The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row. © Denis Linine _ Dreamstime.com Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction. The recent fall was driven by slow growth in mortgage lending (+2.6%), considerably below the 10-year average of 3.8%. The bank did note that growth in mortgage lending might be underestimated. Insurers and pension fund have entered the mortgage market with guns blazing, however their lending reporting is inadequate, according to the bank. Some parts of Switzerland remain at

Topics:

Investec considers the following as important: Property, Swiss property prices, Swiss real estate

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

Investec writes The rise in rental scams in Switzerland

Investec writes The rapidly fading economics of solar panels in Switzerland

The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row.

© Denis Linine _ Dreamstime.com

Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction.

The recent fall was driven by slow growth in mortgage lending (+2.6%), considerably below the 10-year average of 3.8%. The bank did note that growth in mortgage lending might be underestimated. Insurers and pension fund have entered the mortgage market with guns blazing, however their lending reporting is inadequate, according to the bank.

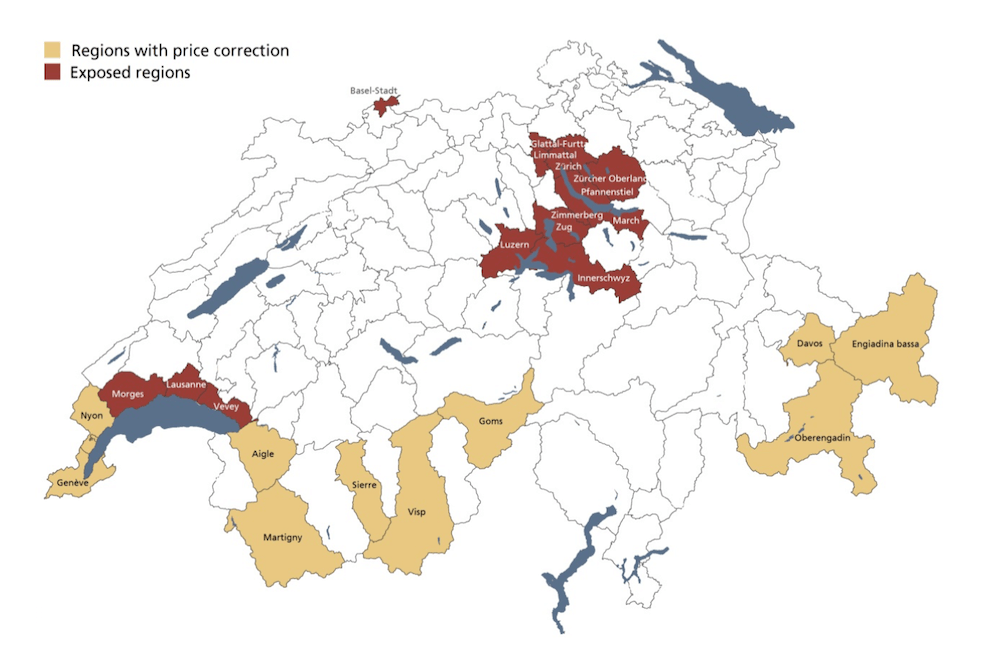

Some parts of Switzerland remain at greater risk of price corrections. They are the usual suspects: greater Zurich and the surrounding region in central Switzerland, Basel and the Lake Geneva Region.

UBS real estate bubble index Q4 2017

The map above shows regions at risk in burgundy. The areas in brown have seen price falls since 2014.