The Swiss financial sector has been leaking banks in recent years. A new private banking venture has joined the growing list of companies applying for licenses from the Swiss financial regulator. Tallyon aims to become a “next generation” private bank, riding the way of “radical change” in the industry. “Banking is to be redefined, and the use of technology should ensure that employees and customers receive a higher esteem than many banks do today,” says chairman...

Read More »Bitcoin Myths, Report 27 Oct

Keith gave a keynote address—the only speaker with an hour to cover his topic—at the Gold and Alternative Investments Conference in Sydney on Saturday. Said topic was the nature of money. “Money is a matter of functions four: a medium, a measure, a standard, a store.” Most of the talk was structured around discussing these functions. Medium is pretty obvious: the dollar is the universal medium of exchange. It is basically frictionless, trading at zero spread (with...

Read More »FX Daily, October 28: Politics Dominates Start of the Week before Yielding to Policy and Economics

Swiss Franc The Euro has risen by 0.24% to 1.104 EUR/CHF and USD/CHF, October 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The pre-weekend rally in US shares, with the S&P 500 flirting with record highs and the back-up in US yields, set the tone for Asia Pacific trading earlier today. Nearly all the equity markets advanced, and bond yields rose. Europe’s Dow Jones Stoxx 600 took a five-day advancing...

Read More »EUR/CHF technical analysis: Bounces up from key support, eyes Oct. 17 high

EUR/CHF is looking north, having bounced up from key MA support. The 4-hour chart indicators are also reporting bullish conditions. EUR/CHF is better bid at 1.1030 press time and could challenge the Oct. 17 high of 1.1059 in the next 24 hours. The 4-hour chart shows, the currency pair has bounced up from the 50-period moving average (MA). That ascending (bullish) technical line has emerged as strong support in the last eight days. The strong bounce from the key MA...

Read More »Real wages set to rise in Switzerland for first time in three years

Is it too early for Swiss workers to crack open the champagne over wages? Employees in Switzerland are expected to receive above-inflation pay rises for the first time since 2016, according to a survey of companies. On average, workers are forecast to take home a 1.1% pay hike – a rise of 0.9% when taking inflation into account. These are the findings of research portal Lohntendenzen.chexternal link, as reported by the NZZ am Sonntagexternal link newspaper. The...

Read More »FX Weekly Preview: Fed’s Mid-Course Correction to be Challenged while ECB Resumes Bond Purchases

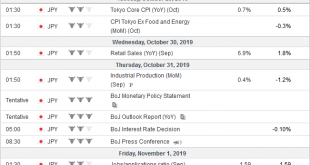

The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU. A few hours before the FOMC meeting concludes on October 30,...

Read More »EM Preview for the Week Ahead

EM has been on a good run but this week will be a big test. Brexit uncertainty may finally end. Or it may not. A delay would be positive for EM, whilst a potential hard Brexit would be negative. The Fed meets Wednesday and key US data will be reported during the week, culminating with the jobs report Friday. The dollar has been on its back foot as September data have come in weaker than expected, so any sort of positive data surprises this week could add to the...

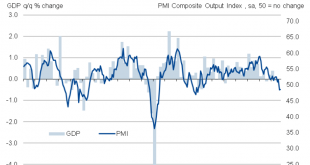

Read More »Somehow Still Decent European Descent

How times have changed. In the middle of 2018, we were told the risks to the global economy were all tilted to the upside. If central bankers weren’t careful, they chanced an uncontrollable inflationary breakout, the kind that would make the last few years of the 2010’s look too much like the 1970’s. Always eager to bottle up the inflation genie, Germany out of everyone actually welcomed negative factors as they built up during the year. From last August: In spite of...

Read More »Swiss central bank makes 388 million from negative interest rates

Swiss National Bank – © J0hnb0y | Dreamstime.com The Swiss National Bank (SNB), Switzerland’s central bank, has earned CHF 388 million from negative interest rates since introducing them in 2014 to tame the rising strength of the Swiss Franc, according to the newspaper SonntagsBlick. On 15 January 2015, the SNB announced that it was abandoning its policy of maintaining an exchange rate cap of 1.20 francs to 1.00 euro. At the same time it increased negative interest...

Read More »Swiss remain the richest in 2019

© Marekusz | Dreamstime.com According to a recent report by the bank Credit Suisse, the Swiss are worth more on average than the residents of any other nation. The bank’s annual Global Wealth Report calculates average net worth per Swiss adult to be US$ 564,653 (CHF 560,643) at mid-2019. The median figure was US$ 227,891 (CHF 226,273). Switzerland’s combined personal wealth of US$ 3.9 trillion represents 1.1% of the global total, while the nation’s population...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637078290921470787-310x165.png)