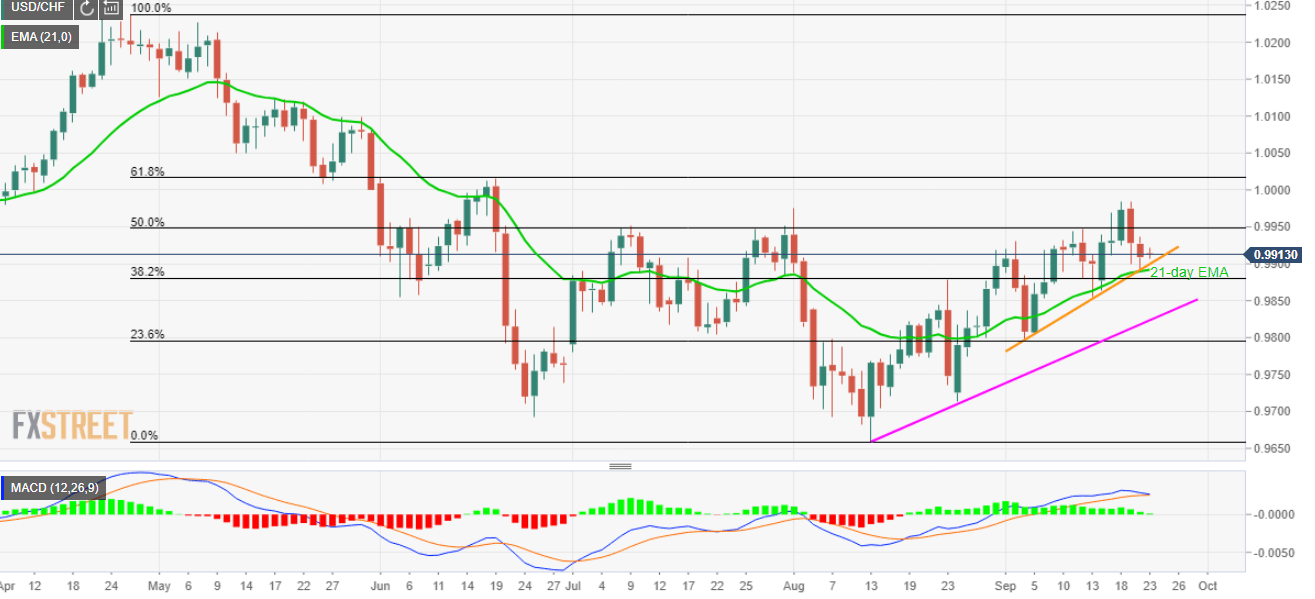

USD/CHF remains modestly changed above 13-day-old rising trend-line, 21-day EMA. An ascending trend-line from August 13 adds to the support. August month top, 61.8% Fibonacci retracement level challenge buyers. The USD/CHF pair’s failure to provide a decisive break above August high seems to not disappoint buyers, even for short-term, unless the quote trades below key support-confluence. Prices seesaw around 0.9910 while heading into the European open on Monday. The 0.9892/0.9900 area including 21-day exponential moving average (EMA) and a rising trend-line since September 04 acts as near-term key support to watch as the break of which could drag prices to 38.2% Fibonacci retracement of April-August declines, at 0.9880. Pair’s south-run below 0.9880 can avail

Topics:

Anil Panchal considers the following as important: 4.) FXStreet on SNB CHF, 4) FX Trends, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF remains modestly changed above 13-day-old rising trend-line, 21-day EMA.

- An ascending trend-line from August 13 adds to the support.

- August month top, 61.8% Fibonacci retracement level challenge buyers.

| The USD/CHF pair’s failure to provide a decisive break above August high seems to not disappoint buyers, even for short-term, unless the quote trades below key support-confluence. Prices seesaw around 0.9910 while heading into the European open on Monday.

The 0.9892/0.9900 area including 21-day exponential moving average (EMA) and a rising trend-line since September 04 acts as near-term key support to watch as the break of which could drag prices to 38.2% Fibonacci retracement of April-August declines, at 0.9880. Pair’s south-run below 0.9880 can avail 0.9840 and nearly six-week-long ascending support-line around 0.9820 as rest-points. On the upside, the recent high of 0.9985 and 61.8% Fibonacci retracement level of 1.0017 keep challenging buyers. |

USD/CHF daily chart, April-October 2019(see more posts on USD/CHF, ) |

Trend: bullish

Tags: Featured,newsletter,USD/CHF