See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. An image from the future: the US dollar, which one of these days is going to sink. Alas, there is many a slip ‘twixt the cup and the lip… Image via pinterest.com The Long Term vs. Trading Ideas The price of gold was up about thirty bucks this week. The price of silver was up almost seventy cents. Last week, a reader...

Read More »The Fundamentals behind Gold Price Seasonality

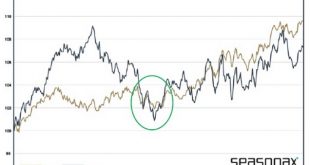

Seasonality of gold and silver In the Six Major Fundamental Factors that Determine Gold and Silver Prices we have learned that prices of gold and silver represent the growth difference between Europe and the Emerging Markets on one side and the United States on the other. When the former two are weak, then gold prices tend to fall. When the U.S. economy is weak, however, then gold prices tend to rise. While...

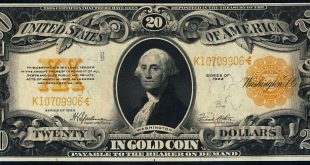

Read More »Why a “Dollar” Should Only Be a Name for a Unit of Gold

Once Upon a Time… Prior to 1933, the name “dollar” was used to refer to a unit of gold that had a weight of 23.22 grains. Since there are 480 grains in one ounce, this means that the name dollar also stood for 0.048 ounce of gold. This in turn, means that one ounce of gold referred to $20.67. Now, $20.67 is not the price of one ounce of gold in terms of dollars as popular thinking has it, for there is no such entity...

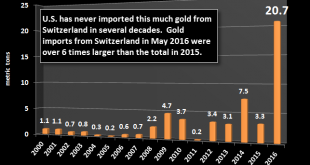

Read More »Record Swiss Gold Flow Into The United States

Submitted by the SRSrocco Report Record Swiss Gold Flow Into The United States There was a huge trend change in U.S. gold investment in May. Something quite extraordinary took place which hasn’t happened for several decades. While Switzerland has been a major source of U.S. gold exports for many years, the tables turned in May as the Swiss exported a record amount of gold to the United States. How much gold? A...

Read More »Gold is not Going to $10,000

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango One Cannot Trade Based on the Endgame The prices of the metals were down again this week, -$15 in gold and more substantially -$0.57 in silver. Stories continued to circulate this week, hitting even the mainstream media. Apparently gold is going to be priced at $10,000. Jump on the bandwagon now, while it’s still cheap...

Read More »The Curious Case of Vanishing Lady Liberty; Only Gold and Silver Remember Her

The very first word anyone ever saw on a circulating United States coin was the word “LIBERTY.” From half-cents to silver dollars, each featured the likeness of an unnamed woman. The images varied, thanks to different engravers, but together they became recognized as Lady Liberty. Many, maybe most, of young America’s citizens were illiterate. “Liberty” may have been the first word they ever learned to read. If not,...

Read More »A Sense of Foreboding

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Amerexit and Brexit… Doubts About Debt This was a shortened week, due to the American holiday of July 4, celebrating the start of the war that lead to “Amerexit”, 240 years ago. The prices of the metals were up this week, +$25 in gold and +$0.48 in silver. The gold to silver ratio dropped a fraction of a point, showing...

Read More »“The World Is Walking From Crisis To Crisis” – Why BofA Sees $1,500 Gold And $30 Silver

Gold With both stocks and US Treasury prices at all time highs the market is sensing that something has to give, and that something may just be more QE, which likely explains the move higher in gold to coincide with both risk and risk-haven assets. As of moments ago, gold rose above $1,370, and was back to levels not seen since 2014. Curiously, the move higher is taking place after Friday’s “stellar” jobs report,...

Read More »Fearing Confiscation, Japanese Savers Rush To Buy Gold And Store It In Switzerland

Japan has pushed further away from being the nation that embraces “Krugman Era” economics and deeper into the new “Bernanke Era” economics of helicopter money. As a result Japan’s citizens have been on a blitz to save what little purchasing power they still possess, before hyperinflation finally arrives. The gold price is up double digits in the past month and as we said last night, something big is coming as Japan...

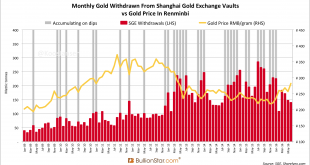

Read More »Chinese Gold Demand 973 tonnes in H1 2016, Nomura SGE Withdrawals Chart False

Chinese wholesale gold demand, as measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), reached a sizable 973 metric tonnes in the first half of 2016, down 7 % compared to last year. Although Chinese gold demand year to date at 973 tonnes is slightly down from its record year in 2015 – when China in total net imported over 1,550 tonnes and an astonishing 2,596 tonnes were withdrawn from SGE...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org