The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before. From the abstract: The key aspects of the revision are: the application of the weighting method used by the IMF, which takes into account so-called third-market effects; continuous updating of the...

Read More »Weekly SNB Interventions and Speculative Positions: Back to 2.4 bn Intervention per Week

Headlines Week April 10, 2017 We were arguing in the previous months, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. The tendency of point 3 had been interrupted when the ECB appeared to be less dovish. FX Last Week:...

Read More »End of EUR/CZK peg: Czech National Bank

The Czech National Bank (CNB) ended the EUR/CZK floor today. Timing was a little earlier than expected, but rising inflation and a robust economy warranted it. We think it’s too soon to talk about a rate hike, as we expect the koruna to overshoot to the strong side. Policy Outlook Price pressures are rising, with CPI accelerating to 2.5% y/y in February. March data will be reported April 10, with consensus at 2.6%...

Read More »Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

Headlines Week April 03, 2017 We were arguing in the previous months, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. The tendency of point 3 had been interrupted when the ECB appeared to be less dovish. FX Last week:...

Read More »Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

Headlines Week March 27, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Llst weeks: The EUR/CHF suddenly appreciated with the ECB...

Read More »Vollgeld? Geht schon!

Der Bundesrat, Economiesuisse und die die Schweizerische Nationalbank haben die Vollgeldinitiative salopp (oder populistisch?) als Hochrisikoexperiment zur Ablehnung empfohlen. In ihrer Überheblichkeit gehen sie davon aus, dass dies auch so geschehen wird. Dazu brauche es nicht einmal einen Gegenvorschlag. Sie haben die Rechnung damit möglicherweise ohne den Schweizer Wirt gemacht. Den meisten Bürgern ist (noch?) nicht...

Read More »2016 Annual Report of the Swiss National Bank

The Swiss National Bank carried out foreign exchange interventions totaling 67.1B Swiss francs in 2016 in order to counter “an undesired tightening of monetary conditions,” the central bank disclosed in its annual report. That was down from 86.1B francs in 2015, when the SNB intervened heavily at the start of the year following its decision to remove a cap on the franc’s value against the euro. SNB Sight Deposits...

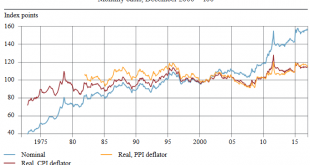

Read More »New calculation of SNB exchange rate indices

Change to a more comprehensive and up-to-date methodology The Swiss National Bank (SNB) is putting the Swiss franc exchange rate indices it calculates and publishes on a new footing. The adjustment allows the Swiss economy’s competitive and trading relationships to be replicated in a more comprehensive and up-to-date way. The new indices, too, show that the Swiss franc is significantly overvalued. The SNB exchange rate...

Read More »Weekly Sight Deposits and Speculative Positions: EUR/CHF suddenly higher after ECB

Headlines Week March 20, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Last week: The EUR/CHF suddenly appreciated with the ECB meeting,...

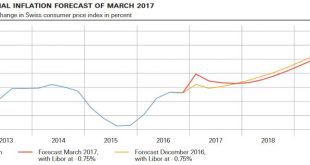

Read More »SNB Monetary Policy Assessment March 2017

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org