It was just a thought…. Cartoon by Bob Rich Loose Monetary Policy Remains in Place Last week, we asked where then will silver go. Well, the price moved around this week, dipping on Thursday but then rebounding sharply on Friday. It closed up 13 cents from last week. The price of gold rose . This week, the Federal Reserve announced that it will not hike rates. Most economists (and traders) have long been expecting a hike (not us). A hike is tighter monetary policy, and therefore not-hiking is looser. Which means a greater quantity of dollars. Which means higher prices. Everyone knows that (except us). So naturally, on the announcement, the price of silver blipped up about 20 cents. It continued to drift another 25 cents higher. And then cascaded down almost 65 cents. Almost no one knows that prices, including the prices of the metals, have anything to do with the quantity of dollars (except us). Then the price began drifting higher, had another sharp drop, and drifted back up again. Though it ended the week quite a bit lower than the post-Fed high of .85. Folks, we have to say it. This is all noise. Not the non-hike. That is serious economics that is undermining capital, crushing business profit margins, driving asset bubbles, and ruining pension funds and banks.

Topics:

Keith Weiner considers the following as important: Central Banks, dollar price, Featured, Gold and its price, Gold and silver prices, gold basis, Gold co-basis, gold price, gold ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver ratio

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Loose Monetary Policy Remains in Place

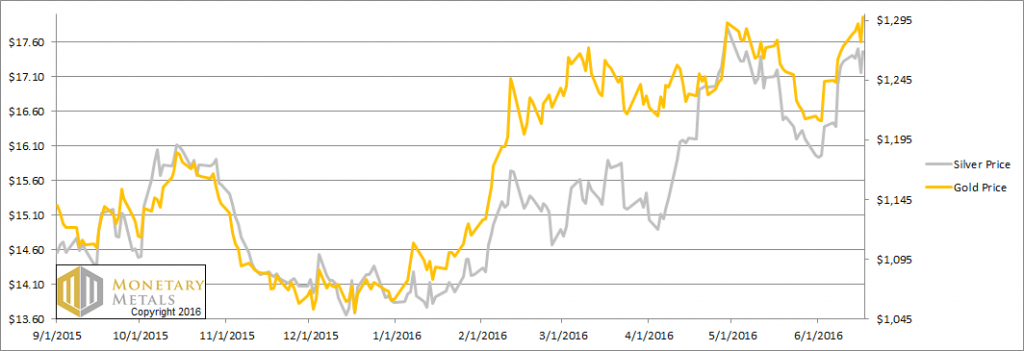

Last week, we asked where then will silver go. Well, the price moved around this week, dipping on Thursday but then rebounding sharply on Friday. It closed up 13 cents from last week. The price of gold rose $24.

This week, the Federal Reserve announced that it will not hike rates. Most economists (and traders) have long been expecting a hike (not us).

A hike is tighter monetary policy, and therefore not-hiking is looser. Which means a greater quantity of dollars. Which means higher prices. Everyone knows that (except us).

So naturally, on the announcement, the price of silver blipped up about 20 cents. It continued to drift another 25 cents higher. And then cascaded down almost 65 cents. Almost no one knows that prices, including the prices of the metals, have anything to do with the quantity of dollars (except us).

Then the price began drifting higher, had another sharp drop, and drifted back up again. Though it ended the week quite a bit lower than the post-Fed high of $14.85.

Folks, we have to say it. This is all noise. Not the non-hike. That is serious economics that is undermining capital, crushing business profit margins, driving asset bubbles, and ruining pension funds and banks. The Great Fed Falling Interest Rate since 1981 continues.

The price moves on these events. Over the long term, only buyers and sellers of real metal can set the price. In the short term, leveraged speculators can place big bets and thereby push or pull the price down or up from where it would otherwise be.

Fundamental Developments

Prices of gold and silverLet’s take a look at those buyers and sellers of real metal, in the only true picture of the supply and demand fundamentals. But first, here’s the graph of the metals’ prices. | |

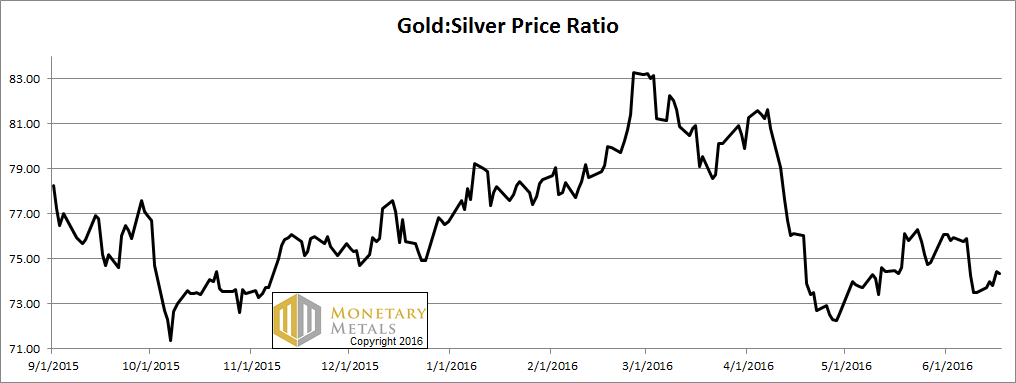

Gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was up a bit this week, interesting when the prices of both metals are up. | |

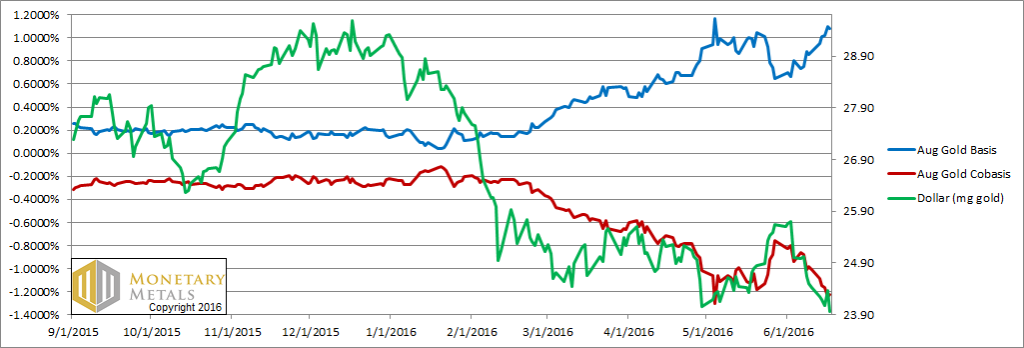

Gold basis and co-basis and the dollar priceHere is the gold graph. Look at that red co-basis line (i.e. scarcity of gold). It is dropping along with the price of the dollar (inverse to the price of gold, measured in dollars). In other words, gold becomes less scarce and more abundant the higher its price. Huh, that’s not what some gold promoters are saying, is it? Our calculated fundamental price is down almost $40, more than $140 below the market price. | |

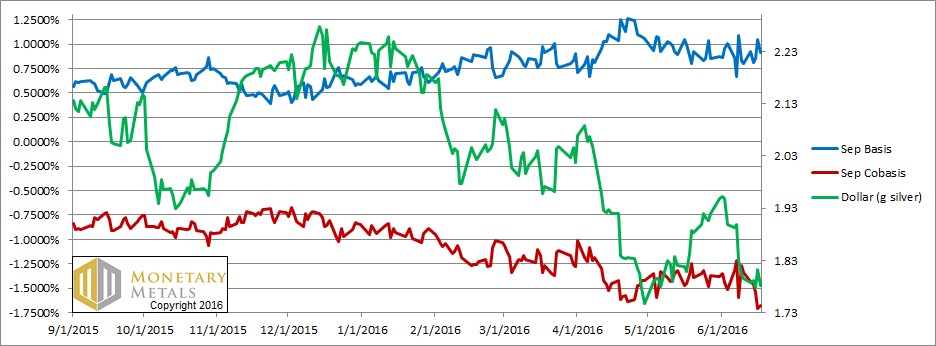

Silver basis and co-basis and the dollar priceNow let’s turn to silver. It’s a similar picture in silver. Note that the co-basis is at a (much) lower absolute level in silver, compared to gold (-1.7% vs. -1.2%). The fundamental price fell over 30 cents, now $2.40 below market. |

Charts by: Monetary Metals