Download issue:English /Français /Deutsch /Español /ItalianoThe early weeks of 2018 were full of twists for financial markets, with a rapid rise in bond yields leading to a short, sharp sell-off in equities. And while volatility subsequently fell back, it has still not returned to the low levels of 2017.What is going on? According to Christophe Donay, Head of Asset Allocation & Macro Research at Pictet Wealth Management (PWM), the correction we saw in early February was “the most visible...

Read More »After an exceptional year…

Download issue:English /Français /Deutsch /Español /Italiano2017 was an exceptional vintage for risk assets that will be hard to repeat this year. But the environment could become increasingly favourable for active management as challenges rise and volatility increases. This is one of the main messages from Pictet Wealth Management (PWM) analysts and strategists featured in the 2018 special edition of Perspectives.What might some of those challenges be? Global strategist Alexandre Tavazzi...

Read More »Hedge funds: alpha at the end of the QE tunnel

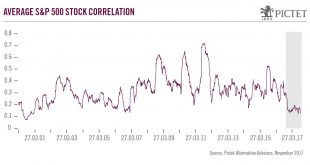

The performance of hedge funds has been bolstered in 2017 by the reversal of the tight market correlations of recent years. The gradual reversal of quantitative easing offers further opportunities to shine.A few years back, news that the Fed was reducing its balance sheet and considering rate rises would have prompted a severe market reaction. Today, as the ECB sets out plans for shrinking its own quantitative easing (QE) programme, the calm on financial markets is striking, affording, we...

Read More »Doing nicely

Published: 24th November 2017Download issue:English /Français /Deutsch /Español /ItalianoThe upturn in economic growth, benign central banks and improving corporate fundamentals have all ensured that most asset classes are set to finish 2017 in positive territory. But will the good times last?In the view of Pictet Wealth Management’s (PWM) chief investment manager, Cesar Perez Ruiz, next year “currently looks set to be a case of more of the same, at least in the first half”. After nine...

Read More »Deceptive calm, ‘Perspectives’, October-November 2017

Published: 4th October 2017Download issue:English /Français /Deutsch /Español /ItalianoThe strong equity gains of early 2017 petered out over the summer, in spite of buoyant earnings, reflecting the market’s belief that remaining upside in equites remains limited, especially in the absence of meaningful tax stimulus in the US. Reflecting relatively modest prospects, Pictet Wealth Management (PWM) recently moved from a positive to a neutral position on a number of sectors in both the US and...

Read More »Up or down?, “Perspectives”, August-September 2017

Published: 12th July 2017Download issue:English /Français /Deutsch /Español /ItalianoRisk assets showed a considerable loss of momentum in the second quarter. Annualised rises of over 50% on the S&P500 for much of the first quarter declined to 5% in the second. The reason was the fading of any belief in the reflation trade that the election of Donald Trump was meant to foster via tax cuts and infrastructure spending. There has also been a palpable loss of momentum in European markets as...

Read More »Looking to the politicians, ‘Perspectives’, June-July 2017

Published: 24th May 2017Download issue:English /Français /Deutsch /Español /ItalianoWith the election of Emmanuel Macron as French president, the tide of populism may have been stemmed for the moment in western Europe. Has Europe’s political class found the formula for dealing with the phenomenon? “I wouldn’t bet my investment career on it,” answers Pictet Wealth Management’s (PWM) chief investment manager, Cesar Perez Ruiz, in the June-July issue of ‘Perspectives’. Signs of ‘peak populism’...

Read More »Time to deliver, ‘Perspectives’, March-April 2017

Published: 28th March 2017Download issue:With President Trump’s plans to ‘reform and repeal’ Obamacare suffering a serious setback in Congress in March, attention is once again turning to the new administration’s plans for tax cuts and fiscal reform. The so-called ‘reflationary trade’, while in large part based on improving economic dynamics, also owes something to expectations that the new US administration will push through with other parts of its economic agenda. This means, writes Pictet...

Read More »The unleashing of animal spirits

Published: 6th February 2017Download issue:Donald Trump’s presidential win has unleashed animal spirits in the US that are likely to continue to drive equities forward in 2017. So argues Frank Bigler, head of equity investment research at Pictet Wealth Management, in the latest special edition of Perspectives. There are undoubtedly risks, but for the moment, “the overall direction of the market is still up,” according to Bigler “and any pull-back would be taken as an opportunity to...

Read More »From deflation to reflation, from bonds to equities

Published: 8th December 2016Download issue:Although Pictet Wealth Management does not expect a significant acceleration in real global economic growth next year, it believes 2017 will see an upturn in price pressures that spark a rise in nominal GDP growth and provides momentum for global reflation.In December’s Perspectives, Pictet Wealth Management’s head asset of asset allocation and macro research, Christophe Donay, discusses the implications of this, his central scenario, for the global...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org