Published: 7th November 2016Download issue:In spite of large doses of policy easing, inflation and global growth remain tepid. With the effectiveness of existing monetary policy styles therefore being increasingly questioned, the November 2016 issue of Perspectives looks at three of the most plausible alternatives.One is asset-price targeting. Could central banks assume responsibility for ensuring the stability of asset prices as well as price stability? Christophe Donay, head asset of asset...

Read More »Gauging the economic plans of U.S. presidential candidates

Published: 11th October 2016Download issue:Both main candidates in the US presidential election have outlined their plans in numerous areas. Whoever wins, both are promising to raise government spending, especially on infrastructure. Writing in the October issue of Perspectives, Pictet Wealth Management’s chief economist Bernard Lambert outlines various scenarios. Should Hilary Clinton win the presidency but the Democrats fail to win a majority in the House of Representatives in...

Read More »Private equity, an antidote to prospect of weak returns?

Published: 13th September 2016Download issue:The summer months were good for risk assets, though things may get bumpier in the months ahead. But alongside this study in chiaroscuro, the September issue of Perspectives offers a brighter picture of investment opportunities.Pictet chief strategist Christophe Donay admits that “prospects for portfolio returns look far weaker than they did in the past” as the extraordinary measures introduced by central banks to combat low growth and inflation...

Read More »Similarities between August 2016 and July 1999

Quantitative analysis points to parallels between state of equity markets today and markets 17 years agoThere are many similarities between the current period and 1999. Then, just as now, we were in the midst of a technology-led bull market following a housing-related recession, central banks were experimenting with very loose monetary policy, there had been a big drop in emerging markets and commodities in the previous year or so, and we had recently gone through a currency-related crisis...

Read More »Investing in a post-Brexit world

Published: 11th July 2016Download issue:Brexit should not lead to a repeat of the financial crisis of 2007-2008. So argue Pictet analysts and economists in the July issue of Perspectives. Central banks are better prepared and banks are less leveraged. In the last resort, the European Central Bank can be expected to step in again should financial stress noticeably increase in the weeks ahead. Longer term, an ideal post-Brexit scenario for European financial markets would be a renewed push for...

Read More »Brexit highlights issue of political polarisation

The UK’s vote to quit the European Union (EU) shook markets in late June and revealed a sharply divided country. And while the EU27 are likely to take a tough line with the UK to discourage other countries from going down the same road, there is clearly a risk that Brexit is followed by further fragmentation of the EU.It is important to understand how we have arrived at such a crisis. There are, of course, many reasons (political, historic, institutional). But along with opposition to...

Read More »In the June 2016 issue of ‘Perspectives’

Published: 14th June 2016Download issue:Will Knut Wicksell be proved right? The Swede’s theories include the notion that there is a ‘natural’ level of interest rates, consistent with the economy operating at its full potential without overheating. But the actions of central banks have forced interest rates to artificially low levels in recent times, well below their ‘natural’ levels. If nature should reassert its predominance again, so the theory goes, then rates could shoot up, leading to...

Read More »Central banks face test of credibility

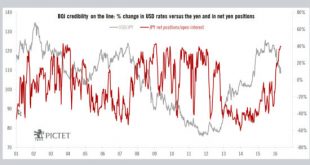

Published: 12th May 2016 Download issue: Central banks contributed to halting the financial crisis (starting with the US Federal Reserve’s first quantitative easing package, launched in late 2008), with successive rate cuts helping companies and households in the West to deleverage. The Bank of Japan (BoJ) and European Central Bank (ECB) followed with aggressive policies at a later stage, when the US recovery was already underway. Central banks’ commitment to their mandates has been...

Read More »In the May issue of ‘Perspectives’

The question of central bank credibility, and fixed-income investing when nominal yields are so low In the May issue of Perspectives, Pictet Wealth Management’s chief investment officer, César Pérez Ruiz, steps back to review the efforts of the world’s main central banks to boost the economy. The banks have introduced ever more radical measures, including negative interest rates and buying corporate as well as government bonds. But growth and inflation remain flaccid throughout the...

Read More »China: Something has to give

Published: 12th April 2016 Download issue: A trip I took to Hong Kong and Singapore in March proved a useful way to gauge the mood of clients on China’s doorstep. Overall, my meetings with these clients—all entrepreneurs with significant investments in the Middle Kingdom— tended to confirm what other observers have been saying: the Chinese authorities have the resources to ensure the economy attains 6.5%-7% growth this year, and maybe even next year as well, but things may get complicated...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org