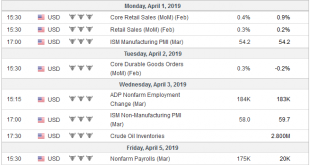

01.04.2019 – Turnover in the retail sector fell by 0.2% in nominal terms in February 2019 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.2% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.2% in February 2019 compared with the previous year....

Read More »FX Weekly Preview: The Green Shoots of Spring

Investors have worked themselves into a lather. Equities crashed in Q4 last year amid on corporate earnings and concerns about growth. The Fed’s tightening decision in December was made unanimously. The above-trend growth, the preferred inflation measure was near target, unemployment was the lowest in a generation and real rates were historically low. There are myths in the market, like the Plunge Protection Committee,...

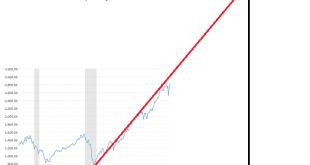

Read More »The Fed Guarantees No Recession for 10 Years, Permanent Uptrend for Stocks and Housing

Those who own stocks and housing now will continue getting richer, those who don’t will be priced out of these markets. A classified Federal Reserve memo sheds new light on the Fed’s confidence in its control of the economy and the stock and housing markets. In effect, the Fed is guaranteeing that there will be no recession for another 10 years, and that stocks and housing will remain in a permanent uptrend....

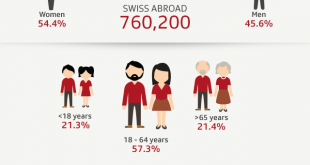

Read More »Swiss expat community hits 760,000

The number of Swiss Abroad citizens grew by 1.1% to reach 760,200 at the end of last year. Most live in neighbouring countries and in the United States. The expatriate community accounts for 10.6% of the total number of Swiss nationals, according to official statisticsexternal link published on Thursday. Nearly three-quarters of the Swiss Abroad have dual nationality. The most significant increase compared with 2017...

Read More »Almost 60,000 Swiss dwellings unoccupied last year

Construction of residential units has also experienced a decline. (Keystone / Martin Ruetschi) A significant increase in vacant homes is predicted by Zurich Cantonal Bank. Suburbs are particularly prone to lower occupancy levels. The problem of empty housing, particularly in the urban periphery, is likely to worsen, with construction activity concentrated in areas with already high vacancy rates. Last year around 59,700...

Read More »Monthly Macro Monitor – March 2019 (VIDEO)

Alhambra CEO discusses all the talk about the recent yield curve inversion and how he views it. [embedded content] Related posts: Monthly Macro Monitor – February (VIDEO) Monthly Macro Monitor – December 2018 (VIDEO) Monthly Macro Monitor – October 2018 (VIDEO) Monthly Macro Monitor – January 2019 Monthly Macro Chart Review – March (VIDEO) Monthly...

Read More »Growth forecast lowered for Swiss economy

The Swiss export industry is expected to suffer from worsening international conditions. Worsening international conditions will have a negative impact on Switzerland’s export-driven economy, prompting the Swiss Economic Institute (KOF) to lower its forecast for this year. KOF on Wednesday announced it had revised its growth forecast down from 1.6% to 1% for Switzerland’s gross domestic product. However, the latest...

Read More »Two Junior Miners Offering Arbitrage Opportunities – an Interview with Jayant Bhandari

Maurice Jackson of Proven and Probable Interviews Jayant Bhandari Maurice Jackson of Proven & Probable has just conducted another interview with Jayant Bhandari, who is known to long-time readers as a frequent guest author on this site. Jayant Bhandari Below is a video of the interview as well as a link for downloading the transcript of the interview in PDF form. But first here is a list of the topics discussed:...

Read More »Facebook rejects most information requests from Swiss authorities

© Klevo _ Dreamstime.com Over the first three months of 2018 Switzerland’s authorities made 80 requests for Facebook user data, however two thirds of them were rejected, according to the newspaper SonntagsBlick as reported in 20 Minutes. When the requests were urgent the response rate rose to two thirds of requests. Reto Nause, responsible for security in Bern, is unhappy with the social network’s response record....

Read More »Public transport enjoys another record year among tourists

On board the Gotthard Panorama Express (Keystone) Foreign visitors spent 6.4% more on Swiss Travel System tickets in 2018 than in the previous year. Sales rose to over CHF130 million ($131 million). 2018 is thus the sixth record year in a row, the Swiss Federal Railways saidexternal link on Tuesday. Chinese guests were the top foreign users of public transport, with sales of CHF20.3 million, an increase of 14.9%. They...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org