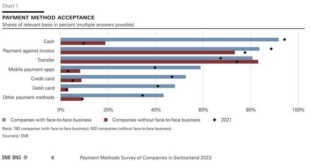

In spring 2023, the Swiss National Bank conducted its second payment methods survey of companies in Switzerland. Around 1,750 companies, across all sizes, language regions and industries, participated in this survey on payment method topics. In-depth knowledge of these topics helps the SNB to fulfil its statutory tasks in relation to the supply and distribution of cash and to cashless payments. . The most important findings of the payment methods survey of...

Read More »“Augenwischerei um SNB-Ausschüttungen (Misconceptions about SNB Distributions),” NZZ, 2024

Neue Zürcher Zeitung, January 25, 2024. PDF. HTML. Kritik an der Höhe der SNB-Ausschüttungen ist somit nur gerechtfertigt, wenn die Finanzverantwortlichen von Bund und Kantonen die genannten Hebel nicht in Bewegung setzen können. Einer solchen Kritik muss sich die SNB stellen. Sie hat die Kompetenz, ihre Bilanz nach geldpolitischen Erfordernissen zu gestalten, aber eine mechanische Rückstellungspolitik entspricht diesem Erfordernis kaum. Die SNB sollte daher begründen, warum eine...

Read More »Fed to Express More Confidence that Policy is Sufficiently Restrictive Despite the Easing of Financial Conditions

Commentary will resume with a 2024 outlook on December 29. Overview: The dollar is trading with a firmer bias today ahead of the outcome of the FOMC meeting. Standing pat for two meetings was framed as a pause, but given the decline in price pressures, being unchanged for a third meeting is understood as the end of the historically aggressive tightening cycle. Fed Chair Powell is expected to express greater confidence that policy is sufficiently restrictive to bring...

Read More »BOJ Speculation Unwound, Taking the Yen Lower

Overview: The busy week of central bank meetings is off to a mostly slow start. The dollar is narrowly mixed in quiet turnover, except against the Japanese yen. Many participants seemed to exaggerate the risks of a BOJ move next week and dollar continued its recovery that began ahead of the weekend. Among emerging market currencies, central European currencies appear to be aided by the firmer euro. They are resisting the dollar's advance seen against most other...

Read More »Swiss National Bank Launches Wholesale Central Bank Digital Currency Project

On 1 December 2023, the Swiss National Bank – together with five Swiss and one German commercial bank – started a pilot project with central bank digital currency for financial institutions (wholesale central bank digital currency) on the regulated platform of SIX Digital Exchange (SDX). With this pilot, called Helvetia Phase III, the SNB will for the first time issue real wholesale CBDC in Swiss francs on a financial market infrastructure based on distributed ledger...

Read More »The Swiss franc’s “phenomenal” bull run

The strength of the Swiss franc (CHF) has been the topic of countless “expert” analyses for over a year and it has received considerable coverage in the mainstream financial press. In fact, the last time the currency garnered this much interest was probably in 2011, when its celebrated “safe haven” status backfired, as investors fled to it in droves and pushed the price to levels that forced the Swiss National Bank (SNB) to intervene and peg it to the euro....

Read More »The Swiss franc’s “phenomenal” bull run

The strength of the Swiss franc (CHF) has been the topic of countless “expert” analyses for over a year and it has received considerable coverage in the mainstream financial press. In fact, the last time the currency garnered this much interest was probably in 2011, when its celebrated “safe haven” status backfired, as investors fled to it in droves and pushed the price to levels that forced the Swiss National Bank (SNB) to intervene and peg it to the euro. Or perhaps it was when...

Read More »“Dunkle Perspektiven: Wenn auch die UBS gerettet werden müsste (Chilling UBS Rescue Scenario),” SRF, 2023

Echo der Zeit, SRF, 12 May 2023. HTML with link to audio file. Implications of capital injections and liquidity assistance for the federal government, the SNB, and Switzerland.

Read More »SNB Strategy Update

With its annual report from a few weeks ago the SNB communicated minor changes in its monetary policy strategy (p. 24): The review of the monetary policy strategy showed that it has fundamentally proved its worth. There was no need to adjust the first two elements, namely the definition of price stability and the conditional inflation forecast. The strategy has enabled the SNB to fulfil its mandate of price stability well, despite repeated strong external shocks in recent years. The...

Read More »Market Hears Dovish Fed Hike and Sells Dollars

Overview: The dollar remains under pressure following the Federal Reserve's rate hike. The market thinks it heard that the Fed was done hiking, even though Fed Chair Powell held out the possibility that "some additional firming may be necessary." The Norwegian krone is the strongest of the G10 currencies today, up more than 1%, spurred by a 25 bp hike and a commitment to do more. The Dollar Index briefly traded below 102.00 for the first time since February 3. A...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org