Radio Bern RaBe, May 15, 2018. HTML with link to podcast (interview starts at 08:15). Interview with Radio Bern RaBe about Vollgeld and the Vollgeld initiative.

Read More »Switzerland’s vote to change its monetary system – sensible or silly?

Sometimes Swiss voters are presented with questions that only specialists are equipped to answer. The vote on 10 June 2018 to change their monetary system appears to be one of these. © Valeriya Potapova | Dreamstime.com On the surface it appears simple. Upon closer inspection it contains much complexity and uncertainty, compounded by a widespread misunderstanding of how the financial system works – banks do not act simply as intermediaries, lending out the deposits that savers place with...

Read More »Konjunktur, Geldpolitik und eine riesige Bilanzsumme

Die Schweizer Konjunktur brummt wie schon lange nicht mehr. Vor allem zeigt der kürzlich publizierte Bericht der Seco-Expertengruppe, dass die Erholung auf breiter industrieller Basis stattfindet. Der Frankenschock von 2015 ist definitiv überwunden (Quelle). Foto: Peter Klaunzer (Keystone ) - Click to enlarge Belässt die Bilanzsumme auf Rekordniveau: Thomas Jordan, Präsident der SNB, wird nach seiner Rede von Jean...

Read More »“Was Vollgeld bringt – und was nicht (Sovereign Money—Pluses and Minuses),” SRF, 2018

[embedded content] Wer soll Franken herstellen dürfen? Nur die Schweizerische Nationalbank, oder auch die Geschäftsbanken wie UBS, CS oder die Kantonalbanken? Ginge es nach der Vollgeld-Initiative, über die wir am 10. Juni abstimmen, wäre künftig klar: Geld als gesetzliches Zahlungsmittel gäbe es nur von der SNB. Offsetmaschine zum Druck von Schweizer Banknoten bei der Schweizerischen Nationalbank. Keystone - Click to...

Read More »“Was Vollgeld bringt – und was nicht (Sovereign Money—Pluses and Minuses),” SRF, 2018

SRF, April 28, 2018. HTML with link to audio file (interview starts at 13:15). Interview with Swiss public radio about Vollgeld and the Vollgeld initiative.

Read More »SNB loses 6.8 billion in Q1/2018

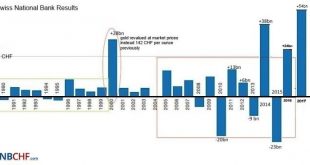

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the...

Read More »SNB reports a profit of CHF 47.6 billion for Q1 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in...

Read More »Weakening franc approaches symbolic mark

The SNB conducts a difficult balancing act to stabilise the national economy. (Keystone) - Click to enlarge As the Swiss franc weakens towards the threshold CHF1.20 exchange rate, the likelihood remains slim that Switzerland’s central bank will alter monetary policy any time soon. On Thursday morning a euro cost CHF1.198 francs. In February, the price of a single euro fell to under CHF1.150. The greater the...

Read More »Elektronisches Zentralbankengeld hat Vorteile

- Click to enlarge Die Schweizerische Nationalbank hat dem E-Franken eine Absage erteilt – zu Unrecht, sagt Dirk Niepelt im Interview mit finews.ch. Der Direktor des SNB-nahen Studienzentrums Gerzensee erklärt, warum digitales Geld Vorteile bringt. Vergangene Woche hat sich Andréa Mächler, Mitglied des dreiköpfigen Direktoriums der Schweizerischen Nationalbank (SNB), kritisch zur Einführung eines elektronischen...

Read More »“Elektronisches Zentralbankengeld hat Vorteile (Benefits of `Reserves for All’),” finews, 2018

finews.ch, April 9, 2018. PDF. Andreas Britt interviewed me. I describe the consequences of “Reserves for All” and point to potential benefits.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org