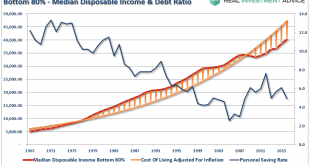

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth. What’s not to love? I just have one question. If things are so good, then why is America’s saving rate posting such a sharp decline? The answer is not...

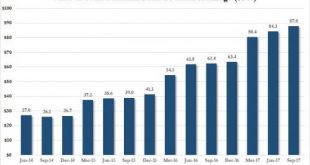

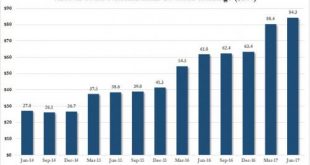

Read More »The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented “coordinated growth spurt”, and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using “money”...

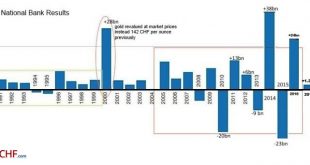

Read More »The good years have started, increasing SNB Profits

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But in 2017, the picture is changed. Assuming a “biblical” cycle of seven good years and seven bad years, the SNB could now increase profits every year – thanks to a weaker franc and the seven good years. … until the next recession comes and the...

Read More »Swiss industry has learned to live with strong franc

An employee of MAN Diesel & Turbo Switzerland grinds turbine blades of a turbo compressor in Zurich in 2015 (Keystone) - Click to enlarge The recent appreciation of the Swiss franc has sent shockwaves through Swiss firms, resulting in job losses and lower research budgets. But viewed long-term, Switzerland’s export-driven economy has adapted remarkably well to a strong currency. This is the overall...

Read More »Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility. Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to...

Read More »Swiss National Bank Releases New 10-franc note

Third banknote in latest series showcases Switzerland’s organisational talent - Click to enlarge The Swiss National Bank (SNB) will begin issuing the new 10-franc note on 18 October 2017. Following the 50-franc and 20-franc notes, it is the third of six denominations in the new banknote series to be released. The current eighth-series banknotes will remain legal tender until further notice. The inspiration behind...

Read More »Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

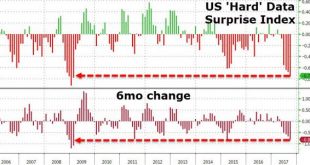

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown – the 4th-longest streak since 1928… So everything is awesome… [embedded content] BUT…US ‘hard’ economic data has not been this weak (and seen the biggest drop) since Feb 2009… US Data Surprise Index, 2006 - 2017 - Click to enlarge Q3 Was a Roller-Coaster… Q3 was the 8th straight quarterly gain in a row for The Dow – the longest streak...

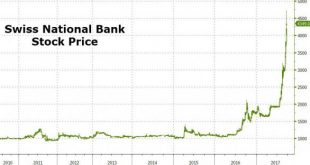

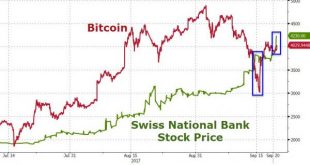

Read More »Is The Swiss National Bank A Fraud?

The price of shares in The Swiss National Bank is up 11 days in a row, soaring 150% in the last two months. SNB Stock Price, 2010 - 2017(see more posts on Swiss National Bank Stock, ) - Click to enlarge That sounds like a ‘tulip’ bubble-like ‘fraud’… Bitcoin and SNB, 2013 - 2017(see more posts on Bitcoin, Swiss National Bank Stock, ) - Click to enlarge The SNB is up over 120% in Q3 so far – more than double...

Read More »Fed’s Asset Bubbles Now At The Mercy Of The Rest Of The World’s Central Bankers

“Like watching paint dry,” is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen’s decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, “have no fear, The SNB knows what it’s doing.” As we reported previously, In...

Read More »Swiss National Bank Bubble Regains Lead Over Bitcoin

A week ago we tweeted… Dear @SNB_BNS_en – you are the next bitcoin: congratulations pic.twitter.com/cld4YNbNLb — zerohedge (@zerohedge) September 14, 2017 But as Bitcoin rebounded from its China challenges, it overtook The SNB once again as bubbliest bubble. However, a 13% spike in the share price of The Swiss National Bank today has put an end to that leaving the central bank back in first place among the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org