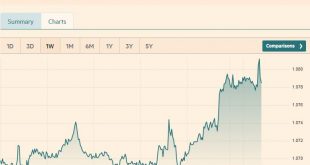

Headlines Week March 13, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Last week: The EUR/CHF suddenly appreciated with the ECB meeting...

Read More »Are Central Banks Losing Control?

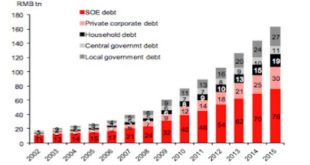

Eight years after the crisis of 2008-09, central banks are still injecting $200 billion a month into the global financial system to keep it from imploding. If you want a central banker to choke on his croissant, read him this quote from socio-historian Immanuel Wallerstein: “Countries (have lost the ability) to control what happens to them in the ongoing life of the modern world-system.” Stated another way, Wallerstein...

Read More »Switzerland ranked world’s worst currency manipulator

The Economist magazine placed Switzerland first in a recent ranking of currency manipulators. According to the analysis, China, commonly thought of as the world’s champion at keeping its currency’s value artificially low, appears to be doing the opposite: actively trying to push the value of its currency up. On the other hand, Switzerland that has been working hardest to artificially devalue its money. © Ginasanders | Dreamstime.com Every six months America’s Treasury looks at a country’s...

Read More »Switzerland ranked world’s worst currency manipulator

The Economist magazine placed Switzerland first in a recent ranking of currency manipulators. According to the analysis, China, commonly thought of as the world’s champion at keeping its currency’s value artificially low, appears to be doing the opposite: actively trying to push the value of its currency up. On the other hand, Switzerland that has been working hardest to artificially devalue its money. © Ginasanders | Dreamstime.com Every six months America’s Treasury looks at a country’s...

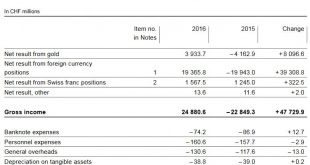

Read More »Swiss National Bank Results 2016 and Comments

The Swiss National Bank (SNB) reports a profit of CHF 24.5 billion for the year 2016 (2015: loss of CHF 23.3 billion). The profit on foreign currency positions amounted to CHF 19.4 billion. A valuation gain of CHF 3.9 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.6 billion. For the financial year just ended, the SNB has set the allocation to the provisions for currency reserves at CHF 4.6 billion. After taking into account the...

Read More »Weekly Sight Deposits and Speculative Positions: Each week an intervention record.

Headlines Week March 06, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Last week:The EUR/CHF remained around 1.0650, the level where the...

Read More »Vollgeld: Bravo NZZ

Urs Birchler Kompliment an Hansueli Schöchli zu seinem luziden Artikel zur Vollgeld-Initiative in der heutigen NZZ! Alles sauber und unvoreingenommen erklärt. Für Stimmbürger(innen) am wichtigsten: Wenn die SNB dem Bund Geld schenkt, wird die Schweiz als ganze nicht reicher. Statt auf der Vermögensseite der SNB steht das Geld dann auf der Vermögensseite des Bundes. Die Gefahr allerdings: Der Wunsch der Politik nach mehr, der nur durch Geldschöpfung (einer Form der Besteuerung) und indirekt...

Read More »Each Week the Same: Another SNB Intervention Record

Headlines Week February 27, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand Speculators increase their dollar shorts against Euro and reduce them against CHF. FX week until February 27 The EUR/CHF fell to new lows. The average rate in the week was 1.0648. The SNB is apparently ready to let the...

Read More »Video: The Swiss National Bank Is Acting Like A Hedge Fund

By EconMatters In this Video, we discuss the fact that Central Banks have basically morphed into Hedge Funds with similar risky investing strategies, except they buy without any regard to the underlying fundamentals of the assets they are buying. When did the Swiss Citizens say it was the proper role for the Swiss National Bank to be buying US Stocks? How is this stimulating the Swiss Economy? Central Banks have really...

Read More »Weekly Sight Deposits and Speculative Positions: Once again a new SNB intervention record

Headlines Week February 20, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org