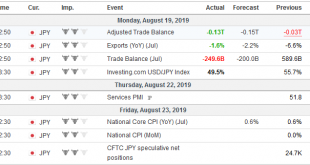

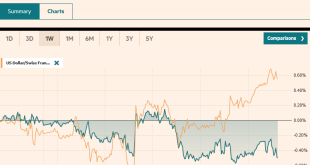

Swiss Franc The Euro has risen by 0.27% to 1.0879 EUR/CHF and USD/CHF, August 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: China announced some changes in its interest rate framework that is expected to lead to lower rates. This helped lift equity markets, which were already recovering at the end of last week from the earlier drubbing. Chinese and Hong Kong shares led the regional rally with 2-3% gains....

Read More »Emerging market sovereign debt update: yields are falling

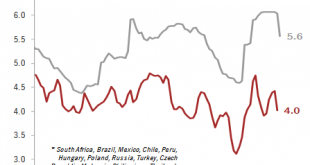

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward. Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a...

Read More »FX Weekly Preview: A Vicious Cycle Grips Markets

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends. To be sure, the end is conceivable but it seems beyond which the...

Read More »Swiss groundwater quality threatened by pollution

Switzerland need to act to ensure the safety of its drinking water supplies in future. Pollution from agriculture, former industrial sites and landfills is threatening Switzerland’s groundwater reserves, according to a detailed study of water quality. The water quality studyexternal link from the Federal Office for the Environmentexternal link (FOEN), released on Thursday, said groundwater faces the greatest pressures in areas of high farming activity. It stated that...

Read More »Some Brief European Leftovers

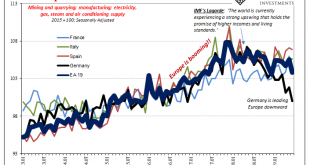

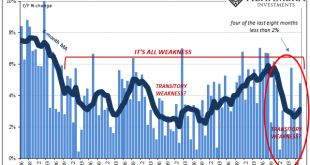

Some further odds and ends of European data. Beginning with Continent-wide Industrial Production. Germany is leading the system lower, but it’s not all just Germany. And though manufacturing and trade are thought of as secondary issues in today’s services economies, the GDP estimates appear to confirm trade in goods as still an important condition and setting for all the rest. The weakness is persisting and intensifying – particularly after May 2019. Europe...

Read More »USD/CHF technical analysis: Heads to 0.9800/05 supply-zone amid bullish MACD

USD/CHF surges to seven-day high. Further upside to near-term key resistance-area expected based on the bullish technical indication. Carrying its early week’s gradual recovery forward, USD/CHF rises to a week’s top while taking the bids to 0.9790 ahead of Friday’s European open. While bullish signal via 12-bar moving average convergence and divergence (MACD) increases the pair’s further run-up, the 0.9800/05 area including mid-July lows and early-month high will...

Read More »Italy: Back to polls in Q4 2019?

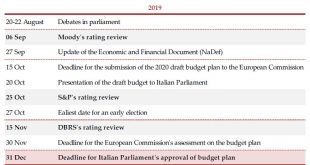

Recent developments in Italy’s political landscape have increased the probability of early elections in Q4 2019, but the situation is not so straightforward. Last week, political tensions in Italy intensified as Matteo Salvini, the League’s leader triggered a no confidence vote against Prime Minister Giuseppe Conte. PM Conte will address the Senate on 20 August. A confidence vote will likely follow the speech, though further delays remain a possibility. Once the...

Read More »Swiss pharma executive gets US sanction for insider trading

The culprit was a head of strategy at Roche, which is headquartered in Switzerland at the Roche tower in Basel. The US Securities and Exchange Commission (SEC) has fined Lorenz Erne, a former senior executive at Swiss pharmaceutical firm Roche, for insider trading and ordered him to pay back the ill-gotten profits. Erne accepted the accusations and agreed to the terms of a settlement with the SEC, according to an SEC documentexternal link published on Thursday....

Read More »Retail Sales’ Amazon Pick Up

The rules of interpretation that apply to the payroll reports also apply to other data series like retail sales. The monthly changes tend to be noisy. Even during the best of times there might be a month way off trend. On the other end, during the worst of times there will be the stray good month. What matters is the balance continuing in each direction – more of the good vs. more of the bad. Or when what seems to be a good month is less good than it used to be....

Read More »FX Daily, August 16: Markets Take Collective Breath Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.01% to 1.0841 EUR/CHF and USD/CHF, August 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are ending the tumultuous week calmly, but it is far from clear that is will hold long. Next week’s flash PMIs have potential to disappoint, and there is risk of new escalation in the US-China trade conflict as the PRC threatens to take action to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org