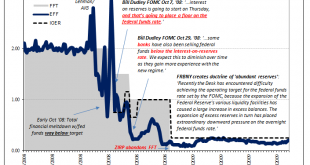

I’ve said it all along; focusing in on bank reserves would leave you dazed and confused. It’s just not how the system works. After all, as I pointed out again not long ago, “our” glorious central bank had the audacity to claim that there were “abundant” reserves during the worst financial panic in four generations. “Somehow” despite that, it was a Global Financial Crisis that lived up to its name – global. Straight away you have to ask, what good are reserves if...

Read More »FX Daily, September 23: Dreadful European Flash PMI Drags the Euro Lower

Swiss Franc The Euro has fallen by 0.24% to 1.089 EUR/CHF and USD/CHF, September 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The critics who claim the ECB’s policy response was disproportionate got a rude shock today with the unexpected weakness revealed by the flash PMI. The euro looks to re-visit the lows set recently near $1.0925. Sentiment has also been eroded by the poor South Korean export figures....

Read More »USD/CHF technical analysis: Bull in control above 21-day EMA, short-term rising support-line

USD/CHF remains modestly changed above 13-day-old rising trend-line, 21-day EMA. An ascending trend-line from August 13 adds to the support. August month top, 61.8% Fibonacci retracement level challenge buyers. The USD/CHF pair’s failure to provide a decisive break above August high seems to not disappoint buyers, even for short-term, unless the quote trades below key support-confluence. Prices seesaw around 0.9910 while heading into the European open on Monday. The...

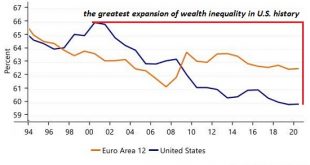

Read More »Automation and the Crisis of Work

Technology, like natural selection, has no goal. When it comes to the impact of automation (robots, AI, etc.) on jobs, there are two schools of thought: one holds that technology has always created more and better jobs than it destroys, and this will continue to be the case. The other holds that the current wave of automation will destroy far more jobs than it creates, but the solution is to tax the robots and use these revenues to distribute the wealth to everyone...

Read More »EM Preview for the Week Ahead

We think the Fed has signaled that the bar to another cut is high. Unless the US data weakens considerably, we see rates on hold for now and this means the liquidity story for EM has worsened. Elsewhere, US-China trade talks appear to be going nowhere. With no end in sight to the trade war, we remain negative on EM. Korea reports trade data for the first 20 days of September Monday. Between the US-China trade war and Korea-Japan tensions over exports of strategic...

Read More »EUR/CHF risk reversals hit highest since May on call demand

EUR/CHF risk reversals have jumped to the levels last seen in May. Risk reversals indicate the demand for call options is rising. Risk reversals on EUR/CHF (EURCHF1MRR), a gauge of calls to put, jumped to the highest level since May on Friday, indicating the investors are adding bets to position for a rally in the common currency. The one-month risk reversals rose to -0.75, the highest level since May 10. The negative print indicates the implied volatility premium...

Read More »MMT, la nouvelle théorie en vogue à Washington

L’influence du ‘Modern Monetary Theory’ est susceptible d’augmenter dans les milieux économiques et politiques américains. La nouvelle théorie monétaire (Modern Monetary Theory/MMT), théorie macroéconomique défendue par des économistes hétérodoxes, commence à faire son chemin aux Etats-Unis. Cette théorie adopte une approche expérimentale de l’économie, basée sur la conviction fondamentale que la monnaie est créée par le gouvernement à travers les dépenses...

Read More »Geneva’s 2020 budget 590 million francs short

© Elenaphotos | Dreamstime.com Next year the canton of Geneva plans to spend CHF 9,143 million. However, forecast revenue is only CHF 8,553 million, leaving a shortfall of CHF 590 million, according to a cantonal government press release. The canton’s finances have been hit hard from both sides. Costs will rise significantly, mainly due to the bailout of the state employee pension fund (+213 million) and higher health insurance subsidies (+176 million). In addition,...

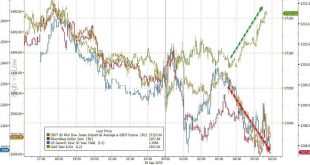

Read More »A “Hawkish Cut”? Traders’ Sleepless Nights Dominated By Indecision & Confusion

Central Banks Remain Calm, Investors Not So Much The avalanche of central bank meetings is rapidly winding down. We’ve had cuts, holds and a raise. The surprises have been minimal. Yet it didn’t prevent the inevitable knee-jerk reactions in the market. In truth, put together as a whole, we are no wiser nor better or worse off. I count that as a success. Especially because there was no projection of panic in any of the decisions. Despite on-going, and universal,...

Read More »AUD/CHF technical analysis: Bears looking for a run to a 50 percent mean reversion

AUD/CHF is in the midst of a sell-off which could extend beyond a 38.2% retracement for a 50% reversion. A subsequent pull-back, however, to the resistance and another sell-off will likely make for a high probability set up. AUD/CHF is in the midst of a sell-off which could extend beyond a 38.2% retracement of the August lows to September highs, located at 0.6715, and target the 50% retracement at 0.6674 (meeting the 2019 lows) should the markets continue to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org