Via The Mises Institute, [An interview with Hans-Herman Hoppe in the Polish weekly Najwy?szy Czas!] What is your assessment of contemporary Western Europe, and in particular the EU? All major political parties in Western Europe, regardless of their different names and party programs, are nowadays committed to the same fundamental idea of democratic socialism. They use democratic elections to legitimize the taxing...

Read More »“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed...

Read More »Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

The following article by David Haggith was first published on the Great Recession Blog. Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic...

Read More »Germany Sells First Ever Negative-Yielding 10Y Treasury, Corporate Bonds

Negative for 10 Years Overnight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon. As it turned out the issue was historic in another way as well: with the prevailing 10Y bond trading well in negative yield territory, it was largely expected that today’s bond auction would likewise issue at a negative yield, and...

Read More »“The World Is Walking From Crisis To Crisis” – Why BofA Sees $1,500 Gold And $30 Silver

Gold With both stocks and US Treasury prices at all time highs the market is sensing that something has to give, and that something may just be more QE, which likely explains the move higher in gold to coincide with both risk and risk-haven assets. As of moments ago, gold rose above $1,370, and was back to levels not seen since 2014. Curiously, the move higher is taking place after Friday’s “stellar” jobs report,...

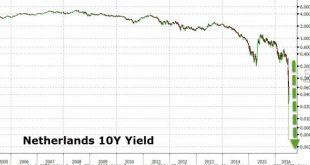

Read More »Going Dutch? Netherlands Joins The 10Y NIRP Club

Netherlands 10Y Yield For the first time in Dutch history, 10Y government bond yields have turned negative (-0.001% intraday) closing at 0.00%… Click to enlarge. Joining Switzerland, Japan, Germany, and Denmark… Pushing Global NIRP bonds over the $13 trillion! Click to enlarge. Chart: Bloomberg

Read More »Fearing Confiscation, Japanese Savers Rush To Buy Gold And Store It In Switzerland

Japan has pushed further away from being the nation that embraces “Krugman Era” economics and deeper into the new “Bernanke Era” economics of helicopter money. As a result Japan’s citizens have been on a blitz to save what little purchasing power they still possess, before hyperinflation finally arrives. The gold price is up double digits in the past month and as we said last night, something big is coming as Japan...

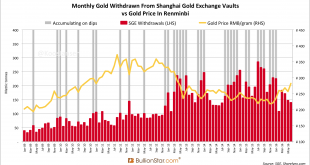

Read More »Chinese Gold Demand 973 tonnes in H1 2016, Nomura SGE Withdrawals Chart False

Chinese wholesale gold demand, as measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), reached a sizable 973 metric tonnes in the first half of 2016, down 7 % compared to last year. Although Chinese gold demand year to date at 973 tonnes is slightly down from its record year in 2015 – when China in total net imported over 1,550 tonnes and an astonishing 2,596 tonnes were withdrawn from SGE...

Read More »Yahoo Finance Editor “We’re Suffering Of Too Much Democracy”

Following James Traub’s mind-numbingly-elitist rebuttal of the democratic rights of “we, the people” in favor of allowing “they, the elite” to ensure the average joe doesn’t run with scissors, “It’s time for the elites to rise up against the ignorant masses.” The Brexit has laid bare the political schism of our time. It’s not about the left vs. the right; it’s about the sane vs. the mindlessly angry… The Guardian’s...

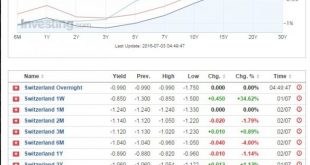

Read More »Swiss Bond Yields all Negative up to 30 years: Greatest Bubble in Financial History

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are “more negative than others”, because investors expect a slow appreciation of the Swiss franc. Sometimes it’s critical to look clearly at the big picture. The big picture is that the financial world has allocated capital… trillions of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org