We have a postscript to last week’s article. We said that rising prices today are not due to the dollar going down. It’s not that the dollar buys less. It’s that producers are forced to include more and more ingredients, which are not only useless to the consumer. But even invisible to the consumer. For example, dairy producers must provide ADA-compliant bathrooms to their employees. The producer may give you less milk for your dollar, but now they’re giving you ADA-bathroom’ed-employees. You may not value it, but it’s in the milk. On Twitter, one guy defended the Quantity Theory of Money this way: inflation (i.e. monetary debasement) is offset by going to China, where they don’t have an Environmental Protection

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Basic Reports, debasement, Dollar, Featured, inflation, newsletter, useless ingredients

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We have a postscript to last week’s article. We said that rising prices today are not due to the dollar going down. It’s not that the dollar buys less. It’s that producers are forced to include more and more ingredients, which are not only useless to the consumer. But even invisible to the consumer. For example, dairy producers must provide ADA-compliant bathrooms to their employees. The producer may give you less milk for your dollar, but now they’re giving you ADA-bathroom’ed-employees. You may not value it, but it’s in the milk.

On Twitter, one guy defended the Quantity Theory of Money this way: inflation (i.e. monetary debasement) is offset by going to China, where they don’t have an Environmental Protection Agency. In other words, the Chinese government does not force manufacturers to put so many useless ingredients into their products as the US government does.

He thought this comment disproved our argument. But actually it reinforces it.

In part II of Keith’s theory of interest and prices, he talks about buying a pair of Levis jeans in 2013 for $5 less than he paid for the same jeans thirty years previously, in 1983. Those who push the inflation theory often assert that the official government inflation number is a lie. The real rate, they tell us, is much higher.

OK, suppose the true rate of monetary debasement were running at 10% per year. If that were true, then a $50 pair of jeans in 1983 should have sold for $872 in 2013 (and $1,545 today). Obviously, the price of jeans is nowhere near this high.

The gold commenter guy asserts that the price is not so high, because of regulatory arbitrage.

But is it plausible that regulatory arbitrage can turn a 17-fold increase into a 10% cut in price? That you can get $872 worth of product for $45? Obviously not.

His comment actually proves our point that the US government is forcing manufacturers to put in useless ingredients. If you can find a jurisdiction where the list of useless ingredients isn’t too big, you can manufacture, warehouse, distribute, and retail jeans for 10% less than you could thirty years earlier.

The prevailing view of economics is arguably the neoclassical school. This school attempts to marry supply and demand with Keynesian ideas. In money, the consensus is clear. It is entirely uncontroversial (except for our merry little band). The Quantity Theory of Money holds that the value of a currency is inversely proportional to the number of units of it. Value = 1/N.

This ideas is based on the supply and demand model. If the supply of a currency goes up (without regard to how, by what mechanism), then its price goes down. And the price of the money is set in terms of consumer goods. So the price of the dollar is 1/milk for example.

This model presumes a chain of logic like this:

- If the total quantity of dollars goes up, then people have more dollars

- Yes, there are quibbles such as first access to newly created dollars

- And what if the dollar go into X goods or Y goods

- If people have more dollars than they want, they buy more goods

- If the same goods are bought by more people, then prices go up

- Institutions buy consumer goods if their portfolio allocation to dollars is too high

Whole essays could be written to debunk each of these premises. But our point today is that everyone from the rabid apologists for the Fed, to the strident enemies of the Fed accepts the basic idea (perhaps with some quibbles).

The second-hardest thing to do is question the prevailing wisdom. One is not going to make lots of new friends (at least at first), if one stands up and says the “emperor has no clothes”. One will face a barrage of criticism, some of it from well-respected persons in the field. One will find that prospective members of one’s audience have closed their minds to one’s ideas, even if they don’t understand the issues under debate. They know that the consensus and well-respected persons are against, and that is enough for them.

But this is only the second-hardest thing, regarding challenging the Quantity Theory of Money. The hardest thing is to change a paradigm of thought. This is why people sometimes work so hard not to see the glaringly evident. Notwithstanding the vast increase in quantity of dollars, prices have not followed.

What has occurred in the economy is tension between falling interest rates and increasing useless ingredients.

The combination of falling interest, and increasing useless ingredients, combine to push something else down. Profit margins.

It is so hard to see that falling interest rates is the way to look at monetary policy, for a simple reason. The quantity approach is the prevailing paradigm. It is so ingrained, that considering another paradigm takes both great courage and great cognitive effort. It is far easier to keep looking harder and harder for signs of the predicted inflation. And to seek excuses for why the predictions have failed to come true.

A reader pointed out that rising costs imposed on producers do not directly lead to rising prices. He is absolutely right. Anyone who doubts this should go out and buy an expensive new car, and then ask his boss for a raise, to cover the higher monthly cost of living.

However, most businesses cannot long sustain selling a product at a loss. So what will happen is the marginal producer will exit the business. For example, a hot downtown area in a major city strikes businesses with a three pronged approach: (1) higher minimum wages, (2) restrictions on when they can unload trucks, and (3) mandatory double-time pay after midnight, plus mandatory three-worker shifts for four hours.

Before the regulation, one employee was on site to unload the daily delivery for 2 hours at $10/hr = $20. After, it’s three employees at $15/hr times double-time = 3 X $30 X 4 = $360. The cost went up by $350 a day. That’s over $125,000 a year.

The marginal coffee shop is not generating that much profit. So it closes forever. If there is extra capacity in the market, even after this closure, then the remaining coffee shops still cannot raise their prices, lest they experience a decline in sales volume. In a competitive market, no one wants to send his customers to competing stores.

So the government strikes again. They say that climate change will kill the Earth, unless all business owners upgrade to more efficient heating and air conditioning, and restaurants must upgrade to more efficient refrigerators and cooking appliances such as coffee makers. Suppose this forces the small coffee shops to spend $100,000 to comply. Another marginal store closes its doors forever.

This goes on and on, until there are more customers than the remaining businesses can serve. Then, those survivors can raise their prices as there is a real shortage. Raising prices is the way to ration coffee capacity, to those who want coffee the most. Everyone else will do without.

Of course, whether this insidious process is due to monetary policy (i.e. rising interest rates, as 1947-1981) or whether it is due to useless ingredient policy (as today), consumers are harmed. Everyone is impoverished, rendered (much) poorer than we would be if the government did not intrude in either the market for money and credit, or the markets for labor, coffee machines, and HVAC systems.

However, the difference is important to anyone who wishes to advocate policy change. In that case, we need to know what monetary policy is doing, and what tax and regulatory policy is doing.Then we know not to bemoan the falling purchasing power of the dollar. The dollar is not, in fact, buying less than it was. It’s buying just as much, if not more. The catch is that it’s buying lots of things that coffee drinkers don’t know about, and don’t want.

We know enough not to blame the Fed. And we know that the Fed cannot and should not adopt a policy to counter truck loading ordinances and green new deal legislation.

And we also know that monetary policy is putting downward pressure on prices, by offering the perverse incentive to borrow more, to open more coffee shops. At the same time, regulation is putting upward pressure on prices, by snuffing out marginal coffee shops.

Even in the gold standard, if cities pass all kinds of ordinances and labor laws, they would cause prices to rise and deprive the poor of the affected goods and services. Gold will fix many problems, but not all problems. Including the problem of mandatory useless ingredients.

Supply and Demand Fundamentals

Last week was holiday-shorted due to Good Friday (it’s not an official holiday in the US, but it is in the UK. And this week’s report is a day later due to Easter Monday).

The price of gold dropped $15, but the price of silver rose ¢4. Perhaps silver traders got word that we are paying interest on silver, which gives people reason to hold silver? J

The discussion above (in the opening essay) is germane to the topic of the gold price. It should be clear that—whatever its virtues—gold will not protect you from the second cause of rising prices (i.e. regulation that destroys productive businesses, and thus supply of goods, and hence causes prices to rise). The price of gold does not go up, just because the city bankrupts another coffee shop.

It is tempting to cling to the idea of the Quantity Theory of Money, the neoclassical notion that the price of money is inverse to its quantity. This sets the expectation of rapidly rising prices, due to monetary policy. It is convenient to see rising prices due to the ever-increasing mandate to put useless ingredients in everything from coffee to the milk that goes in it.

Mainstream economics has one word to refer to rising prices, due to either cause. Inflation. And this biases gold analysis. If inflation is affecting the price of coffee in Seattle, then why isn’t it affecting the price of gold? The answer is simple, now that we have two clear concepts.

Inflation in this falling-interest rate cycle, is not monetary. Monetary forces are pushing prices down (due to falling interest rates). So if prices are rising, they are rising due to the increasing burden of useless ingredients.

But all the gold ever mind in human history is still in human hands. No one has the power to add useless ingredients to gold. So the price of gold does not go up from this cause.

This is one more reason why gold is the best way to measure declines in the dollar, and why the consumer price index fails. From the above discussion, we can see that coffee and milk are wholly inadequate measures.

Gold and Silver PriceAnyways, let’s look at the supply and demand picture of silver (and gold too). But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

Gold: Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio fell. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

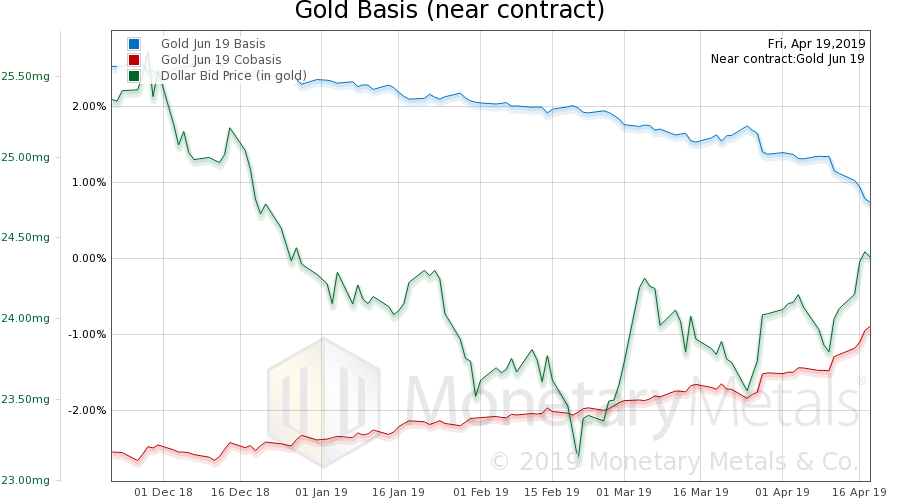

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. The scarcity (i.e. cobasis) continues to rise, but not that much (especially the gold basis continuous). The Monetary Metals Gold Fundamental Price is down $33, to $1,426. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

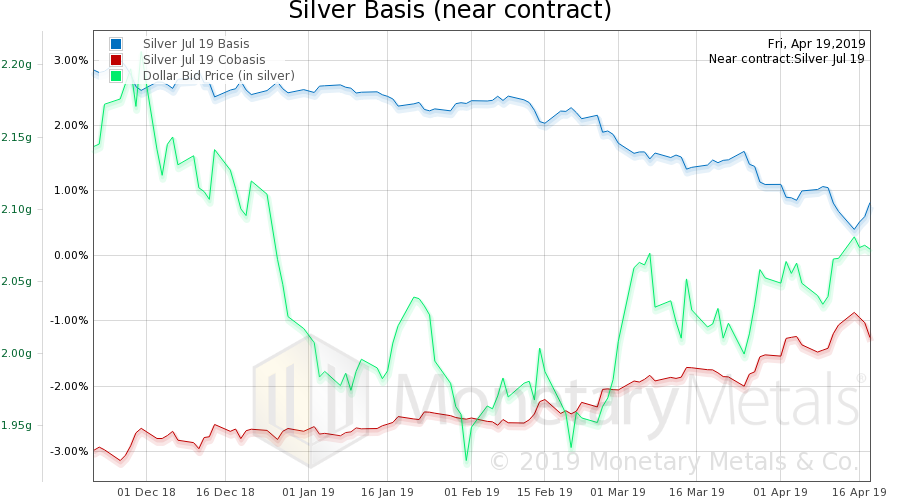

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. The scarcity of silver (i.e. cobasis) fell a bit. But the price did not change that much. The Monetary Metals Silver Fundamental Price was down another 25 cents to $15.84. © 2019 Monetary Metals |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Tags: Basic Reports,debasement,dollar,Featured,inflation,newsletter,useless ingredients