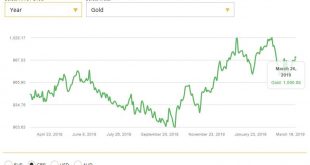

– Gold gains due to concerns about slowing growth, monetary and geopolitical risks – Increasing possibility of ‘No Deal’ Brexit heightens recession risks in UK, Ireland – Brexit uncertainty is impacting UK & Irish economies; Likely do long term damage – UK sees sharp slowdown in mortgage approvals in February as housing market slows – Gold surges to near all time record highs in Australian dollars at $1,860/oz –...

Read More »FX Daily, March 27: Global Bond Rally Continues, Greenback Remains Firm

Swiss Franc The Euro has fallen by 0.05% at 1.1194 EUR/CHF and USD/CHF, March 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US 10-year yield is trading below the Fed funds target. The two-year yield is trading below the lower end of the Fed funds target range. A warning by New Zealand that the next rate move could be a cut sent New Zealand and Australian...

Read More »Pound to Swiss Franc Forecast – Will GBP/CHF rates rise or fall on Brexit?

The Brexit date of 29th March has been delayed to the 12th April or the 22nd May as the EU provide a lifeline to the UK to help them avoid a no-deal scenario. This has helped the pound to rise and has provided some of the best rates to buy Swiss Francs in many months. The outlook for the pound is now looking much less rosy as investors await the latest news on Brexit and to see if the House of Commons will be likely to...

Read More »Cool Video: Bloomberg–Sterling and the Euro

I joined Shey Ann and Amanda Lang on the Bloomberg set to talk about sterling and the euro. The media makes it sound like there was a coup in the UK and Parliament has taken control of Brexit. This is an exaggeration. The House of Commons did secure tomorrow to have “indicative votes” on the different alternatives. These votes are not binding on the Prime Minister who as already indicated some alternatives that she will...

Read More »Additional flaw found in Swiss Post e-voting system

This is the second flaw in the Swiss Post future e-voting system discovered during the public intrusion test phase. (Keystone) A second error in the Swiss Post planned e-voting system has been discovered as the public intrusion test phase comes to an end. The Federal Chancellery announced the need for action and confirmed a review of the e-voting certification and approval process. The same computer experts who...

Read More »When Are We Going to Tackle the For-Profit Monopolies Which Censored RussiaGate Skeptics?

We either take down Facebook and Google and turn them into tightly regulated transparent public utilities available to all or they will destroy what little is left of American democracy. The RussiaGate Narrative has been revealed as a Big Con (a.k.a. Nothing-Burger), but what’s dangerously real is the censorship that’s being carried out by the for-profit monopolies Facebook and Google on behalf of the status quo’s Big...

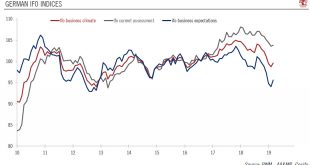

Read More »Germany: signs of rebound ?

German growth may remain subdued in H1 2019, before picking up somewhat in H2 2019 as some near-term risks dissipate. Germany’s leading indicator, the Ifo index, rose in March, driven by an increase in both sub-components: current assessment and expectations. The Ifo index differs in make-up from Markit’s purchasing manager indexes, but at the sector level, the story is the same: the more domestically driven services...

Read More »FX Daily, March 26: Semblance of Stability Re-Emerging

Swiss Franc The Euro has risen by 0.06% at 1.1231 EUR/CHF and USD/CHF, March 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The sell-off in equities seemed to peak yesterday, and US indices were narrowly mixed. Traders found comfort in that performance, even though the S&P 500 finished a little below 2800, and took the markets in the Asia-Pacific region...

Read More »Swiss parliament calls for more online purchases to be taxed

© Panuwat Dangsungnoen | Dreamstime.com Since 1 January 2019, companies abroad making more than CHF 100,000 in revenue must charge Swiss VAT on sales made to anyone in Switzerland. Now the Swiss government has decided to take aim at online platforms such as Aliexpress and Wish, according to the broadcaster RTS. Rather than chasing foreign companies selling products in Switzerland, Beat Vonlanthen, an MP from Fribourg,...

Read More »Europe and China

The US-China trade talks look like they may very well continue through most of the second quarter, despite how much progress is being claimed. Meanwhile, the tariffs remain in effect, but the market’s sensitivity to developments has slackened since it was clear the Trump and Xi were not going to meet at the end of this month. Europe’s relationship with China will eclipse the US-China trade talks that resume with Mnuchin...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org