Summary:

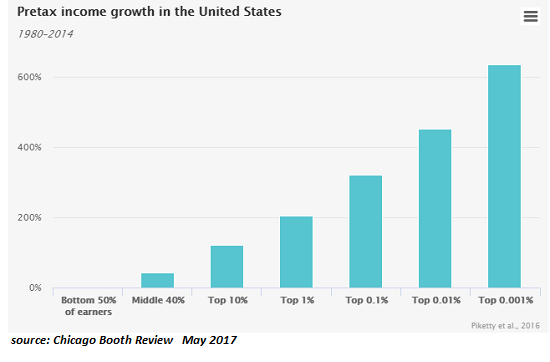

If we look at these charts, it looks like only the top 10%, or perhaps the top 20% at best, might qualify as “middle class” by the metrics described below.

The conventional definition of working class is based on income and education:the working class household earns between ,000 and ,000 annually, and the highest education credential in the household is a two-year community college degree or trade certification.

The definition of the middle class is also based on on income and education, but adds financial security as a metric: the middle class household earns ,000 or more, holds 4-year college diplomas or graduate degrees, owns a home, has a 401K retirement account and so on.

(My own definition is much

Topics:

Charles Hugh Smith considers the following as important:

5) Global Macro,

Featured,

newsletter,

The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

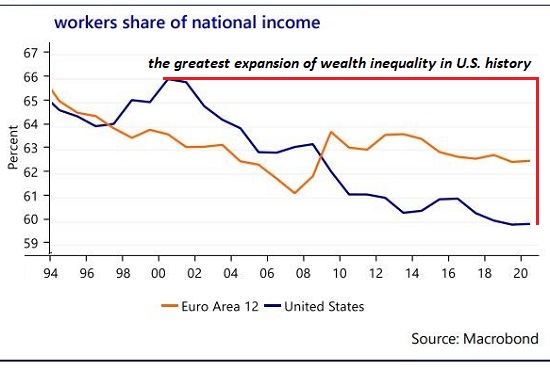

If we look at these charts, it looks like only the top 10%, or perhaps the top 20% at best, might qualify as “middle class” by the metrics described below.

The conventional definition of working class is based on income and education:the working class household earns between $30,000 and $69,000 annually, and the highest education credential in the household is a two-year community college degree or trade certification.

The definition of the middle class is also based on on income and education, but adds financial security as a metric: the middle class household earns $80,000 or more, holds 4-year college diplomas or graduate degrees, owns a home, has a 401K retirement account and so on.

(My own definition is much more rigorous, as I reckon “middle class” today should have the same basic assets as the “middle class” held 40 years ago:

What Does It Take To Be Middle Class? (December 5, 2013.)

But in some key ways, income and education are misleading metrics: the key attributes that actually define the working class are:

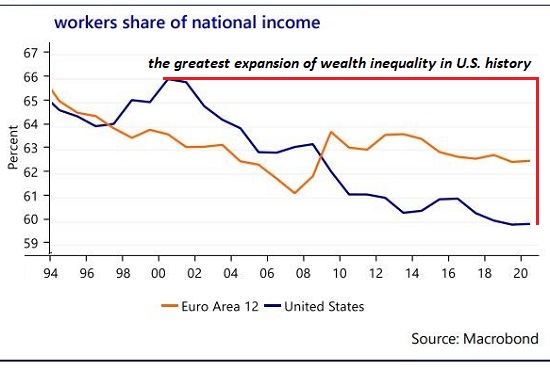

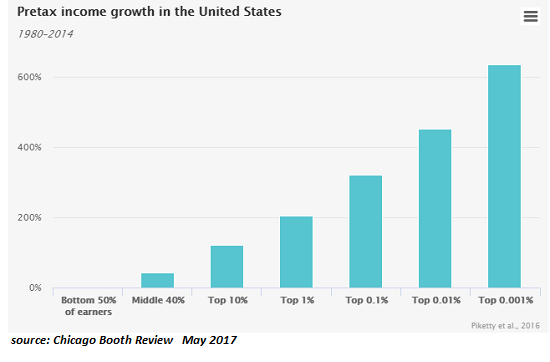

1. Stagnant incomes: incomes that over time barely keep up with real-world inflation or even lose purchasing power.

2. Income insecurity: wages, benefits and pensions are not as guaranteed as advertised.

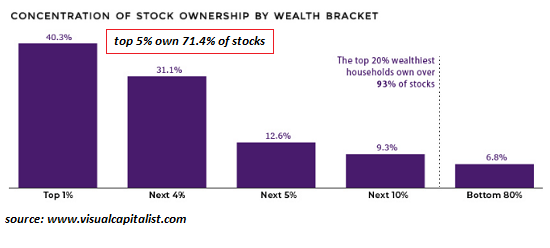

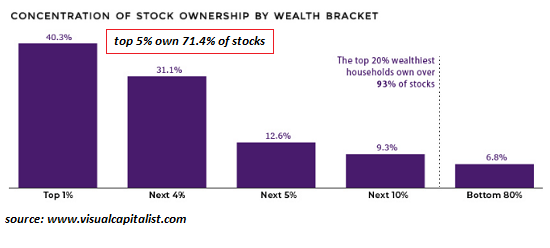

3. Not enough ownership of financial capital to be meaningful. Financial capital excludes household items, vehicles, etc. Financial capital includes stocks, bonds, certificates of deposit, ownership of a profitable business, equity in real estate, precious metals, bitcoin, etc.

By meaningful I mean enough to:

— augment Social Security benefits in a way that greatly improves the household’s lifestyle and retirement options

— equity that is significant enough to fund college educations so one’s children do not have to become debt-serfs to attend college

— enough capital to fund (or help with) a down payment for a house, i.e. inheritable wealth that transforms the children’s lives while the parents are still alive

— income from capital, i.e. income isn’t dependent on a government agency or government transfer.

How many U.S. households qualify to be middle class if that means:

— the household income has outpaced real-world inflation over the past 20 years

— the household’s financial capital/assets have grown to become meaningful (as defined above) in the past 20 years

— the household doesn’t depend on government transfers for much of its income / spending

— the household income and wealth are not dependent on financial bubbles, corporate guarantees, local government pensions on the verge of insolvency, etc.

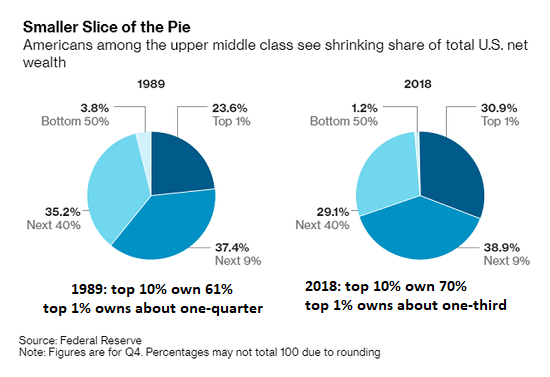

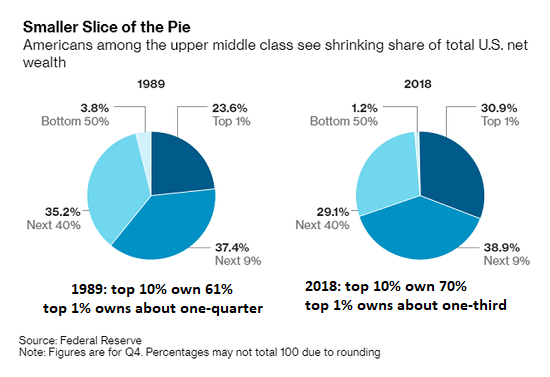

While tens of millions of households qualify as “middle class” based on college diplomas and income, far fewer qualify when wealth and financial security are the key metrics. Plenty of households earn well in excess of $100,000 annually, but their financial status is as precarious and threadbare as any working class household.

They don’t own enough assets or capital to move the needle, and what they do own is generally dependent on financial bubbles or speculative gambles.

| Feeling like we belong to the “middle class” because we have a college diploma and make a good income offers up a false sense of pride and progress.If we’re realistic about the financial wealth and security of “middle class” households, most qualify as working class: stagnant incomes, precarious financial circumstances, very little meaningful wealth and even less meaningful wealth that isn’t dependent on the bubble du jour or promises that might not be kept. |

Pretex Income Growth in the United States - Click to enlarge |

| If we look at these charts, it looks like only the top 10%, or perhaps the top 20% at best, might qualify as “middle class” by the metrics described above. |

Concentration of stock ownership by Wealth Bracket - Click to enlarge |

| What sort of society do we have if the bottom 20% of households are poor, the next 60% are working class/precariat and only the top 20% (at best) have any of the core attributes of “middle class” financial security and wealth? |

Smaller Slice of the Pie, 1989 and 2018 - Click to enlarge |

| If we take off our rose-colored glasses, we have a much more stratified economy and society than we might like to believe: there’s the top 1%, the next 4% “upper middle class,” the next 10% “middle class,” the next 65% working class, and the bottom 20% poor, those largely dependent on government transfers.

The “middle” has eroded away, leaving the top 15% who are doing very well in the status quo and the bottom 85% who are struggling to maintain a meaningful sense of prosperity and progress.

Personally, I’m proud to be working class in terms of my skillsets and values. Labels mean nothing. What counts is having skills, drive, agency, curiosity, frugality, integrity, self-discipline and kindness. Those forms of wealth cannot be taken from you when the bubble du jour pops and all the phantom “wealth” vanishes like mist in Death Valley. |

Worker Share of National Income, 1994-2020 - Click to enlarge |

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the

book's website.

Tags:

Featured,

newsletter