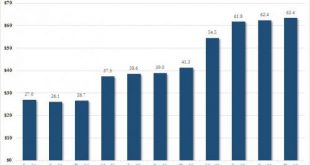

Being able to print your own money and buy stocks at any price sure can be fun. Just as the SNB which unlike many other (if ever fewer) central banks admits to doing just that. In its latest 13F filing, the Swiss National Bank reported that the value of its portfolio of US stocks rose again in the fourth quarter, increasing by 1.6% from $62.4 billion as of Sept. 30 to a record high $63.4 billion at the end of the year....

Read More »The Central Banks Pull Back: Now It’s Up to Fiscal Policy to “Save the World”

Another problem is the rise of social discord, for reasons that extend beyond the reach of tax reductions and increased infrastructure spending. Have you noticed that the breathless anticipation of the next central bank “save” has diminished? Remember when the financial media was in a tizzy of excitement, speculating on what new central bank expansion would send the global markets higher in paroxysms of risk-on joy?...

Read More »The VIX Will Be Over 100 due to Central Bank Created Tail Risk

By EconMatters We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory! We had the Financial Crisis of 2008, and instead of learning from the mistakes of incentivizing excessive risk taking, the Central Banks were allowed to...

Read More »Weekly Sight Deposits and Speculative Positions: SNB Intervenes for 2.4 bn CHF, while Speculators increase CHF Shorts

Headlines Week February 06, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards...

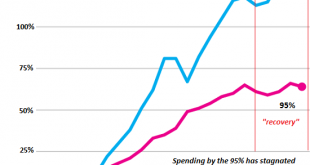

Read More »The Central Banks Face Unwelcome Realities: Their Policies Boosted Wealth Inequality, Failed to Generate “Growth”

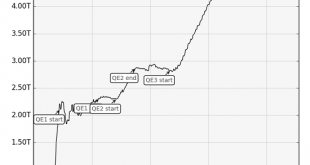

Rather than be seen to be further enriching the rich, I think central banks will start closing the “free money for financiers” spigots. Take a quick glance at these charts of the Federal Reserve balance sheet and bank credit in the U.S. Notice what happened to bank credit after the Fed “tapered” and stopped expanding its balance sheet? U.S. Fed Summary - Click to enlarge Bank credit exploded higher: U.S. Bank...

Read More »France’s FN sets out unorthodox economic plans to support a euro exit

By Ingrid Melander, Leigh Thomas and Simon Carraud Marine Le Pen © Reuters. France's FN sets out unorthodox economic plans to support a euro exit - Click to enlarge PARIS (Reuters) – France’s National Front will combine the euro exit at the heart of its economic platform with a cocktail of unorthodox policies including money printing, currency intervention and import taxes, a top party official told Reuters. A key...

Read More »Weekly Sight Deposits and Speculative Positions: Strong Swiss Trade Balance: SNB allows EUR/CHF to 1.0680

Headlines Week January 30, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards...

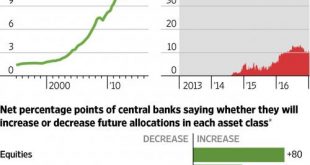

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »Weekly Sight Deposits and Speculative Positions: Weaker dollar let SNB accumulates losses

Headlines Week January 23, 2017 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro during the weak inflation period. The last ECB meeting showed that the...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Headlines Week January 23, 2017 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro during the weak inflation period. The last ECB meeting showed that the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org