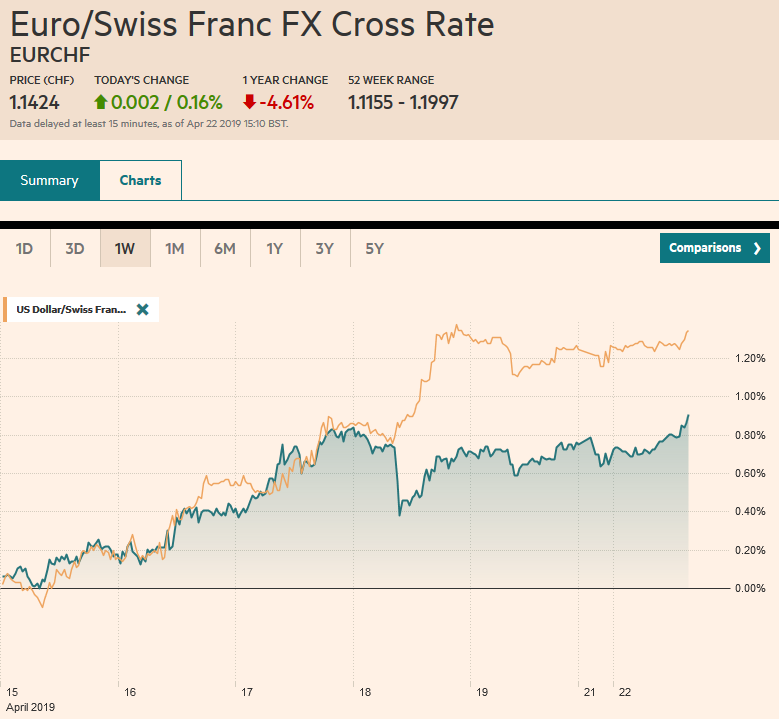

Swiss Franc The Euro has risen by 0.16% at 1.1424 EUR/CHF and USD/CHF, April 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: With many centers closed for the extended holiday, the calm in the global capital markets has been punctuated by reports that the US is considering ending its exemption for eight countries to have bought Iranian oil over the past six months. The waivers were to end on May 2, but previously it was thought that a couple of waivers, like for China and India, would be extended. Oil prices have surged to new six-month highs. Asian equities were mixed, with losses in China, India, and Indonesia and gains in Japan, Korea, and Taiwan. Most

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Featured, FX Daily, newsletter, Oil, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.16% at 1.1424 |

EUR/CHF and USD/CHF, April 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

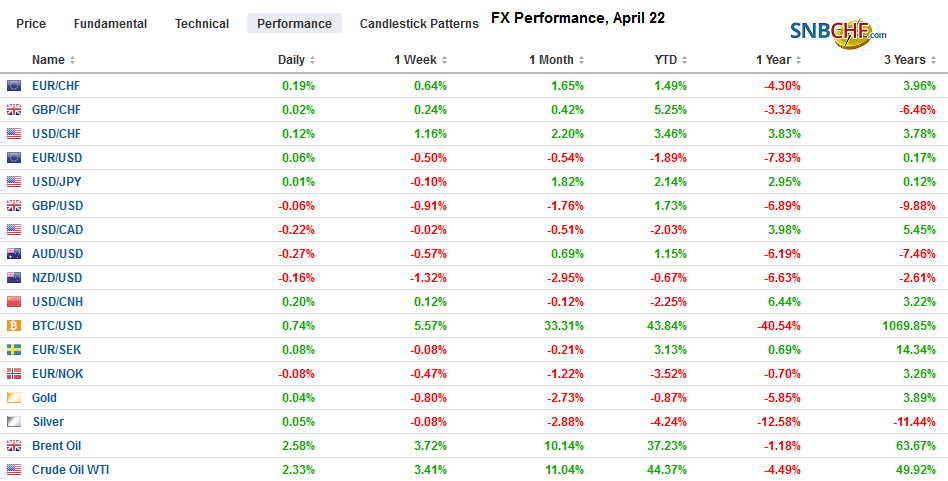

FX RatesOverview: With many centers closed for the extended holiday, the calm in the global capital markets has been punctuated by reports that the US is considering ending its exemption for eight countries to have bought Iranian oil over the past six months. The waivers were to end on May 2, but previously it was thought that a couple of waivers, like for China and India, would be extended. Oil prices have surged to new six-month highs. Asian equities were mixed, with losses in China, India, and Indonesia and gains in Japan, Korea, and Taiwan. Most European centers are closed. The S&P 500 is trading 0.3% lower after alternating last week between gains and losses. Benchmark bond yields were higher in Asia, with China’s 10-year edging above. 3.40% for the first time since the middle of last November. European stock and bond markets are closed. The US 10-year tested the 2.60%-level last week and backed-off. The US dollar is narrowly mixed against the majors. The Canadian dollar and the Norwegian krone are the strongest in an apparent oil play. The euro, sterling, and yen are practically unchanged. The liquid, accessible emerging market currencies, like the South African rand, Turkish lira, and Mexican peso are nursing losses. The Russian rouble is an exception, and that too seems driven by the jump in oil prices. |

FX Performance, April 22 |

Asia Pacific

Three Japanese meetings this week will command attention. The Bank of Japan meets. A Bloomberg poll found 45 of 48 surveyed do not expect a change in stance. Many do expect the BOJ to downgrade production and export components of its economic assessment. Bloomberg surveys found an increase in those economists that expect the next move to be easing policy. A year ago, less than one in five expected the BOJ to ease further. Note that before the weekend, and before the 10-day holiday beginning at the end of this week, the BOJ surprised the market by announcing a reduction in its long duration bond buying (10-years and beyond). Our concern is not immediate, but later in the year, Japan faces disinflation pressure from initiative to make young children’s education free and cuts in mobile phone service fees, coupled with the retail sales tax increase (Oct 1).

The other two meetings this week are Prime Minister Abe’s visit to Europe and the US. Recall Japan and Europe’s trade agreement went into effect Feb 1. Japan and US trade talks are just beginning. Abe is perceived to be trying to ingratiate himself with the mercurial American president and many note that his visit to the US at the end of the week also coincides with the First Lady’s birthday. Trump and Abe will likely be meeting three times in as many months. After meeting his week, Trump will visit Tokyo next month and maybe the first foreign leader to meet the new Emperor. In June, Trump will return to Japan (Osaka) to attend the G20 meeting. The high-level meetings are hoped to facilitate the first part of a two-part trade agreement. Japan’s recent trade agreements (TPP and with Europe) have left US producers at a (self-imposed) disadvantage with will be remedied in the first part, and then protracted negotiations over reducing Japan’s roughly $60 bln a year trade surplus with the US.

The dollar is confined to less than a 15 tick range below JPY112.00 today. There is an option there that expires today for about $915 mln. Last week, the dollar was confined to a JPY111.77 to JPY112.17 range according to Bloomberg, one of its tightest weekly ranges in years. The Australian dollar is in a quarter-cent range, but this is sufficient to trade on both sides of its pre-weekend range. The technical importance of the outside day lies with the close. A close below the previous session low (~$0.7145) would be more negative. Nearby support is seen in the $0.7100-$0.7110 area.

Europe

Most centers are closed today. The economic calendar is light this week, following the disappointing flash PMI last week. This week’s economic feature is the German IFO in the middle of the week. Sweden’s Riksbank meets on April 25. No change is expected in its minus 25 bp repo rate and minus 100 bp deposit rate. Last week, Sweden reported an unexpected jump in March unemployment (7.1% vs. 6.6%), which reinforced the standpat outlook.

Politics takes center stage. Spain’s elections are on April 28. It is the third election in four years. The critical issue has shifted from the push back against austerity to the Catalan separatism. The polls suggest the governing Socialists may emerge as the largest party but may find it difficult to cobble together a center-left coalition. The center-right appears equally challenged. Spanish asset markets have taken the political uncertainty in stride. Spanish bonds have outperformed Italian bond, though arguably this may say more about Italy than Spain. Spanish bonds have outperformed German Bunds over the past month by easing half a basis point compared to the three basis point increase in Germany.

With Parliament’s holiday break ending, Brexit returns the center ring. The key development to note today is that the Chair of the 1922 Committee of backbenchers reportedly informed Prime Minister May that she either resigns by the end of June or the party will change the rules to allow it to try to force her out. Recall that she survived a previous party leadership challenge. This will likely encourage May to double her efforts to seek a deal with Labour, which is the direction of a softer exit, which, at least until recently, was seen as sterling positive.

Sterling finished the last two sessions below $1.30 for the first time in two months. It is confined to less than a fifth of a cent and has seen offers in the $1.30 area. The euro has held below $1.1250 but has not been below $1.1235 either. While there are no large options near the money that are set expire today, there is a 1.8 bln euro option at $1.1250 that will be cut tomorrow, which is also where the 20-day moving average is found. Additional resistance is pegged in the $1.1265-$1.1275 area. On the downside, we note that dips below $1.12 have been bought.

America

The economic highlight of the week comes ahead of the weekend in the form of the first look at Q1 US GDP. It looked dismal at the start of the quarter with the shock from the Q4 equity meltdown, the government shutdown, and the bitterly cold weather. However, the economy gradually found better traction and most expect growth to be above what the Fed regards as the long-term average (~1.8%). Today’s data consists of the Chicago Fed’s National Economic Index. It is not the stuff the typically moves the market, but it is expected to be consistent with the economic narrative of the US economy getting better traction. The US also reports existing home sales for March. After a nearly 12% surge in February, some pullback is nearly inevitable. The jump in February took it from a 3.5 year low to an almost one-year high. In terms of units, the 12-month average is 5.29 mln, and the 24-month average is 5.41 mln. March is expected at 5.30 mln, according to the median forecast in the Bloomberg survey.

US earnings season focus shifts from the banks, where retail did well, to technology this week. Amazon, Facebook, Twitter, and Microsoft are among the highlights. Boeing also reports. Many economists expect Boeing’s woes to shave Q2 GDP by 0.2%-0.3%. Separately, note that many large European banks will also report this week.

The Bank of Canada meets tomorrow. There is no reason to expect a change in policy or the 1.75% overnight interest rate. The weakness of non-oil exports remains problematic, but the labor market and consumption (retail sales) seem strong enough to keep in check concerns about the impact of housing prices. Meanwhile, with the US no showing any indication of lifting the steel and aluminum tariffs, Canada remains unlikely to take up the new trade deal with the US and Mexico. Next month is seen to be the last opportunity until after the October election, which then may run into US political issue ahead of the 2020 election.

The US dollar closed last week knocking on CAD1.34, which it has not closed above since late March. It is testing the 20-day moving average a little below CAD1.3360. The last time the dollar closed below CAD1.33 was the end of February. The challenge is that the tactics that allow one to make money in the range leave one vulnerable to a real breakout. The Dollar Index is consolidating the gains it scored in the wake of the divergent news of disappointing EMU (and Japan) flash PMI and a jump in US retail sales. It tested the 97.50 area on April 18 and has drifted lower. June crude oil (WTI) is pushing through the $65 cap of recent weeks to approach $66 a barrel. We have been suggesting a $67-$68 technical target since late January. Many are now talking about $70. If the US does eliminate the waivers, around 1.1 mln barrels a day of Iranian oil is at risk. China and India may protest. It may encourage more talk in Europe about the need for another payment system outside of SWIFT (which is headquartered in Europe). Recall that last year, the US forced the Bundesbank to block a large cash transfer from an Iranian owned-bank in Hamburg to Tehran. Europe chaffs under what it sees as extraterritoriality. It will be another issue that and Turkey’s interest diverge.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Featured,FX Daily,newsletter,OIL

Thanks a lot for the great insights. You mentioned $67-$68 technical target since late January, do you have any forecast for the next period? Thanks in advance