Pros and Cons The original Bethlehem Steel Works in Bethlehem, Pennsylvania. Photo via leggendaurbana.it The recent rally in commodity prices has surprised many market participants and has greatly supported the stock market’s rebound. It has also made bulls out of a number of former stock market bears, as one of its side effects was to cause an improvement in market internals. But does the rally actually make sense? As always, there are arguments both for and against the idea. We...

Read More »Paper Gold Is Rising

The Metals Take Off Photo via sprottmoney.com The price of gold shot up over $60 this week. The price of silver moved up proportionally, gaining over $0.85. The mood is now palpable. The feeling in the air is that of long suffering suddenly turned to optimism. Big gains, if not the collapse of the price-suppression cartel, are now inevitable. The headlines and articles, screaming for gold to hit $10,000 to $50,000, are pervasive. Today we won’t dwell on our favorite point that if the...

Read More »Gold Stampede

Better get out of the way… stampeding bisons Stampeding Animals The mass impulse of a cattle stampede can be triggered by something as innocuous as a blowing tumbleweed. A sudden startle, or a perceived threat, is all it takes to it set off. Once the herd collectively begins charging in one direction it will eliminate everything in its path. The only chance a rancher has is to fire off a pistol with the hope that the shot turns the herd onto itself. If the rancher is successful, it...

Read More »Gold and Negative Interest Rates

The Inflation Illusion We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discusses the use of negative rates. We first have to define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest we have...

Read More »Silver is on Fire

The Prices of Gold and Silver Drift Apart Another interesting week, in that the price of silver separated from the price of gold. The former went no nowhere, while the latter gained over 4.5%. Inside the Sierra silver mine in Wallace, Idaho Photo credit: silverminetour.org We get the trading thesis, that if the precious metals are in a bull market, then silver should go up more than gold. Silver is the high-beta gold. It’s a smaller market, less liquid, and at the same time it’s the...

Read More »A Historic Rally in Gold Stocks – and Most Investors Missed It

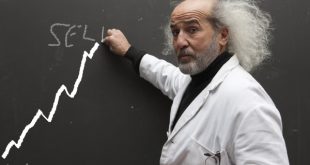

Buy Low, Sell High? It is an old truism and everybody has surely heard it more than once. If you want to make money in the stock market, you’re supposed to buy low and sell high. Simple, right? As Bill Bonner once related, this is how a stock market advisor in Germany explained the process to him: Thirty years ago, at an investment conference, there was a scalawag analyst from Germany. He showed a chart where a stock had gone up steadily for 10 years. He pointed to the bottom, left...

Read More »Making Sense of China’s Gold Fix and Hungary’s Dim Sum Offering

Earlier today, China launched its first gold fix. It will offer a fixing twice a day going forward yuan. The Shanghai Gold Exchange established the fix the same way it is done in London and New York, by prices submitted by financial institutions. In China’s case, 18 institutions, including two foreign banks, participate in the process. The key question for investors is if there is some larger implication of this development that they should be aware? China is the world’s largest...

Read More »Monetary Metals Report: Gold – Silver Opposites

What Differentiates Gold from Silver? Well that was an interesting week. Gold went down over thirty bucks and silver went up over thirty cents. How much longer can this silver rally continue in the face of gold’s non-participation? Will speculators really be comfortable bidding silver up to $20 while gold sits at $1200? Do the fundamentals support a higher silver price? Gold, active June futures contract over the past week – click to enlarge. How is silver different from gold? Aside...

Read More »Gold Stocks Break Out

No Correction Yet Photo via Museo del Oro / Bogota Late last week the HUI Index broke out to new highs for the move, and so did the XAU (albeit barely, so it did not really confirm the HUI’s breakout as of Friday). Given that gold itself has not yet broken out to a new high for the move, it would normally be expected to do so, as Jordan Roy-Byrne argues here. The chart below shows the situation as of Friday (HUI, HUI-gold ratio and gold): The HUI and the HUI-gold ratio have broken...

Read More »The Precious Metals Conspiracy

Tricky and Dangerous Assumptions A metallic conspirator and his flying factotum… Image via sceptic.com For at least a few weeks now, we have noticed a growing drumbeat from a growing corps of analysts. Gold is going to thousands of dollars. And silver is going to outperform. Reasons given are myriad. Goldman Sachs apparently said to short gold, so if one assumes that the bank always advises clients to take the other side of its trades — a tricky and dangerous assumption at best — then...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org