The buck. The Dollar Increases in Value The dollar moved up, though most people would say gold fell about $40, and silver 32 cents. In the mainstream view, the value of the dollar is 1/N (N is the quantity). So how could the dollar go up? Certainly, the quantity keeps on increasing. Our view is different. If you borrow dollars to buy an asset, and the asset doesn’t generate enough yield to pay the interest, you have to sell or default. It should go without saying that it is an...

Read More »Great Graphic: Gold and the Dollar

Many investors still think about gold as if it were money. Economists identify three functions of money: store of value, means of exchange, and a unit of account. It can be a store of value, but the price fluctuates compared with other forms of money, or other commodities, like oil or silver. Some argue that it is a store of value because of the limited supply, but that argument applies to many other goods, including commodities and real estate (which Mark Twain said you have to...

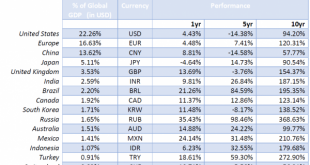

Read More »The Global Monetary System Has Devalued 47 percent Over The Last 10 Years

We have argued the inevitability of Fed-administered hyperinflation, prompted by a global slowdown and its negative impact on the ability to service and repay systemic debt. One of the most politically expedient avenues policy makers could take would be to inflate the debt away in real terms through coordinated currency devaluations against gold, the only monetize-able asset on most central bank balance sheets. To do so they would create new base money with which to purchase gold at...

Read More »Revenge of the Fundamentals

Illustration via irs.com A Wake-Up Call The price of gold moved down about twenty Federal Reserve Notes, and the price of silver dropped $0.57. The big news is that the gold-silver ratio moved up about 1.5. We hate to say “we told you so,” well, OK. Actually… sometimes there’s a certain je ne said quoi about gloating. *Achem* In all seriousness, the dollar is going up. We measure it in gold, or alternatively in silver. In gold, the dollar rose 0.4mg gold to 24.84. In silver, it was up...

Read More »Gold Demand is Falling

Federal Reserve – still managing to maintain enough confidence Photo credit: Adam Fagen / Flickr Confidence Not Lost Yet The price of gold moved down about sixteen bucks, while that of silver dropped about three dimes. In other words, the dollar gained 0.3 milligrams of gold and 0.04 grams of silver. We continue to read stories of the “loss of confidence in central banks.” We may not know the last detail of what that will look like—when it occurs one day. However, we will wager an...

Read More »Fresh Mainstream Nonsense on Gold Demand

They Will Never Get It… Gold wants to know what it has done now… Photo credit: Ajay Verma / Reuters We and many others have made a valiant effort over the years to explain what actually moves the gold market (as examples see e.g. our article “Misconceptions About Gold”, or Robert Blumen’s excellent essay “Misunderstanding Gold Demand”). Sometimes it is a bit frustrating when we realize it has probably all been for naught. This was brought home to us again in a recent missive posted...

Read More »Arizona Governor Ducey Vetoes Gold

The Euthanasia of Widows and Orphans Sound money also looks better than the government’s scrip! In my testimony in support of the gold legal tender bill this year, I discussed failing pension funds. Retirees who count on their pension checks are being told that their monthly check will be reduced by up to 60%. This is devastating to them, obviously. What isn’t obvious is the cause. In the news coverage of this, the angry pensioners are blaming the union, the fund manager, and Wall...

Read More »Gold – The Commitments of Traders

Commercial and Non-Commercial Market Participants The commitments of traders in gold futures are beginning to look a bit concerning these days – we will explain further below why this is so. Some readers may well be wondering why an explanation is even needed. Isn’t it obvious? Superficially, it sure looks that way. As the following chart of the net position of commercial hedgers illustrates, their position is currently at quite an extended level: Gold Hedgers Position Net position...

Read More »Gold Is Slowing

A Loss of Momentum Photo credit: R.P. Visual The price of gold moved down slightly this week, while that of silver dropped more substantially—1.9%. We don’t see much decrease in the enthusiasm yet from this minor setback. This was a shortened week due to the May Day holiday outside the US. Let’s look at the only true picture of supply and demand fundamentals. Gold and silver prices. First, here’s the graph of the metals’ prices. Gold and silver prices – click to enlarge....

Read More »Gold and Gold Stocks – Is the Correction Finally Beginning?

Triangle Thrust and Reversal In mid April, we discussed weekly resistance levels in the HUI Index. Given the recent almost blow-off like move in the index and its subsequent reversal, we decided to provide a brief update on the situation. First, here is a daily chart comparing the HUI, the HUI-gold ratio and gold: After building another triangle, the HUI has delivered an upside thrust in the direction of the preceding trend. This is quite normal, and so is the subsequent move back to its...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org