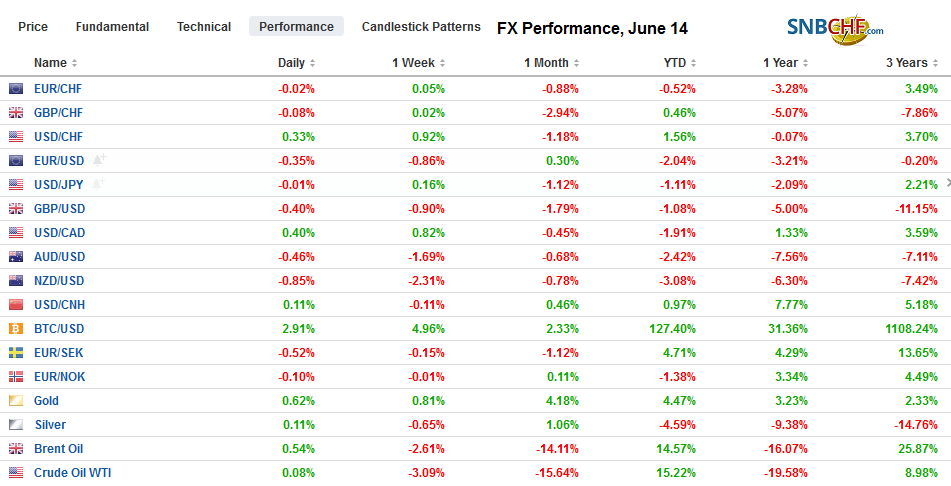

Swiss Franc The Euro has fallen by 0.02% at 1.1201 EUR/CHF and USD/CHF, June 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Worries about an escalation in the Gulf following US accusations that Iran was behind yesterday’s two attacks and weaker growth impulses, while trade tensions remain high, are dampening risk appetites ahead of the weekend. Equities are lower. Nearly all the stock markets in the Asia Pacific region fell today with Japan and Australia being the notable exceptions. The MSCI Asia Pacific Index will take a three-day losing streak into next week. Europe’s Dow Jones Stoxx 600 is giving back half of the week’s gains with a 0.4% loss through

Topics:

Marc Chandler considers the following as important: 4) FX Trends, brl, China Industrial Production, China Retail Sales, Chinese Unemployment Rate, EUR/CHF, Featured, newsletter, U.K., USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.02% at 1.1201 |

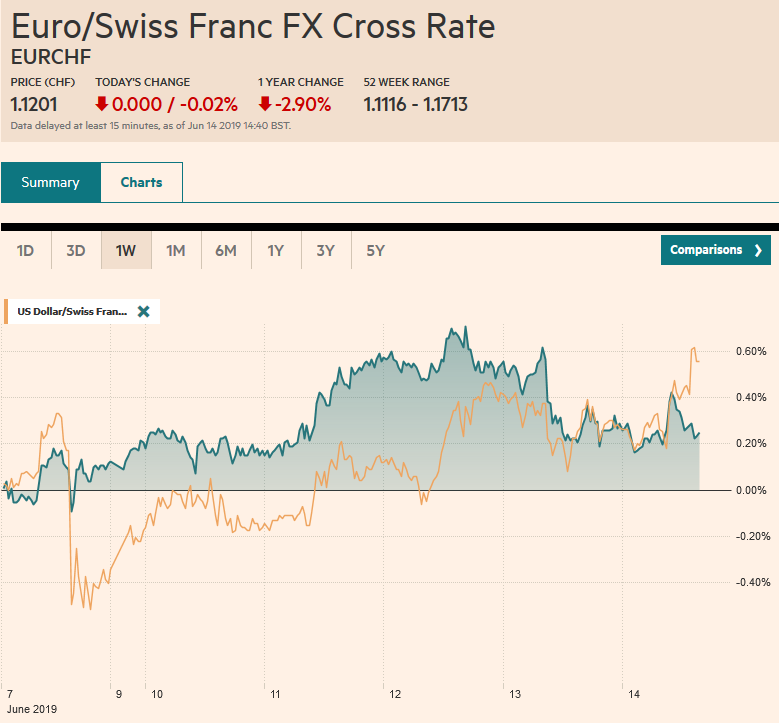

EUR/CHF and USD/CHF, June 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Worries about an escalation in the Gulf following US accusations that Iran was behind yesterday’s two attacks and weaker growth impulses, while trade tensions remain high, are dampening risk appetites ahead of the weekend. Equities are lower. Nearly all the stock markets in the Asia Pacific region fell today with Japan and Australia being the notable exceptions. The MSCI Asia Pacific Index will take a three-day losing streak into next week. Europe’s Dow Jones Stoxx 600 is giving back half of the week’s gains with a 0.4% loss through late morning turnover. Only utilities are posting gains, which is partly a reflection of the continued rally in bonds. Disappointing Chinese and New Zealand dollar has seen the Antipodean 10-year benchmark yields fall to new record lows, and pushing their currencies lower. European yields are mostly two to four basis points lower. The benchmark yields in Germany, Spain, Portugal, and Greece are at new record lows. The US 10-year yield is off about three basis points to almost 2.05%. The dollar is firmer against most of the major currencies. In addition to the heavier tone for the Australian and New Zealand dollars, sterling is also leading the pack lower. For the week, the US dollar has risen against all the majors, though against the yen, it is virtually flat. Oil is paring yesterday’s gains but is still off 3.8%-4.0% this week, and gold is higher for the 11th of the past 13 sessions and has moved above $1350 for the first time since April 2018. |

FX Performance, June 14 |

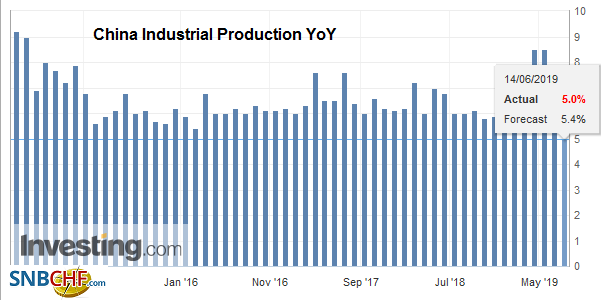

Asia PacificChina’s data disappointed, and although the recently announced stimulative measures have yet to be picked up by the data, additional steps to support the economy are likely. Another reduction in required reserves may be delivered in the coming weeks. Industrial output slowed to 5% in May from 5.4% in April. |

China Industrial Production YoY, May 2019(see more posts on China Industrial Production, ) Source: investing.com - Click to enlarge |

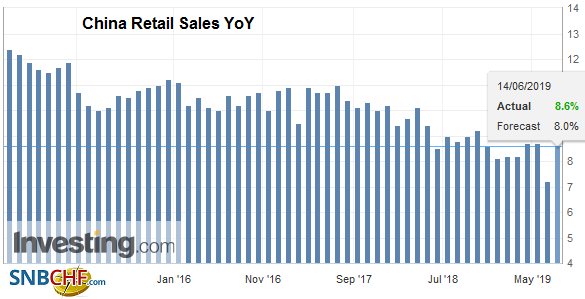

| It was weaker than expected and is the slowest pace since 2002. Fixed asset investment slowed to 5.6% from 6.1%. It is the lowest since last September. The one upside surprise was retail sales. Helped by a long holiday at the beginning of the month, retail sales accelerated to 8.6% from 7.2% year-over-year rate in April. |

China Retail Sales YoY, May 2019(see more posts on China Retail Sales, ) Source: investing.com - Click to enlarge |

| Protests in China are likely to continue over the weekend. Hong Kong equities were lower today for the second session but not out of line with the regional moves. The Hong Kong dollar’s peg is under no pressure whatsoever. In fact, it is near its best level for the year. Currently, a person committing a crime in China and fleeing to Hong Kong cannot be extradited back to China. However, many fear that the law will be used to subject foreign investors and Hong Kong citizens at mainland law, though the extradition bill excludes political crimes. This is emerging as another bipartisan foreign policy issue in the US. A bill that would require the State Department to evaluate Hong Kong’s autonomy every year to renew Hong Kong’s special trade treatment, under which it is not treated as a Chinese city. The current tariffs levied on China do not apply to Hong Kong. The extradition bill could jeopardize Hong Kong’s privilege and could be another point of leverage in the ongoing US-China trade dispute. |

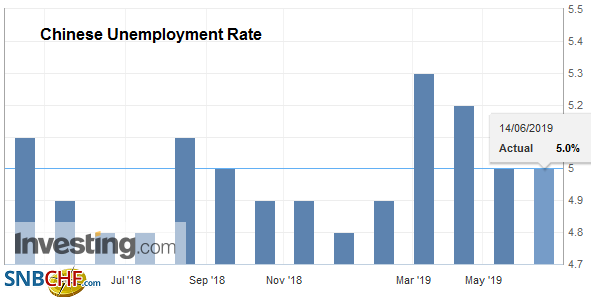

Chinese Unemployment Rate, June 2019(see more posts on Chinese Unemployment Rate, ) Source: investing.com - Click to enlarge |

The dollar-yen exchange rate has been confined to a little more than 6/10 of a yen this week. Three-month implied vol dipped below 6.5% for the first time this month. It has been stuck on the JPY108 handle. Today’s option expirations may continue to restrict the price action. There is a nearly $640 mln option atJPY108 and one for about $380 mln at JPY108.45. Lower yields and weaker equities amid heightened uncertainty keeps the dollar’s downside exposed. Disappointing Chinese data and soft New Zealand data (homes sales and April PMI) took the Australian dollar down in sympathy. The New Zealand dollar fell every day this week after advancing the previous six consecutive sessions. It is at the lows for the month today (~$0.6540). The Aussie has been pushed below $0.6900 for the first time in June. It has not distanced itself much from this level, where a roughly A$615 mln option will be cut today. Last month, a base had been forged near $0.6865. The dollar edged higher against the Chinese yuan for the third session. It has gained a net 0.2% this week.

Europe

After the first round of voting, the main question is who will emerge as the alternative to Boris Johnson. He won handsomely with 114 votes, more than the next three candidates combined. Foreign Secretary Hunt was in a distant second with 43 votes. Three candidates were eliminated. The next round will be June 18. Of the seven candidates, the one with the least amount of votes will be cut as will any candidate that does not get at least 33 votes. The bottom three or four candidates may try to combine forces. After the Tory MPs narrow the choice of candidates for the next leader to two, the rank-and-file will pick. The new Tory leader will lead a minority government, and it is not clear that the DUP, which May’s government relied on, will support a Tory government willing to leave with only the WTO trade terms and no deal with the EU. New national elections could result, which would be the third in four years.

The flash PMI readings are the economy highlight from the eurozone next week. If one looks closely, something of a recovery may be underway. The composite PMI bottomed in January, and a small gain to 52.0 is expected here in June. That would be the highest since last November and would put the Q2 average at 51.7 compared with 51.5 in Q1.

The euro has eased to a new low for the week (~$1.1260). It is the first day this week and the first since June 4 that the euro has not traded above $1.13. It may be being blocked today by the expiry of 4.4 bln euros in options struck there. The $1.11255 area corresponds to a (38.2%) retracement of the rally from last month’s test on $1.11. Below there is $1.1225, around where the 20-day moving average is found and the next (50%) retracement objective. Sterling, which is also at lows for the week (~$1.2635), is probing the (61.8%) retracement of this month’s bounce. Then there is the $1.26 area.

America

Today’s US retail sales and industrial production reports follow a disappointing employment report and soft inflation. Retail sales, which account for a little more than 40% of household consumption, have been firm. The monthly average through the first four months was 0.5% compared with 0.1% in the same period a year ago. However, the path has not been smooth, as retail sales have fallen in two of the four months. The components used for GDP purposes have also been firm overall, even if in a sawtooth pattern. The sales in the “control group” have risen by an average of 0.6% this year so far and 0.1% average in the first third of 2018. Industrial output has been weak. It has fallen in three of the past four months, averaging a 0.3% decline compared with a 0.4% gain in the year-ago period. Manufacturing output itself has not risen this year, and economists are hopeful of the first gain this year in May. The market may not accept disappointment well, yet nearly three cuts have been fully discounted over the next five meetings. The fed funds futures contract implies about a one-in-three chance that the first cut is delivered next week.

The G20 summit is two weeks away and Trump’s economic adviser Kudlow acknowledged that no formal arrangements for a meeting between Xi and Trump have been set. Kudlow reiterated Trump’s threat that there will be consequences for refusing the invitation. At the same time, Kudlow reaffirmed the US position that it cannot accept a balanced agreement because the relationship is out of balance. Both in the deal that Mnuchin had struck that Trump walked away from last year and more recently, China has offered to buy more US goods to reduce the bilateral imbalance. Although China’s share of US imports is a little large than Japan’s was in the early 1980s, more of China’s work is assembling components, so the value-added in the PRC (and in yuan) is less than was the case for Japan.

Pension reform is the key to fiscal reform in Brazil. It has been stymied for several years. There has been concern that President Bolsonaro was diluting his political capital by antagonizing his rivals and pursuing a controversial social agenda at the expense of needed reforms. The congressional reform bill coordinator projected that the government’s bill will generate savings of around BRL913.5 bln (~$237 bln) over a decade. Formal discussion can begin next week, and a preliminary vote is likely before the congressional recess starting July 18. Although investors have been disappointed before, there is new optimism that the pension reform can pass. Brazil’s equities and real rose by nearly 0.5% yesterday. On the week, coming into today, the dollar has fallen against the real by about 0.8%, which if it holds, will be the fourth consecutive weekly decline, as it consolidates near two-month lows. The Bovespa is also set to extend its advancing streak for the fourth straight week, during which time it has gained around 10%.

The US dollar has risen against the Canadian dollar the first three sessions of the week before slipping slightly yesterday. It is firmer today and is caught between two chunky option expirations today. There is one set at CAD1.33 for $880 mln and another set at CAD1.3350 for nearly $580 mln. The greenback was testing the upper end of that range in the European morning. It had found support just ahead of CAD1.33 yesterday. We note that the US two-year premium continues to narrow and today near 40 bp it is at a new low since March of last year. Near MXN19.215, the US dollar is recouping some of this week’s loss but is still off about 2% on the week. The dollar bottomed earlier this week, a little below MXN19.09. The high today (~MXN19.23) is the highest since the low was reached on Tuesday. Recall that last week’s low was around MXN19.4670. This week’s high set on Monday was almost MXN19.33, and it appears the large gap is attracting prices.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,brl,China Industrial Production,China Retail Sales,Chinese Unemployment Rate,EUR/CHF,Featured,newsletter,U.K.,USD/CHF