Net Lines It’s that dreaded day after Independence Day. The weather is gorgeous and I don’t really feel like trading either. The thought of just phoning it in had occurred to me, but as the new month just rolled over I thought I may as well take another peek at our monthly charts. Which uncovered quite some interesting perspectives that I’m eager to share. But no worries – we’re keeping it light and easy...

Read More »Gold Silver Update for Purists

Net Lines It’s that dreaded day after Independence Day. The weather is gorgeous and I don’t really feel like trading either. The thought of just phoning it in had occurred to me, but as the new month just rolled over I thought I may as well take another peek at our monthly charts. Which uncovered quite some interesting perspectives that I’m eager to share. But no worries – we’re keeping it light and easy...

Read More »The Gold Situation

A Growing Bullish Chorus – With Somewhat Muted Enthusiasm A few days ago a well-known mainstream investment house (which shall remain nameless) informed the world that it now expects the gold price to reach “$1,500 by early 2017”. Our first thought was: “Now they tell us!”. You won’t be surprised to learn that the same house not too long ago had its eyes firmly fixed in the opposite direction. Why are we telling you...

Read More »Silver – OMG!

A hi-ho silver moment… Photo credit: Pat Corkery, United Launch Alliance Going Parabolic From Wednesday through Friday, the price of silver spiked massively. It ended the week about $2 higher than the previous week. The last time we recall silver price action like this was about 3 years ago, in August 2013. That one week, the price rose about $2.50. Before that was a week in August 2012, with a price gain of about...

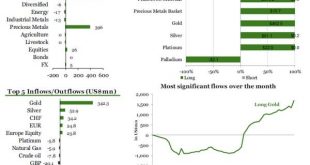

Read More »ETF Securities Reports Biggest One-Day Gold Inflow Since Financial Crisis

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional “buy low, buy more lower” investing would suggest), “investors” in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and...

Read More »Brexit Drives Gold Frenzy

He should have known… (the cartoon shows a list of polls of “Dewey wins by landslide” or “Trump will never win the primaries” quality…) Markets Blindsided by Brexit The big news this week was that the British voted to exit the European Union. This was not the outcome expected by pundits, or the polls. “Risk on” assets were relentlessly bid up prior to the vote. For example, S&P 500 index futures had closed the...

Read More »Soft and Softer Silver Fundamentals

It was just a thought…. Cartoon by Bob Rich Loose Monetary Policy Remains in Place Last week, we asked where then will silver go. Well, the price moved around this week, dipping on Thursday but then rebounding sharply on Friday. It closed up 13 cents from last week. The price of gold rose $24. This week, the Federal Reserve announced that it will not hike rates. Most economists (and traders) have long been expecting a...

Read More »Where Then Will Silver Go?

Silver gets the Saruman question…(see further below) Photo credit: New Line Cinema Precious Metals Surge The price of gold bumped up thirty bucks, and that of silver about one buck. Is this liftoff — when the dollar falls sharply, and the price of each metal in dollar terms skyrockets? Is this the denoument when the gold bug does not get rich, because although his net worth measured in dollar is massively up, the...

Read More »Central Banks & Governments and their gold coin holdings

Within the world of central bank and government gold reserves, there is often an assumption that these gold holdings consist entirely of gold bullion bars. While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves. These...

Read More »The Cost of Bullish Bets

Philipsburg, Montana, 1890: evidently, these gentlemen did not suffer from a silver shortage. Photo via mininghistoryassociation.org Surging Contango There are two views of the markets for the monetary metals. One, as we have discussed many times in this Report, holds that gold and silver will eventually go up so high that those who own the metals will be rich. This is the Schrodinger’s dollar view. Buy gold because...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org