continent

Authored by Peter Cleppe, originally posted at Euro Insight, If Brexit marks the beginning of the end for the European project, Brussels will take its share of the blame If Britain leaves the EU and if the reaction to Brexit causes years of uncertainty, the EU will reap what it has sowed. British discontent is only a precursor to unrest on the Continent, where populists from across the political spectrum feel they...

Read More »Who Is The “European Movement” And Why The Answer May Change How You Vote On “Brexit”

Werner’s main points: The “EU Movement” has been created by the US Government and their secret services in order centralise their influence over Europe. Big business, banks, central banks and the IMF want to excercise their power through unelected officials. The free trade area with the EU is beneficial and will surely be maintained, even in the Brexit case. The election outcome is not so clear as it seems to the...

Read More »The British Referendum And The Long Arm Of The Lawless

Submitted by Danielle DiMartino Booth via DiMartinoBooth.com, “Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law, possessed...

Read More »World’s Central Bankers Gathering At BIS’ Basel Tower Ahead Of Brexit Results

What happens on the 18th floor of the main tower at Centralbahnplatz 2 in Basel, stays on the 18th floor of the main tower at Centralbahnplatz 2. That’s because this is where every other month the world’s central bankers meet in complete secrecy – no minutes are ever kept – to discuss the global economy completely unfettered of any concerns of accountability, and decide on what monetary policies they will implement to...

Read More »“Contemplating the End of Fractional Reserve Banking”

Presentation and Q&A session at an event organized jointly by the CFA Institute and the CFA Society Switzerland. Live webcast.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org