Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and “other bonds”, at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below. There was one notable –...

Read More »Swiss Banks Paid Out €1 Billion In Negative Interest Rates In The First Half

Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and "other bonds", at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below. There was one notable - and unexpected - development, and it had to do with the SNB's -0.75%...

Read More »Switzerland’s Changing International Linkages

In a CEPR discussion paper, Cedric Tille argues that Switzerland’s international linkages have been transformed over the last decade. Abstract: Over the last decade, the economic linkages between Switzerland and the rest of the world have been transformed. First, merchanting and the chemical industry account for an increasing share of international trade, with chemicals exports expanding robustly in recent years despite the European crisis and the strong Swiss franc. Second, the nature of...

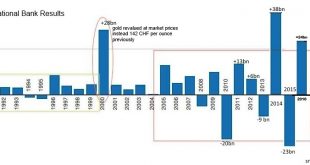

Read More »SNB reports a profit of CHF 1.2 billion for the first half of 2017

From the official news release Interim results of the Swiss National Bank as at 30 June 2017 The Swiss National Bank (SNB) reports a profit of CHF 1.2 billion for the first half of 2017. A valuation gain of CHF 0.3 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 0.1 billion and the profit on Swiss franc positions stood at CHF 0.9 billion. The SNB’s financial result...

Read More »When Do We Know These Are Delusional Markets

Latest Investment Outlook In his latest investment outlook, Fasanara Capital’s Franceso Filia, who two months ago explained in one chart how the “fake market” operates… … discuss what happens when a “Twin Bubble meets quantitative tightening” and answers why record-low volatility breeds market fragility and precedes system instability. We’ll have more to share on that shortly, but for now, here is Filia with his take...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the...

Read More »“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

Authored by Kevin Muir via The Macro Tourist blog, After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside. I am willing to take that chance. It would be just like me to pound the table on the long side,...

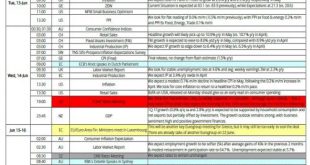

Read More »Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp...

Read More »New Gold Pool at the BIS Switzerland: A Who’s Who of Central Bankers

This is an extract and summary from “New Gold Pool at the BIS Basle, Switzerland: Part 1” which was first published on the BullionStar.com website in mid-May. Part 2 of the series titled “New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil” is also posted now on the BullionStar.com website. “In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday,...

Read More »Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

The following article by David Haggith was first published on The Great Recession Blog: We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%. Tech stocks nosedived while others rose to create new highs. Is this a one-off, or has a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org