Latest Investment Outlook In his latest investment outlook, Fasanara Capital’s Franceso Filia, who two months ago explained in one chart how the “fake market” operates… … discuss what happens when a “Twin Bubble meets quantitative tightening” and answers why record-low volatility breeds market fragility and precedes system instability. We’ll have more to share on that shortly, but for now, here is Filia with his take on ‘when do we know these are delusional markets‘: Signs of complacency and disconnect from fundamentals abound. So to sanity check, it may still be helpful to periodically remind ourselves of a few recent ones. In no particular order: Argentina uses defaults as a recurrent macro-prudential policy,

Topics:

Tyler Durden considers the following as important: Bank of Japan, Bond, Business, Cov-lite, Economic bubble, economy, Emergence, Equity Markets, European Central Bank, European Union, Featured, Japan, loans, Mizuho Research Institute, newsletter, Private Equity, S&P, SNB, Swiss National Bank, Volatility

This could be interesting, too:

investrends.ch writes Der Franken und die Grenzen der Geldpolitik

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

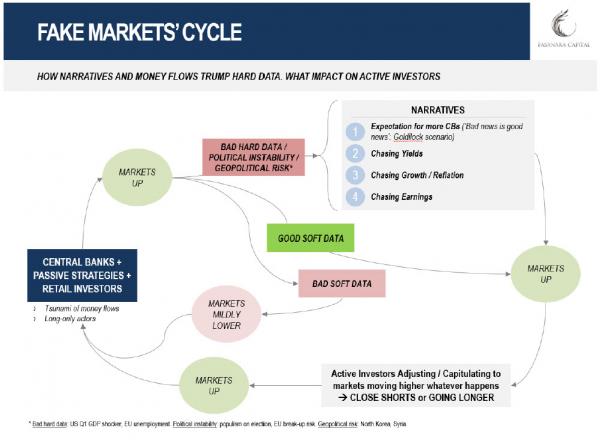

Latest Investment OutlookIn his latest investment outlook, Fasanara Capital’s Franceso Filia, who two months ago explained in one chart how the “fake market” operates… … discuss what happens when a “Twin Bubble meets quantitative tightening” and answers why record-low volatility breeds market fragility and precedes system instability. We’ll have more to share on that shortly, but for now, here is Filia with his take on ‘when do we know these are delusional markets‘:

|

Markets Cycle |

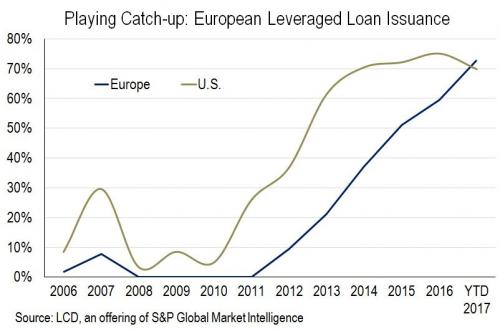

| Cov-Lite Loans In Both EU And The US Reached A Staggering 70% Of All Loan Supply In 2017. Before the credit bubble burst in 2007, it was 30%. |

European Leveraged Loan Issuance, 2006 - 2017 |

Tags: Bank of Japan,Bond,Business,Cov-lite,Economic bubble,economy,Emergence,Equity Markets,European central bank,European Union,Featured,Japan,Loans,Mizuho Research Institute,newsletter,Private Equity,SP,Swiss National Bank,Volatility