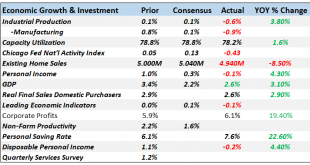

We’re changing the format on our Macro updates, breaking the report into two parts. This is part one, a review of the data released the previous month with charts to highlight the ones we deem important. We’ll post another one next week that will be more commentary and the market based indicators we use to monitor recession risk. We are still playing catch up on the economic data releases due to the government...

Read More »Bi-Weekly Economic Review: As Good As It Gets?

In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not. 10 year yields fell nearly 40 basis points in a matter of days as did TIPS yields. The...

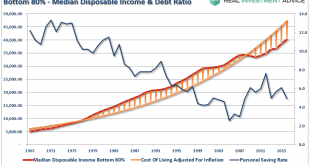

Read More »The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth. What’s not to love? I just have one question. If things are so good, then why is America’s saving rate posting such a sharp decline? The answer is not...

Read More »Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it. I don’t waste much time on it myself because it is subject to large revisions and has little predictive capability. In...

Read More »NIRP Has Failed: European Savings Rate Hits 5 Year High

One year ago, when it was still widely accepted conventional wisdom that NIRP would “work” to draw out money from savers who are loathe to collect nothing (or in some cases negative interest) from keeping their deposits at the bank, and would proceed to spend their savings, either boosting the stock market or the economy, we showed research from Bank of America demonstrating that far from promoting dis-saving, those...

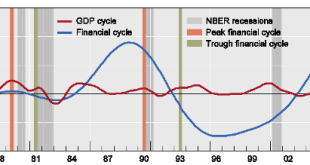

Read More »Weak CHF during the Fat Years of the Joseph Cycle

In December 2015, the seven year Joseph cycle ended with a Fed rate hike. These lean years of the Joseph cycle started in December 2008 when the Fed lowered rates to the current level. We think that in the next seven year cycle, even the risk-averse Swiss investors will buy more foreign assets, not only the central bank and speculators. Different crises have passed in the three parts of the world, the U.S. subprime, the euro crisis and the Emerging Markets crisis. The last one culminated...

Read More »Weak CHF during the Fat Years of the Joseph Cycle

In December 2015, the seven year Joseph cycle ended with a Fed rate hike. These lean years of the Joseph cycle started in December 2008 when the Fed lowered rates to the current level. We think that in the next seven year cycle, even the risk-averse Swiss investors will buy more foreign assets, not only the central bank and speculators. Different crises have passed in the three parts of the world, the U.S. subprime, the euro crisis and the Emerging Markets crisis. The last one culminated...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org